FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

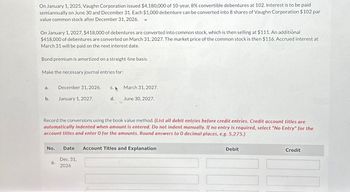

Transcribed Image Text:On January 1, 2025, Vaughn Corporation issued $4,180,000 of 10-year, 8% convertible debentures at 102. Interest is to be paid

semiannually on June 30 and December 31. Each $1,000 debenture can be converted into 8 shares of Vaughn Corporation $102 par

value common stock after December 31, 2026.

On January 1, 2027, $418,000 of debentures are converted into common stock, which is then selling at $111. An additional

$418,000 of debentures are converted on March 31, 2027. The market price of the common stock is then $116. Accrued interest at

March 31 will be paid on the next interest date.

Bond premium is amortized on a straight-line basis.

Make the necessary journal entries for:

a.

December 31, 2026.

C. A

March 31, 2027.

b.

January 1, 2027.

d.

June 30, 2027.

Record the conversions using the book value method. (List all debit entries before credit entries. Credit account titles are

automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275.)

No.

Date

Account Titles and Explanation

Dec. 31,

a.

2026

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On Aug 29, Sindhu received an invoice for $85.49, dated Aug 27. If the terms of the invoice are 4/10, 2/20, n/60, what amount is required on Sep 15 to pay the invoice in full?arrow_forwardNeed help with part B. Thank youarrow_forwardJournalize the first annual interest payment on December 31, 20X1.arrow_forward

- PA5. 12.2 Review the following transactions, and prepare any necessary journal entries. A. On July 16, Arrow Corp. purchases 200 computers (Equipment) at $500 per computer from a supplier, on credit. Terms of the purchase are 4/10, n/50 from the invoice date of July 16. B. On August 10, Hondo Inc. receives advance cash payment from a client for legal services in the amount of $9,000. Hondo had yet to provide legal services as of August 10. C. On September 22, Jack Pies sells thirty pies for $25 cash per pie. The sales tax rate is 8%. D. On November 8, More Supplies paid a portion of their noncurrent note in the amount of $3,250 cash.arrow_forwardInterval Answer: A. B. C. Monthly D. on day 1st of every 1 O An unscheduled journal entry O Recording uncollectable receivables O Logging the usage of a prepaid service O Setup of a recurring transfer month(s) Start date 01/01/2026 End After 12 occurrencesarrow_forwardAdjusting entry: On 1 December 2019, Count-On-Us Pty Ltd invested $50,000 in a term deposit at Commonwealth Bank. Interest is received after one year and the interest rate is 6% p.a. Instructions: Record the adjusting entry for the year ending 30 June 2020 by selecting the correct accounts and amounts that are debited and credited.arrow_forward

- Prepare all necessary journal entries for 2024.arrow_forward* CengageNOwv2 | Online teachir x d21 mnsu - Bing x |+ O https://v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSes. Problem 9-94B (Algorithmic) Note Computations and Entries (Straight Line) On January 1, 2020, Benton Corporation borrowed $930,000 with a 10-year, 8.75% note, interest payable semiannually on June 30 and December 31. Cash in the amount of $915,500 was recelved when the note was issued. Required: 1. Prepare the necessary journal entry at January 1, 2020. 2020 Jan. 1 Record issuance of notes at discount 2. Prepare the necessary journal entry at June 30, 2020. If required, round amounts to the nearest dollar. 2020 June 30 Record interest expense 3. Prepare the necessary journal entry at December 31, 2020. If required, round amounts to the nearest dollar. 2020 Dec. 31 11:36 AM a 4/6/2021arrow_forwardPrepare journal entries to record the following transactions entered into by the Ivanhoe Company. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 2024 June Nov. 1 1 Received a $10,800, 9%, 1-year note from Luke Bryan as full payment on his account. Sold merchandise on account to Ace, Inc., for $17,000, terms 2/10, n/30. Nov. 5 Ace, Inc., returned merchandise worth $1,500. Received payment in full from Ace, Inc. Accrued interest on Bryan's note. Nov. 9 Dec. 31 2025 June 1 Luke Bryan honored his promissory note by sending the face amount plus interest.arrow_forward

- 2. Using the fact pattern presented in Exercise 8-15, prepare journal entries for CVC and Buffalo Supply on the following dates (for homework, you recorded the journal entries for CVC and Buffalo Supply on 1/1/2019 (20X3] only): a. 12/31/2019 (20X3] b. 12/31/2020 (20x4] c. 1/1/2021 [20X5] Central Valley Construetion (CVC) purchased S80,000 of sheet metal fabricating equipment from Buffalo Supply on January I, Page 9-40 20XI. CVC paid $15,000 cash and signed a five year, 10% note for the remaining $65,000 of the purchase price. The note specifies that payments of $13,000 plus interest be made each year on the loan's anniversary date. CVC made the required January 1, 20X2, payment but was unable to make the second payment on January 1, 20X3, because of a downturn in the construction industry. At this time, CVC owed Buffalo Supply $52.000 plus $5.200 interest that had been accrued by both companies. Rather than write off the note and repossess the equipment, Buffalo Supply agreed to…arrow_forwardmake journal entries for recording interest income and interest received and recognition of FV at dec31, 2023, 2024, and 2025. the entries should be: to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record Fair value adjustment to record interest collected (3 lines) to record gain or loss Dont use AI Tools. Thank youarrow_forwardBefore you begin this assignment, review the Tying it All Together feature in the chapter. It will also be helpful if you review TravelCenters of America LLC’s 2075 annual report</i> (https://www.sec.gov/Archives/edgar/data/1378453/000137845316000040/a2015123110k.htm). TravelCenters of America LLC is the largest full-service travel center company in the United States, serving both professional drivers and motorists. Since 2011, the company’s growth strategy has been to acquire additional travel center and convenience center locations. In addition to agreements entered into in 2015, the company acquired 3 travel centers and 170 convenience centers for a total purchase price of $320.3 million. Requirements Using the payback method, suppose TravelCenters of America expect to receive an annual net cash inflow of $32.03 million per year. How many years would it take to pay back the initial investment? What are some disadvantages to using the payback method? Why would a company, such…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education