FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

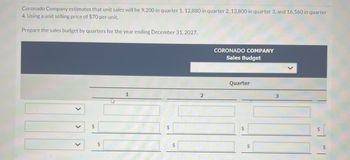

Transcribed Image Text:Coronado Company estimates that unit sales will be 9,200 in quarter 1, 12,880 in quarter 2, 13,800 in quarter 3, and 16,560 in quarter

4. Using a unit selling price of $70 per unit.

Prepare the sales budget by quarters for the year ending December 31, 2027.

$

$

1

$

$

CORONADO COMPANY

Sales Budget

2

Quarter

$

3

$

$ [

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Do not give answer in imagearrow_forwardNonearrow_forwardPrepare a direct labor budget for each of the upcoming five years. Cost labor per unit = $8 Total direct labor hours needed for a period = Number of units to be produced in that period * Direct labors hours needed per unit Total direct labor costs needed to meet production =Total direct labor hours needed for that period * Direct labor cost per hourarrow_forward

- Copr Goedl 2022 Sheba Industries reported the following budgeted sales in units for the first quarter of the fiscal year. Month Units June 3,300 July 2,960 3,120 August The desired ending finished goods inventory should be 10% of the next month's sales in units. The inventory on May 31 contained 330 units, which is the beginning inventory for June. The manager is preparing the production budget. The total number of units to be produced in July is: 2,976 units 3,272 units 3,266 units O3,596 unitsarrow_forwardFill in the missing information from the following schedules: Sales Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Expected sales (units) 7,600 8,300 8,700 9,100 fill in the blank 1 Sales price per unit $45 $50 $50 $56 Total sales revenue $342,000 $415,000 $435,000 $fill in the blank 2 $fill in the blank 3 Production Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Q1, Year 2 Expected sales 7,600 8,300 8,700 9,100 7,900 Desired ending inventory 1,660 1,740 1,820 fill in the blank 4 900 Total required units 9,260 10,040 10,520 10,680 8,800 Less: Beginning inventory 1,520 1,660 1,740 1,820 1,580 Required production 7,740 8,380 8,780 fill in the blank 5 7,220 Total fill in the blank 6 Direct Materials Budget For the Year Ending Dec. 31, 2018 Quarter 1 Quarter 2 Quarter 3 Quarter 4 Total Units to be produced 7,740…arrow_forwardBudgeted sales for the month of April are shown in the following table: April May June $500 $800 Sales Cash Sales Sales on Account The company expects a 25% Increase in sales per month for May and June. The amount of sales revenues that would appear on the company's 2nd quarter pro forma income statement would be Multiple Choice O O $4,956.25. $4,225.50. $3,050.00. $2,031.25.arrow_forward

- Current Attempt in Progress Monty Company combines its operating expenses for budget purposes in a selling and administrative expense budget For the first quarter of 2022, the following data are developed L Sales: 21,500 units unit selling price 2 Variable costs per sales dollar Sales commissions Delivery expense 3 Advertising Fixed costs per quarter Sales salaries Office salaries Depreciation Insurance Utilities $30 Save for Later 6% 4% $24,400 19,500 5,000 2,100 1,000 Prepare a selling and administrative expense budget for the first quarter of 2022 (List variable costs before fixed costs) MONTYCOMPANY Selling and Administrative Expense Budgetarrow_forwardPlease avoid images in solution thankuarrow_forwarda1arrow_forward

- Diane Buswell is preparing the 2022 budget for one of Current Designs' rotomolded kayaks. Extensive meetings with members of the sales department and executive team have resulted in the following unit sales projections for 2022. Quarter 1 1,300 kayaks Quarter 2 2,000 kayaks Quarter 3 950 kayaks Quarter 4 950 kayaks Current Designs' policy is to have finished goods ending inventory in a quarter equal to 25% of the next quarter's anticipated sales. Preliminary sales projections for 2023 are 1,100 units for the first quarter and 2,000 units for the second quarter. Ending inventory of finished goods at December 31, 2021, will be 325 rotomolded kayaks. Production of each kayak requires 44 pounds of polyethylene powder and a finishing kit (rope, seat, hardware, etc.). Company policy is that the ending inventory of polyethylene powder should be 20% of the amount needed for production in the next quarter. Assume that the ending inventory of polyethylene powder on December 31, 2021, is 21,800…arrow_forwardXYZ Inc. is preparing its annual budgets for the year ending December 31, 2025. Product JB 50 Product JB 60 Sales Budget: Anticipated volume in units 677,000 345,000 Unit Selling Price $23 $45 Production budget: Desired ending finished goods units 65,000 21,500 Beginning finished good units 54.300 10,750 Prepare the Production Budget for the year.arrow_forwardDO NOT GIVE SOLUTION IN IMAGEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education