FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

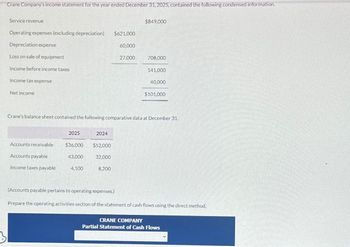

Transcribed Image Text:Crane Company's income statement for the year ended December 31, 2025, contained the following condensed information.

Service revenue

Operating expenses (excluding depreciation) $621,000

Depreciation expense

Loss on sale of equipment

Income before income taxes

Income tax expense

Net income

$849,000

60,000

27,000

708,000

141,000

40,000

$101,000

Crane's balance sheet contained the following comparative data at December 31.

2025

2024

Accounts receivable

$36,000

$52,000

Accounts payable

43,000

32,000

Income taxes payable

4,100

8.200

(Accounts payable pertains to operating expenses.)

Prepare the operating activities section of the statement of cash flows using the direct method.

CRANE COMPANY

Partial Statement of Cash Flows

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QueensLand Ltd. had the following operating results for 2021: sales = $20,200; cost of goods sold = $8,200; depreciation expense = $1,200; interest expense = $1,400; dividends paid = $600. At the beginning of the year, net fixed assets were $9,100, current assets were $3,200, and current liabilities were $1,800. At the end of the year, net fixed assets were $9,700, current assets were $3,850, and current liabilities were $2,100. The tax rate for 2021 was 34%. What was the OCF for the year 2021? a. $9,600 b. $7,604 c. $6,204 d. $8,804arrow_forwardForecast an Income StatementSeagate Technology reports the following income statement for fiscal 2019. SEGATE TECHNOLOGY PLC Consolidated Statement of Income For Year Ended June 28, 2019, $ millions Revenue $20,780 Cost of revenue 14,916 Product development 1982 Marketing and administrative 906 Amortization of intangibles 46 Restructuring and other, net (44) Total operating expenses 17,806 Income from operations 2,974 Interest income 168 Interest expense (448) Other, net 50 Other expense, net (230) Income before income taxes 2,744 (Benefit) provision for income taxes (1,280) Net income $4,024 Forecast Seagate’s 2020 income statement assuming the following income statement relations ($ millions). Revenue growth 5% Cost of revenue 71.8% of revenue Product development 9.5% of revenue Marketing and administrative 4.4% of revenue Amortization of intangibles No change Restructuring and other, net $0 Interest income No change…arrow_forwardThe 2021 income statement of Adrian Express reports sales of $19,710,000, cost of goods sold of $12,350,000, and net income of $1,780,000. Balance sheet information is provided in the following table. Assets Current assets: Cash ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 2021 Industry averages for the following profitability ratios are as follows: 3.5 times 35% 2020 $ 740,000 $ 880,000 1,650,000 1,130,000 2,070,000 1,550,000 4,940,000 4,360,000 $9,400,000 $7,920,000 $1,964,000 $1,784,000 2,436,000 2,524,000 1,950,000 1,930,000 3,050,000 1,682,000 $9,400,000 $7,920,000arrow_forward

- Oriole Company's income statement contained the following condensed information ORIOLE COMPANY Income Statement For the Year Ended December 31, 2022 Service revenue Operating expenses, excluding depreciation $624.500 Depreciation expense Loss on disposal of plant assets Income before income taxes Income tax expense Net income Accounts receivable Accounts payable Income taxes payable 2022 $74,400 40.300 Oriole's balance sheets contained the comparative data at December 31, shown below. 12.900 2021 54,600 $61000 27.000 6.400 24.100 $972,000 703,200 268,800 40,100 $228.700 Accounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a-sign e.g.-15.000 or in parenthesis e.g. (15.000))arrow_forwardThe income statement of Price Ltd for the year ended 31 December 2020, reported the following condensed information: Revenue from fees $600,000 Operating expenses 360,000 Income from operations 240,000 Income tax expense 60,000 Net income $180,000 Price's balance sheet contained the following comparative data at December 31: 2020 2019 Accounts receivable $50,000 $45,000 Accounts payable 35,000 41,000 Income taxes payable 6,000 3,000 Price has no depreciable assets. Accounts payable pertains to operating expenses. Required: (a) Calculate: Cash receipts from customers. Cash payments for operating expenses. (b) Prepare the operating activities…arrow_forwardProvided below are the financial statements for J Ltd.: Income statement Balance Sheet Net sales $984 2021 2020 Assets Cost of goods sold $752 Current assets $452 $354 Depreciation $27 Long-term assets $389 $374 EBIT $205 Total assets $841 $728 Interest expense $25 Liabilities and shareholders' equity Current liabilities $247 $164 Income before taxes $180 Long-term debt $157 $145 Taxes $27 Shareholders' equity $437 $419 Net income $153 Total liabilities and shareholders' equity $841 $728 Calculate economic value added (EVA), assuming cost of capital is 7.5%. (Round all the intermediate calculations and the final answer to 2 decimal places) $131.95 $135.70 $98.40 $129.70arrow_forward

