FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

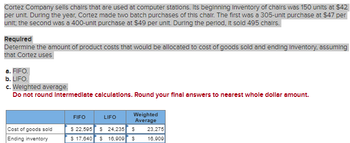

Transcribed Image Text:Cortez Company sells chairs that are used at computer stations. Its beginning Inventory of chairs was 150 units at $42

per unit. During the year, Cortez made two batch purchases of this chair. The first was a 305-unit purchase at $47 per

unit; the second was a 400-unit purchase at $49 per unit. During the period, it sold 495 chairs.

Required

Determine the amount of product costs that would be allocated to cost of goods sold and ending Inventory, assuming

that Cortez uses

a. FIFO.

b. LIFO.

c. Weighted average.

Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount.

FIFO

Weighted

LIFO

Average

Cost of goods sold

Ending inventory

$ 22,595 $ 24,235

$

23,275

$ 17,640 $ 16,909

$

16,909

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the year, Wright Company sells 480 remote-control airplanes for $100 each. The company has the following inventory purchase transactions for the year. Date Transaction Number of Units Unit Cost Total Cost January 1 Beginning inventory 50 $70 $3,500 May 5 Purchase 260 73 18,980 November 3 Purchase 210 78 16,380 520 $38,860 Calculate ending inventory and cost of goods sold for the year, assuming the company uses weighted-average cost. (Round your average cost per unit to 4 decimal places.)arrow_forwardLate in the year, Software City began carrying WordCrafter, a new word processing software program. At December 31, Software City's perpetual Inventory records included the following cost layers in its Inventory of WordCrafter programs. Purchase Date Nov. 14 Dec. 12 Total available for sale at Dec. 31 Quantity 10 28 38 Unit Cost $ 400 320 $ Total Cost $ 4,000 8,960 $12,960 a. At December 31, Software City takes a physical Inventory and finds that all 38 units of WordCrafter are on hand. However, the current replacement cost (wholesale price) of this product is only $250 per unit. 1. Prepare the entries to record this write-down of the Inventory to the lower-of-cost-or-market at December 31. (Company policy is to charge LCM adjustments of less than $2,000 to Cost of Goods Sold and larger amounts to a separate loss account.) 2. Prepare the entries to record the cash sale of 32 WordCrafter programs on January 9, at a retail price of $380 each. Assume that Software City uses the FIFO flow…arrow_forwardEllie Inc. sold 6 similar items in February for $15 each. The company started with 3 items in inventory that cost $5. The following purchases were made during February: 2 items were purchased on February 3 with a unit cost of $8 1 item on February 15 with a unit cost of $8.50 4 items on February 22 with a unit cost of $7.50 What is the cost of goods sold using the FIFO method?arrow_forward

- Llleo, inc purchases 2,100S of inventory with shipping terms FOB Vancouver.The supplier is based in Olympia and Illeo is based in vancouver. The shipping costs are $300. What is the cost of Illeos inventoryarrow_forwardCortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 140 units at $65 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 130-unit purchase at $74 per unit; the second was a 228-unit purchase at $78 per unit. During the period, it sold 288 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses: a. FIFO. b. LIFO. c. Weighted average.arrow_forwardFancy Iron began August with 45 units of iron inventory that cost $24 each. During August, the company completed the following inventory transactions: Requirement 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method. Start by entering the beginning inventory balances. Enter the transactions in chronological order, calculating new inventory on hand balances after each transaction. Once all of the transactions have been entered into the perpetual record, calculate the quantity and total cost of merchandise inventory purchased, sold, and on hand at the end of the period. (Enter the oldest inventory layers first.) - X Cost of Goods Sold Inventory on Hand Requirements Unit Cost Unit Cost Purchases Unit Date Quantity Cost Aug. 1 3 81 21 30 Totals Total Cost Quantity Total Cost Quantity C Total Cost 1. Prepare a perpetual inventory record for the merchandise inventory using the FIFO inventory costing method. 2. Prepare a perpetual…arrow_forward

- Cortez Company sells chairs that are used at computer stations. Its beginning inventory of chairs was 220 units at $44 per unit. During the year, Cortez made two batch purchases of this chair. The first was a 285-unit purchase at $49 per unit; the second was a 380-unit purchase at $51 per unit. During the period, it sold 555 chairs. Required Determine the amount of product costs that would be allocated to cost of goods sold and ending inventory, assuming that Cortez uses a. FIFO. b. LIFO. c. Weighted average, (Do not round Intermediate calculations. Round your final answers to nearest whole dollar amount.) Cost of goods sold Ending inventory FIFO LIFO Weighted Averagearrow_forwardUsing periodic costing procedures, compute the cost of the Dec. 31 inventory and the cost of goods sold for the MP8 systems during the year under each of the following cost flow assumptions. (Round your unit cost values to 2 decimal places and final answers to the nearest whole dollar amount.)arrow_forwardAlpha places 900 units in production during the year. All 900 units are completed during the year. It had no beginning WIP inventory. Direct material costs added during the year were $81,000 and conversion costs were $9,000. 8) What is the Direct Material cost per equivalent unit for the year? 9) What is the Conversion Cost per equivalent unit for the year? 10) How much is Cost of Goods manufactured for the year? 11) Assume beginning FG inventory was 0 (zero) and that Alpha sold 10% of what it manufactured this year. How much is COGS?arrow_forward

- During the year, Wright Company sells 495 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. Number of Unit Date January 1 May 5 Transaction Units Cost Total Cost Beginning inventory 60 $69 $4,140 Purchase 265 72 19,080 November 3 Purchase 215 77 16,555 540 $39,775 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. Cost of Goods Available for Sale Cost of Goods Sold LIFO Number Cost per of units unit Beginning Inventory 60 $ 69 $ Cost of Goods Available for Sale 4,140 Number of units Cost per Cost of Goods unit Number Sold of units Ending Inventory Cost per unit Ending Inventory $ 0 Purchases: May 5 265 $ 72 19,080 0 November 3 215 $ 77 16,555 0 Total 540 $ 39,775 $ 0 0 $ 0arrow_forwardDuring the year, Wright Company sells 425 remote-control airplanes for $110 each. The company has the following inventory purchase transactions for the year. Number Date Transaction of Units Unit Cost Total Cost $ 4,740 19,270 14,790 Jan. 1 $79 Beginning inventory Purchase 60 Мay 5 Nov. 3 235 82 Purchase 170 87 465 $ 38,800 Calculate ending inventory and cost of goods sold for the year, assuming the company uses LIFO. LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Cost of Average # of units Cost per Average # of units Cost per unit Cost of Goods Average Cost Goods Ending Inventory # of units Available unit for Sale Sold per unit Beginning Inventory $ $ $ Purchases: May 5 $ Nov. 3 $ Totalarrow_forwardMarvin Company has a beginning inventory of 13 sets of paints at a cost of $1.90 each. During the year, the store purchased 5 sets at $2.00, 7 sets at $2.60, 7 sets at $2.90, and 11 sets at $3.40. By the end of the year, 28 sets were sold. Calculate the number of paint sets in ending inventory. Number of paint sets = 15 Calculate the cost of ending inventory under LIFO, FIFO, and the weighted average methods. Note: Round your answers to the nearest cent. ost of ending inventory under LIFO $28.70selected answer correct Cost of ending inventory under FIFO $49.00selected answer correct Cost of ending inventory under Weighted Average $ Please answer weighted average question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education