FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:### Coronado Corporation's Ending Inventory Assessment

Coronado Corporation has provided data regarding the cost and Net Realizable Value (NRV) of four items in its ending inventory. The details are as follows:

| Item | Cost | Net Realizable Value (NRV) |

|------------|-------|----------------------------|

| Jokers | $2,480| $2,604 |

| Penguins | $6,200| $6,138 |

| Riddlers | $5,456| $5,735 |

| Scarecrows | $3,968| $4,749 |

### Instructions for Determination

Determine the following: the Lower of Cost or Net Realizable Value (LCNRV) for each item.

| Item | LCNRV |

|------------|-------|

| Jokers | $ |

| Penguins | $ |

| Riddlers | $ |

| Scarecrows | $ |

**Guidance on LCNRV Calculation:**

- **LCNRV** is the lower value between the cost and the NRV.

- Compare the cost and NRV for each item.

- Enter the lower value in the LCNRV column for each item.

This exercise helps in aligning inventory valuation with accounting standards by recognizing potential losses.

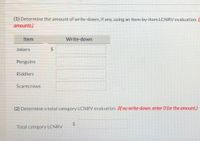

Transcribed Image Text:**Instructions for LCMRV Evaluation**

**(1) Determine the amount of write-down, if any, using an item-by-item LCMRV evaluation. (If no write-down, enter 0 for the amounts.)**

| Item | Write-down |

|------------|------------|

| Jokers | $ |

| Penguins | $ |

| Riddlers | $ |

| Scarecrows | $ |

**(2) Determine a total category LCMRV evaluation. (If no write-down, enter 0 for the amount.)**

Total category LCMRV: $______

---

**Explanation**

The table above provides a framework for determining the write-down amounts for various items, using an item-by-item evaluation method. This involves assessing each item (Jokers, Penguins, Riddlers, Scarecrows) individually to determine if a write-down is necessary. If not, you should enter "0" for the amounts.

Additionally, there is an option to calculate the total category LCMRV if a broader category evaluation is required, with a similar instruction to enter "0" if no write-down is needed.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- M3arrow_forwardS At the end of the year, Randy's Parts Company had the following items in inventory: Item P1 Quantity 60 P2 40 P3 80 P4 70 Required Unit Cost Unit Market Value $ 85 70 130 125 $ 90 72 a. Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each individual inventory item. b. Provide the adjustment necessary to write down the inventory based on Requirement a. Assume that Randy's Parts Co. uses the perpetual inventory system. c. Determine the amount of ending inventory, assuming that the lower-of-cost-or-market rule is applied to the total inventory in aggregate. 120 130 d. Provide the adjustment necessary to write down the inventory based on Requirement c. Assume that Randy's Parts Co. uses the perpetual inventory system. Required A Required B Required C Ending inventory Complete this question by entering your answers in the tabs below. Required D Determine the amount of ending inventory using the lower-of-cost-or-market rule applied to each…arrow_forwardUsing LIFO, what is the ending balance in inventory? Date $4,800 3/1/2011 Purchase Total Goods Available for Sale O $8,400 Source 1/1/2011 Beginning Inventory 2/1/2011 Purchase $9,100 O $8,159 Units sold Units Purchased 1000 700 1,500 3,200 2500 Cost Per Unit $13 $9 $12 $20 Total Cost $13,000 $6,300 $18,000 $37,300arrow_forward

- helparrow_forwardValuing Inventory at Lower-of-Cost-or-Market Gard Inc. has compiled the following information related to its five products. Costs of disposal are estimated to be 10% of selling price, and gross profit is estimated to be 25% of the selling price. Determine the value of inventory applying the lower-of-cost-or-market rule to each individual inventory item. Note: Round each amount to the nearest dollar. #1 #2 #3 #4 #5 Estimated selling price $66 $76 $82 $100 $130 Original cost (LIFO) 45 48 60 63 90 Replacement cost 50 70 49 66 83 Inventory at the lower-of-cost-or-market $ (10) x $ (11) x $ (12) x $ (25) х $ (20) xarrow_forwardFloyd Corporation has the following four items in its ending inventory. 000Item000 000Cost000 Net Realizable 0Value (NRV)0 Jokers $2,00000 $2,100000 Penguins 5,00000 4,950000 Riddlers 4,40000 4,625000 Scarecrows 3,20000 3,830000 Determine the following: (a) the LCNRV for each item, and (b) the amount of write-down, if any, using (1) an item-by-item LCNRV evaluation and (2) a total category LCNRV evaluation.arrow_forward

- Calculate cost of goods sold using the following information under the LIFO method of inventory: Beginning Inventory 12/1 Purchased 12/10 Purchased 12/15 Sold 12/25 $112,500 $200,000 $175,000 $62,500 2,500 units at $20 per unit 3,000 units at $25 per unit $2,500 units at $30 per unit $4,000 units for $50 eacharrow_forwardUse the following inventory table to find the cost of goods sold using the first-in, first-out (FIFO) inventory method. Date of purchase Units purchased Cost per unit Retail price per unit Beginning inventory 42 $860 $965 February 5 25 $1,770 $2,115 February 9 19 $945 $1,208 March 3 27 $490 $600 Units sold 81 Question content area bottom Part 1 The cost of goods sold is $enter your response here. (Type an integer or a decimal.)arrow_forwardPowder Ski Shop reports inventory using the lower of cost and net realizable value (NRV). Below is information related to its year-end inventory. Inventory Inventory Ski jackets Skis Calculate the total amount to be reported for ending inventory in the balance sheet. Ski jackets Skis Quantity Quantity 10 15 10 15 Unit Unit Cost NRV $104 $124 440 390 Lower of Cost and NRV per unit Ending Inventory $ $ 0 0 0arrow_forward

- Consider the following information pertaining to a company's inventory: Product Quantity Cost Net Realizable Value Revolvers 15 $ 128 $ 155 Spurs 28 27 22 Hats 11 58 48 At what amount should the company report its inventory? Multiple Choice $3,156 $3,469 $3,064 $3,314arrow_forwardAmes Trading Company has the following products in its ending inventory. Required: Compute lower of cost or market for inventory applied separately to each product. Inventory Items Mountain bikes Skateboards Gliders Units 11 13 26 Cost Per Unit $600 350 800 Market $550 425 700 Cost Total Market LCM Applied to Each Productarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education