FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

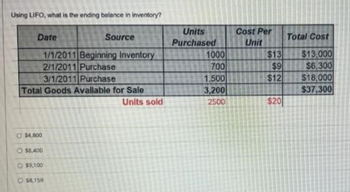

Transcribed Image Text:Using LIFO, what is the ending balance in inventory?

Date

$4,800

3/1/2011 Purchase

Total Goods Available for Sale

O $8,400

Source

1/1/2011 Beginning Inventory

2/1/2011 Purchase

$9,100

O $8,159

Units sold

Units

Purchased

1000

700

1,500

3,200

2500

Cost Per

Unit

$13

$9

$12

$20

Total Cost

$13,000

$6,300

$18,000

$37,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help on problem a2arrow_forwardQ.3 The following are the inventory records of the Jordan Company: Total $40 Cost $2 Units Balance, January 1 Purchases: 20 February May August December 30 3 90 40 200 6. 10 20 120 10 100 Available for sale 120 $550 Calculate ending inventory, which consists of 30 units, and cost of sales, using: (a) FIFO, (b) LIFO, and (c) average give your opinion on the resultsarrow_forwardDo not give answer in imagearrow_forward

- Using Perpetual Inventory, identify cost of goods sold expense for Oct 2021 # Units Cost Sale price 01-Oct Opening Inventory 500 $10,000.00 04-Oct Sales 100 $4,000.00 07-Oct Purchase 300 $6,300.00 11-Oct Sales 225 $9,225.00 15-Oct Purchase 350 $6,650.00 17-Oct Sales 175 $6,650.00 18-Oct Sales 275 $10,725.00 Using FIFO, provide Closing Inventory Question 5 options: 7565.23 7415.65 7433.44 7395.58arrow_forwardPeriodic Inventory System Company A $ 520,000 Company B Beginning inventory + Net Purchases 327,000 TOTAL GOODS AVAILABLE TO SELL 685,000 750,000 (Ending Inventory) 290,000 Cost of Goods Sold $ 615,000 For Company A determine Net Purchases and Cost of Goods Sold. For Company B determine Beginning Inventory and Ending Inventory. Company A: Net purchases 4 and Cost of goods sold type your answer. Company B: Beginning inventory type your answer... and Ending inventory type your answer.arrow_forwardSh15arrow_forward

- Given the following: Numberpurchased Costper unit Total January 1 inventory 32 $ 4 $ 128 April 1 52 6 312 June 1 42 7 294 November 1 47 8 376 173 $ 1,110 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 53 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 53 units).arrow_forwardPlease do not give solution in image format thankuarrow_forwardFIFO inventory assumptions: Beginning inventory of 10 units @ $5 = $50 Purchases month #1 of 10 units @ $10 = $100 Purchases month #2 of 10 units @ $15 = $150 Cost of goods available for sale (subtotal) = $300 Less ending inventory of 10 units Equals cost of goods sold (also known as cost of sales) Under the FIFO inventory method, calculate the cost of goods sold or cost of sales. Using your computation of FIFO cost of goods sold, and further assuming sales equal $500 and operating expenses equal $50, what is the gross profit amount?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education