FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

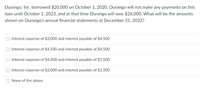

Transcribed Image Text:Durango, Inc. borrowed $20,000 on October 1, 2020. Durango will not make any payments on this

loan until October 1, 2023, and at that time Durango will owe $26,000. What will be the amounts

shown on Durango's annual financial statements at December 31, 2022?

O Interest expense of $2,000 and interest payable of $4,500

Interest expense of $4,500 and interest payable of $4,500

O Interest expense of $4,500 and interest payable of $1,500

Interest expense of $2,000 and interest payable of $1,500

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On April 1, 2021, the Electronic Superstore borrows $21 million of which $7 million is due in 2022. Show how the company would report the $21 million debt on its December 31, 2021 balance sheet. (Enter your answers in dollars not in millions. For example, $7,000,000 rather than $7 million.) Electronic Superstore Partial Balance sheet December 31st 2021 Current liabilities: Long-term liabilities: Total liabilitiesarrow_forwardOn October 1, 2023, Marigold Corp. sold a harvesting machine to Bonita Industries. Instead of a cash payment, Bonita Industries gave Marigold a $170,000, two-year, 10% note; 10% is a realistic rate for a note of this type. The note required interest to be paid annually on October 1, beginning October 1, 2024. Marigold's financial statements are prepared on a calendar-year basis. (a) Your answer has been saved. See score details after the due date. Assuming that no reversing entries are used and that Bonita Industries fulfills all the terms of the note, prepare the necessary journal entries for Marigold for the entire term of the note. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Debit Crarrow_forwardRequired information [The following information applies to the questions displayed below.] On August 1, 2019, Colombo Co.'s treasurer signed a note promising to pay $121,200 on December 31, 2019. The proceeds of the note were $115,800. Required: a. Calculate the discount rate used by the lender. (Enter your answer as a percentage rounded to 1 decimal place (l.e., 32.1).) Discount rate %arrow_forward

- At the end of 2022, the following information is available for Great Adventures. Additional interest for five months needs to be accrued on the $32,200, 6% loan obtained on August 1, 2021. Recall that annual interest is paid each July 31. Assume that $12,200 of the $32,200 loan discussed above is due next year. By the end of the year, $20,000 in gift cards have been redeemed. The company had sold gift cards of $27,200 during the year and recorded those as Deferred Revenue. Great Adventures is a defendant in litigation involving a biking accident during one of its adventure races. The company believes the likelihood of payment occurring is probable, and the estimated amount to be paid is $14,200. For sales of MU watches, Great Adventures offers a warranty against defect for one year. At the end of the year, the company estimates future warranty costs to be $6,200. No Date General Journal Debit Credit 1 Dec 31 Interest Expense 805 Interest Payable 805…arrow_forwardB10.arrow_forwardParton owes $3 million that is due on March 5, 2021. The company borrows $2,600,000 on February 25, 2021(5-year note) and uses the proceeds to pay down the $3 million note. How much of the $3 million note is classified as long-term in the February 28, 2021 financial statements?arrow_forward

- On 15 April 2021, Growth Realty Ltd purchased a piece of equipment worth $200,000 by accepting a 6 - month discounted bank bill. The bill has a face value of $209,000 and is due for settlement on 15 October 2023. Required: (a) State the items and amounts, if any, that would appear in each of Growth Realty Ltd's financial statements on 30 June 2023 pertaining to the discounted bill. Provide your working process. (1) Income statement items) and amount(s): (i) Balance sheet items) and amounts): (ili) Cash flow statement items) and amount(s) ):arrow_forwardOn January 1, 2024, Evanston Corporation borrowed $7 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $2,570,460 on December 31 of each year. The payments include interest at a rate of 5%. Required: 1. Record the cash received when the note is issued. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answer in dollars, not millions (i.e., $5.5 million should be entered as 5,500,000).) View transaction list Journal entry worksheet < 1 Record the receipt of cash from the issue of the note payable. Note: Enter debits before credits. Date January 01, 2024 Cash Notos Davahin General Journal Debit Creditarrow_forwardCrane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forward

- Accarrow_forwardOn May 3, 2020, Leven Corporation negotiated a short-term loan of $660,000. The loan is due October 1, 2020, and carries a 5.40% interest rate. Use ordinary interest to calculate the interest. What is the total amount Leven would pay on the maturity date? (Use Days in a year table.) Note: Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education