Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

h9

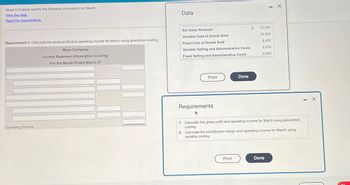

Transcribed Image Text:Maya Company reports the following information for March:

View the data.

Read the requirements.

Data

Requirement 1. Calculate the gross profit and operating income for March using absorption costing.

Maya Company

Income Statement (Absorption Costing)

For the Month Ended March 31

Net Sales Revenue

$

72,500

Variable Cost of Goods Sold

24,500

Fixed Cost of Goods Sold

8,400

Variable Selling and Administrative Costs

Fixed Selling and Administrative Costs

9,500

5,800

Operating Income

Print

Done

Requirements

1. Calculate the gross profit and operating income for March using absorption

costing.

2. Calculate the contribution margin and operating income for March using

variable costing.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Summarized data for Walrus Co. for its first year of operations are: A. Prepare an income statement under absorption costing B. Prepare an income statement under variable costingarrow_forwardStatement of cost of goods manufactured for a manufacturing company Cost data for Johnstone Manufacturing Company for the month ended March 31 are as follows: a. Prepare a cost of goods manufactured statement for March. b. Determine the cost of goods sold for March.arrow_forwardBrief Exercise 3-32 Absorption-Costing Income Statement Refer to the data for Beyta Company above. Required: 1. Calculate the cost of goods sold under absorption costing. 2. Prepare an income statement using absorption costing. Use the following information for Brief Exercises 3-32 and 3-33: During the most recent year, Beyta Company had the following data:arrow_forward

- Use the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forwardGallatin County Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: a. Prepare an income statement according to the absorption costing concept. b. Prepare an income statement according to the variable costing concept. c. What is the reason for the difference in the amount of operating income reported in (a) and (b)?arrow_forwardAbsorption and variable costing income statements for two months and analysis During the first month of operations ended July 31, Head Gear Inc. manufactured 6,400 hats, of which 5,200 were sold. Operating data for the month are summarized as follows: During August, Head Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) July and (b) August. 2. Using the variable costing concept, prepare income statements for (a) July and (b) August. 3. A. Explain the reason for the differences in the amount of operating income in (1) and (2) for July. B. Explain the reason for the differences in the amount of operating income in (1) and (2) for August. 4. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain.arrow_forward

- On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forwardOn March 31, the end of the first month of operations, Barnard Inc. manufactured 15,000 units and sold 12,000 units. The following income statement was prepared, based on the variable costing concept: Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.arrow_forwardUsing the data in P4-2 and Microsoft Excel: 1. Separate the variable and fixed elements. 2. Determine the cost to be charged to the product for the year. 3. Determine the cost to be charged to factory overhead for the year. 4. Determine the plotted data points using Chart Wizard. 5. Determine R2. 6. How do these solutions compare to the solutions in P4-2 and P4-3? 7. What does R2 tell you about this cost model?arrow_forward

- During the first month of operations ended May 31, Big Sky Creations Company produced 40,000 designer cowboy boots, of which 36,000 were sold. Operating data for the month are summarized as follows: During June, Big Sky Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots. Operating data for June are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) June. 3. a. Explain the reason for the differences in operating income in (1) and (2) for May. b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain.arrow_forwardCost of goods sold, profit margin, and net income for a manufacturing company The following information is available for Bandera Manufacturing Company for the month ending January 31: For the month ended January 31, determine Bandera Manufacturings (A) cost of goods sold, (B) gross profit, and (C) net income.arrow_forwardThe records of Anderjak Corporation contain the following information for the month of January: The company has no beginning inventory. REQUIREMENT You have been asked to prepare a variable costing (direct costing) income statement and an absorption costing income statement for the month of January. Review the worksheet VARCOST that follows these requirements.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning