FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

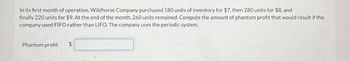

Transcribed Image Text:In its first month of operation, Wildhorse Company purchased 180 units of inventory for $7, then 280 units for $8, and

finally 220 units for $9. At the end of the month, 260 units remained. Compute the amount of phantom profit that would result if the

company used FIFO rather than LIFO. The company uses the periodic system.

Phantom profit

SA

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please answer questions #2-7, Thank you!! :) Determine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 90,450 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,341,600 Cost of goods sold 2,144,000 Gross profit $2,197,600 Expenses: Selling expenses $1,072,000 Administrative expenses 1,072,000 Total expenses 2,144,000 Income from operations $53,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $384,000 in yearly sales. The expansion will increase fixed costs by $38,400, but will not affect the relationship between sales and…arrow_forwardA company normally sells its product for $20 per unit. This company's current inventory consists of 200 units purchased at $16 per unit. Replacement cost has now fallen to $13 per unit. Calculate the value of this company's inventory at a lower cost or market. A) $2,550 B) $2,600 C) $3,000 D) $3,200arrow_forwardIn its first month of operations, Sheffield Corp. made three purchases of merchandise in the following sequence: (1) 350 units at $8, (2) 400 units at $9, and (3) 500 units at $10. Calculate average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Average unit cost $___________________arrow_forward

- Applying Differential Analysis to Profitability Scenarios Assume that Company A and Company B sell a microwave popcorn popper for $20. Although the companies have different cost structures, both companies currently show a profit of $21,000 based on sales of 14,000 units as shown in the following financial statements for the month of June. Both companies hold no inventory and sell contractual orders in the month. For the Month of June Company A Company B Sales ($20) $280,000 $280,000 Variable cost of goods sold ($5.00, 7.50, Company A and B, respectively) 70,000 105,000 Variable selling and administrative costs ($2.00, $4.00, Company A and B, respectively) 28,000 56,000 Contribution margin 182,000 119,000 Fixed cost of goods sold 105,000 70,000 Fixed selling and administrative costs 56,000 28,000 Profits Before-Tax $21,000 $21,000 For each company, determine the impact on monthly profit using differential analysis for each of the following separate scenarios.1.…arrow_forwardLily Company had 100 units in beginning inventory at a total cost of $10,000. The company purchased 200 units at a total cost of $26,000. At the end of the year, Lily had 90 units in ending inventory. (a) Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round average-cost per unit and final answers to 0 decimal places, e.g. 1,250.) FIFO LIFO Average-cost The cost of the ending inventory $ $ $ The cost of goods sold $ $ $arrow_forwardCrane Company had 100 units in beginning inventory at a total cost of $8,000. The company purchased 200 units at a total cost of $22,000. At the end of the year, Crane had 60 units in ending inventory. Crane Company uses a periodic inventory system. Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round average-cost per unit and final answers to 0 decimal places, e.g. 1,250.) FIFO LIFO Average-cost The cost of the ending inventory $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places The cost of goods sold $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal places $enter a dollar amount rounded to 0 decimal placesarrow_forward

- At May 31, Lily Company has net sales of $320,000 and cost of goods available for sale of $216,000.Compute the estimated cost of the ending inventory, assuming the gross profit rate is 35%. Estimated cost of ending inventory $________arrow_forward5) Day Company, which uses the FIFO inventory method, had 254,000 units in inventory at the beginning of the year at a FIFO cost per units of $30. No purchases were made during the year. Quarterly sales information and two sets of end of quarter replacement cost figures follow: Quarter Unit Sales Case A Case B S $ 1 2 3 4 100,000 29 25 30,000 22 27 42,500 18 19 30,500 22 27 The market decline in the first quarter under Case A was expected to be temporary, whereas under Case B the decline was expected to be non temporary. Declines in other quarters were expected to be permanent. Required: Determining cost of goods sold for the four quarters under each case and verify the amounts by computing cost of goods sold using the lower of cost or market method applied on an annual basis.arrow_forwardNord Store’s perpetual accounting system indicated ending inventory of $20,000, cost of goodssold of $100,000, and net sales of $150,000. A year-end inventory count determined that goodscosting $15,000 were actually on hand. Calculate (a) the cost of shrinkage, (b) an adjusted costof goods sold (assuming shrinkage is charged to cost of goods sold), (c) gross profit percentagebefore shrinkage, and (d) gross profit percentage after shrinkage. Round gross profit percentagesto one decimal placearrow_forward

- Shepard Company sold 4,000 units of its product at $100 per unit during the year and incurred operating expenses of $15 per unit in selling the units. It began the year with 840 units in inventory and made successive purchases of its product as follows. Jan. 1 Beginning inventory . 840 units @ $58 per unit Apr. 2 Purchase . 600 units @ $59 per unit June 14 Purchase . 1,205 units @ $61 per unit Aug. 29 Purchase . 700 units @ $64 per unit Nov. 18 Purchase . 1,655 units @ $65 per unit Total . 5,000 units Required 1. Prepare comparative income statements similar to Exhibit 6.8 for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 40%. 2. How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing decreasing prices in its…arrow_forwardMarvin Company has a beginning inventory of 13 sets of paints at a cost of $1.90 each. During the year, the store purchased 5 sets at $2.00, 7 sets at $2.60, 7 sets at $2.90, and 11 sets at $3.40. By the end of the year, 28 sets were sold. Calculate the number of paint sets in ending inventory. Number of paint sets = 15 Calculate the cost of ending inventory under LIFO, FIFO, and the weighted average methods. Note: Round your answers to the nearest cent. ost of ending inventory under LIFO $28.70selected answer correct Cost of ending inventory under FIFO $49.00selected answer correct Cost of ending inventory under Weighted Average $ Please answer weighted average question.arrow_forwardYale Company manufactures hair brushes that sell at wholesale for $3 per unit. The company had no beginning inventory in the prior year. These data summarize the current and prior year operations: Prior Year Current Year Sales (000s) 2,300 units 3, 700 units Production (000s) 3,000 units 3,000 units Production cost Factory-variable (per unit) $ 0.60 $ 0.60 —fixed (000s ) $ 1,500 $1,500 Marketing-variable (per unit) $ 0.40 $ 0.40 Administrative-fixed (000s) $ 500 $ 500 Required: 1. Prepare an income statement for each year based on full costing. 2. Prepare an income statement for each year based on variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from using the full costing method and variable costing method.Complete this question by entering your answers in the tabs below. Required 1 Prepare an income statement for each year based on full costing. (Enter your answers in thousands of dollars.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education