FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1

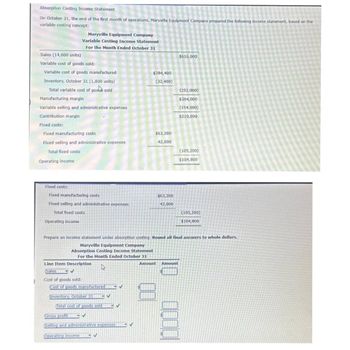

Absorption Costing Income Statement

On October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the

variable costing concept:

Sales (14,000 units)

Variable cost of goods sold:

Variable cost of goods manufactured

Inventory, October 31 (1,800 units)

Total variable cost of goods sold

Maryville Equipment Company

Variable Costing Income Statement

For the Month Ended October 31

Manufacturing margin

Variable selling and administrative expenses

Contribution margin

Fixed costs:

Fixed manufacturing costs

Fixed selling and administrative expenses

Total fixed costs

Operating income

Fixed costs:

Fixed manufacturing costs

Fixed selling and administrative expenses

Total fixed costs

Operating income

Line Item

Sales

Absorption Costing Income Statement

For the Month Ended October 31

Description

✔

Cost of goods sold:

Cost of goods manufactured

Inventory, October 31

Total cost of goods sold

Prepare an income statement under absorption costing. Round all final answers to whole dollars.

Maryville Equipment Company

V

$284,400

(32,400)

✔

Gross profit DV

Selling and administrative expenses

Operating income

$63,200

42,000

$63,200

42,000

Amount

$616,000

Amount

(252,000)

$364,000

(154,000)

$210,000

(105,200)

$104,800

(105,200)

$104,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Cost of Goods Manufactured, using Variable Costing and Absorption Costing On March 31, the end of the first year of operations, Barnard Inc., manufactured 3,300 units and sold 2,800 units. The following income statement was prepared, based on the variable costing concept: Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, March 31 Total variable cost of goods sold Manufacturing margin Total variable selling and administrative expenses Contribution margin Fixed costs: Barnard Inc. Variable Costing Income Statement For the Year Ended March 31, 20Y1 Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating income Variable costing Absorption costing $508,200 (77,000) $231,000 72,800 $896,000 (431,200) $464,800 (106,400) $358,400 (303,800) $54,600 Determine the unit cost of goods manufactured, based on (a) the variable costing concept and (b) the absorption costing concept.arrow_forwardWhat is the Total period cost for April under variable costing?A. P 55,200 B. P 82,500 C. P 123,900D. P 137,700arrow_forwardProvide answer this questionarrow_forward

- On November 30, the end of the first month of operations, Weatherford Company prepared the following income statement, based on the absorption costing concept: Weatherford Company Absorption Costing Income Statement For the Month Ended November 30 Sales (6,100 units) Cost of goods sold: Cost of goods manufactured (7,000 units) Inventory, November 30 (1,000 units) Total cost of goods sold Gross profit $161,000 Sales Variable cost of goods sold: Variable cost of goods manufactured Inventory, November 30 (23,000) $201,300 138,000 $63,300 Selling and administrative expenses 35,910 Income from operations $27,390 Assume the fixed manufacturing costs were $38,640 and the fixed selling and administrative expenses were $17,590 Prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Weatherford Company Variable Costing Income Statement For the Month Ended November 30 201,300arrow_forwardRahularrow_forwardam. 106.arrow_forward

- don't give answer in image formatarrow_forwardVariable Costing Income Statement On April 30, the end of the first month of operations, Joplin Company prepared the following income statement, based on the absorption costing concept: Joplin CompanyAbsorption Costing Income StatementFor the Month Ended April 30 Sales (6,600 units) $178,200 Cost of goods sold: Cost of goods manufactured (7,700 units) $146,300 Inventory, April 30 (1,100 units) (20,900) Total cost of goods sold (125,400) Gross profit $52,800 Selling and administrative expenses (32,280) Operating income $20,520 If the fixed manufacturing costs were $39,501 and the fixed selling and administrative expenses were $15,810, prepare an income statement according to the variable costing concept. Round all final answers to whole dollars. Joplin CompanyVariable Costing Income StatementFor the Month Ended April 30 $Sales Variable cost of goods sold: $Variable cost of goods manufactured…arrow_forwardIncome Statements under Absorption Costing and Variable Costing Gallatin County Motors Inc. assembles and sells snowmobile engines. The company began operations on July 1 and operated at 100% of capacity during the first month. The following data summarize the results for July: Sales (4,000 units) $2,600,000 Production costs (4,350 units): Direct materials Direct labor Variable factory overhead Fixed factory overhead Selling and administrative expenses: Variable selling and administrative expenses Fixed selling and administrative expenses Sales a. Prepare an income statement according to the absorption costing concept. Gallatin County Motors Inc. Absorption Costing Income Statement For the Month Ended July 31 $ 2,600,000 Cost of goods sold Gross profit 1,800,000 $1,218,000 522,000 87,000 130,500 1,957,500 $ 800,000 $60,000 25,000 85,000arrow_forward

- Michie Company's management accountant prepared the following income statement relating to its second year of operations using the absorption costing format: Michie Company Income Statement (Absorption Costing) Year Ended December 31, Year 2 Sales Cost of goods sold: Beginning inventory Variable and fixed manufacturing costs Cost of goods available for sale Less ending inventory Total cost of goods sold Gross margin Less operating costs: Variable selling and administrative costs Fixed selling and administrative costs Net income (50,000 x $ 20.00) (10,000 $ 10.00*) (45,000 x $ 10.00*) (55,000 $10.00) (5,000 * $ 10.00) $ 1,000,000 $ 100,000 450,000 550,000 50,000 (500,000) $ 500,000 (50,000 x $ 2.00) $ 100,000 150,000 Variable manufacturing costs of $8.00 plus fixed manufacturing costs of $2.00. (250,000) $ 250,000arrow_forwardPlease do not give solution in image format thankuarrow_forwardVariable Costing Income Statement for a Service Company East Coast Railroad Company transports commodities among three routes (city-pairs): Atlanta/Baltimore, Baltimore/Pittsburgh, and Pittsburgh/Atlanta. Significant costs, their cost behavior, and activity rates for April are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education