- he current sections of Skysong, Inc.’s balance sheets at December 31, 2021 and 2022, are presented here.Skysong’s net income for 2022 was $152,700. Depreciation expense was $27,600. 2022 2021 Current assets Cash $107,600 $95,900 Accounts receivable 78,400 89,400 Inventory 167,800 172,100 Prepaid expenses 26,800 22,000 Total current assets $380,600 $379,400 Current liabilities Accrued expenses payable $15,800 $8,600 Accounts payable 84,900 95,500 Total current liabilities $100,700 $104,100 Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).)arrow_forwardConcord Ltd. had the following 2023 income statement data: Sales revenue Cost of goods sold Gross profit Operating expenses (includes depreciation of $22,900) Income before income taxes Income taxes Net income $207,500 (a) 119,000 88,500 48,000 40,500 16,000 $24,500 The following accounts increased during 2023 by the amounts shown: Accounts Receivable, $15,900; Inventory, $10,800; Accounts Payable (relating to inventory), $13,900; Taxes Payable, $2,200; and Mortgage Payable, $40,500. Prepare the cash flows from operating activities section of Concord's 2023 statement of cash flows using the indirect method and following IFRS. (Show amounts that decrease cash flow with either a negative sign e.g.-15,000 or in parenthesis e.g. (15,000).) Concord Corporation Statement of Cash Flows Indirect Mothed)arrow_forwardPARNELL COMPANY Income Statement For the Year Ended December 31, 2024 ($ in thousands) Revenues and gains: Sales $ 790 Gain on sale of building 10 $ 800 Expenses and loss: Cost of goods sold $ 295 Salaries 119 Insurance 39 Depreciation 122 Interest expense 49 Loss on sale of equipment 12 636 Income before tax 164 Income tax expense 82 Net income $ 82 PARNELL COMPANY Selected Accounts from Comparative Balance Sheets December 31, 2024 and 2023 ($ in thousands) Year Change 2024 2023 Cash $ 133 $ 101 $ 32 Accounts receivable 323 217 106 Inventory 322 424 (102) Prepaid insurance 67 87 (20) Accounts payable 209 118 91 Salaries payable 104 94 10 Deferred tax liability 62 53 9 Bond discount 188 201 (13) Required: 1. Prepare the cash flows from operating activities section of the statement of cash flows for Parnell Company using the direct method. 2. Prepare the cash flows from operating activities…arrow_forward

- The comparative balance sheets for 2021 and 2020 and the statement of income for 2021 are given below for Wright Company. Additional information from Wright's accounting records is provided also. WRIGHT COMPANYComparative Balance SheetsDecember 31, 2021 and 2020($ in thousands) 2021 2020 Assets Cash $ 116 $ 95 Accounts receivable 136 140 Short-term investment 47 14 Inventory 137 135 Land 102 125 Buildings and equipment 695 530 Less: Accumulated depreciation (193 ) (140 ) $ 1,040 899 Liabilities Accounts payable $ 40 $ 48 Salaries payable 2 6 Interest payable 8 5 Income tax payable 5 10 Notes payable 0 33 Bonds payable 296 230 Shareholders’ Equity Common stock 390 330 Paid-in capital—excess of par 187 165…arrow_forwardReturn on Total Assets A company reports the following income statement and balance sheet information for the current year: Net income $157,080 Interest expense 27,720 Average total assets 2,800,000 Determine the return on total assets? If required, round the answer to one decimal place.arrow_forwardThe current sections of Crane Inc.’s balance sheets at December 31, 2021 and 2022, are presented here. Crane’s net income for 2022 was $154,700. Depreciation expense was $26,300. 2022 2021 Current assets Cash $102,700 $97,700 Accounts receivable 79,400 90,000 Inventory 168,200 173,000 Prepaid expenses 26,900 22,900 Total current assets $377,200 $383,600 Current liabilities Accrued expenses payable $15,000 $9,300 Accounts payable 84,000 95,600 Total current liabilities $99,000 $104,900 Prepare the operating activities section of the company’s statement of cash flows for the year ended December 31, 2022, using the indirect methodarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education