FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q5.

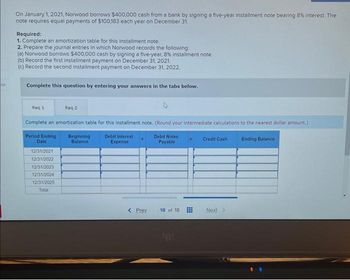

Transcribed Image Text:On January 1, 2021, Norwood borrows $400,000 cash from a bank by signing a five-year installment note bearing 8% interest. The

note requires equal payments of $100,183 each year on December 31.

Required:

1. Complete an amortization table for this installment note.

2. Prepare the journal entries in which Norwood records the following:

(a) Norwood borrows $400,000 cash by signing a five-year, 8% installment note.

(b) Record the first installment payment on December 31, 2021.

(c) Record the second installment payment on December 31, 2022.

Complete this question by entering your answers in the tabs below.

Req 1

Complete an amortization table for this installment note. (Round your intermediate calculations to the nearest dollar amount.)

Period Ending Beginning

Debit Interest

Expense

Debit Notes

Payable

Ending Balance

Date

Balance

12/31/2021

12/31/2022

Req 2

12/31/2023

12/31/2024

12/31/2025

Total

< Prev

18 of 18

Credit Cash

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- E10.15arrow_forwardHansen Corporation. a C Corporation (mot a manufacturer) reports the following items in income and expenses for 2021 Gross Revenue $900,000 Dividend Received from 30% owned Corp 200,000 LTCG 30,000 STCL 12000 City of Lee's Summit Bond Interest 10000 COGS 375000 Administrative Expenses 325000 Charitable Contribution 60,000 Compute Hansen's C Corp Taxable income?arrow_forwardCalculate: (1+)" m m where m=132, and r=0.102arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education