Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

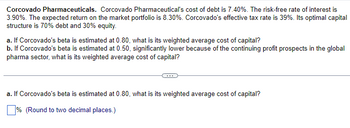

Transcribed Image Text:Corcovado Pharmaceuticals. Corcovado Pharmaceutical's cost of debt is 7.40%. The risk-free rate of interest is

3.90%. The expected return on the market portfolio is 8.30%. Corcovado's effective tax rate is 39%. Its optimal capital

structure is 70% debt and 30% equity.

a. If Corcovado's beta is estimated at 0.80, what is its weighted average cost of capital?

b. If Corcovado's beta is estimated at 0.50, significantly lower because of the continuing profit prospects in the global

pharma sector, what is its weighted average cost of capital?

a. If Corcovado's beta is estimated at 0.80, what is its weighted average cost of capital?

% (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Adamson Corporation is considering four average-risk projects with the following costs and rates of return: Cost Expected Rate of Return $2,000 16.00% 3,000 15.00 5,000 13.75 4 2,000 12.50 The company estimates that it can issue debt at a rate of rd = 11%, and its tax rate is 25%. It can issue preferred stock that pays a constant dividend of $6.0 per year at $60.00 per share. Also, its common stock currently sells for $52.00 per share; the next expected dividend, D₁, is $5.75; and the dividend is expected to grow at a constant rate of 5% per year. The target capital structure consists of 75% common stock, 15% debt, and 10% preferred stock. Project a. What is the cost of each of the capital components? Do not round intermediate calculations. Round your answers to two decimal places. Cost of debt: 123 % Project 1 Project 2 Project 3 Project 4 Cost of preferred stock: Cost of retained earnings: b. What is Adamson's WACC? Do not round intermediate calculations. Round your answer to two…arrow_forwardGanado's Cost of Capital. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.30%, the company's credit risk premium is 3.60%, the domestic beta is estimated at 0.94, the international beta is estimated at 0.61, and the company's capital structure is now 75% debt. The expected rate of return on the market portfolio held by a well-diversified domestic investor is 9.80% and the expected return on a larger globally integrated equity market portfolio is 8.60%. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.60% and the company's effective tax rate is 42%. For both the domestic CAPM and ICAPM, calculate the following: a. Ganado's cost of equity b. Ganado's after-tax cost of debt c. Ganado's weighted average cost of capital a. Using the domestic CAPM, what is Ganado's cost of equity? % (Round to two decimal places.)arrow_forwardA firm's unlevered beta is 0.5 and tax rate is 30%. If it is with 20% debt. What is the firm's levered beta? 0.9012 1.2533 0.5875 0.6235arrow_forward

- Consider this case: Globex Corp. currently has a capital structure consisting of 30% debt and 70% equity. However, Globex Corp.'s CFO has suggested that the firm increase its debt ratio to 50%. The current risk-free rate is 3.5%, the market risk premium is 7.5%, and Globex Corp.'s beta is 1.15. If the firm's tax rate is 25%, what will be the beta of an all-equity firm if its operations were exactly the same? Now consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 25%. It currently has a levered beta of 1.15. The risk-free rate is 3.5%, and the risk premium on the market is 7.5%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm's level of debt will cause its before-tax cost of debt to increase to 12%. First, solve for US Robotics Inc.'s unlevered beta. Use US Robotics Inc.'s unlevered beta to solve…arrow_forwardHampton Corporation has a beta of 1.6 and a marginal tax rate of 34%. The expected return on the market is 11% and the risk-free interest rate is 6%. Estimate the firm's cost of internal equity. 13.8% 6.56% 12.8% 12.5% 14.0%arrow_forward↑ Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.50%, the company's credit risk premium is 4.50%, the domestic beta is estimated at 1.06, the international beta is estimated at 0.75, and the company's capital structure is now 25% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.30% and the company's effective tax rate is 35% Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates 8.10% b. 7.00% 6.5.00% d. 3.90% ++ a. Using the domestic CAPM, what is Ganado's weighted average cost of capital of the fom's equity risk premium is 10% (Round to two decimal places) tude 1.1.... oline mearrow_forward

- Now consider the case of another company: US Robotics Inc. has a current capital structure of 30% debt and 70% equity. Its current before-tax cost of debt is 10%, and its tax rate is 25%. It currently has a levered beta of 1.10. The risk-free rate is 3%, and the risk premium on the market is 7.5%. US Robotics Inc. is considering changing its capital structure to 60% debt and 40% equity. Increasing the firm’s level of debt will cause its before-tax cost of debt to increase to 12%. First, solve for US Robotics Inc.’s unlevered beta. 0.83 0.75 1.00 0.91 Use US Robotics Inc.’s unlevered beta to solve for the firm’s levered beta with the new capital structure. 1.76 1.67 1.58 1.94 Use US Robotics Inc.’s levered beta under the new capital structure, to solve for its cost of equity under the new capital structure. 14.58% 16.20% 12.96% 18.63% What will the firm’s weighted average cost of capital (WACC) be if it makes this change in…arrow_forwardWilde Software Development has a 10% unlevered cost of equity. Wilde forecasts the following interest expenses, which are expected to grow at a constant 4% rate after Year 3. Wilde's tax rate is 25%. Interest expenses Year 1=$70 , Year 2= $85, Year 3= $125. What is the horizon value of the interest tax shield? PLEASE Do not round intermediate calculations And please round the answer to the nearest cent. Please show me the steps I don't know what I'm doing wrong!arrow_forwardStevensons bakeries and all equity firm that has a projected perpetual EBIT of $144,000 per year. The cost of equity is 10.5% and the tax rate is 21%. Assume there's no depreciation, no capital spending and no change in networking capital. The firm can borrow perpetual debt at 5.8%. Currently, the firm is considering converting to a debt equity ratio of .54. What is the firms levered value? MM assumptions hold.arrow_forward

- Clifford Chance is a large U.K. firm with the before tax cost of debt of 10%. The risk-free rate of interest on 10-year Treasury bonds is 4%. The expected return on the market portfolio is 8%. After effective taxes, Clifford Chance’s effective tax rate is 20%. Its optimal capital structure is 70% debt and 30% equity. If Clifford Chance’s beta is estimated at 1.5, what is its weighted average cost of capital? (4 marks) This firm has collected 50,000 GBP from U.K. stock and bond markets by using the weighted average cost of capital calculated in step (a). It has invested this fund on a 3-year project in U.K. and earned the cash flows of 10,000, 15,000, and 20,000 for the first, second, and third years of the project, respectively. Calculate Net Present Value of the project and provide a decision whether this project is acceptable for investment?arrow_forwardBrannan Manufacturing has a target debt-equity ratio of .30. Its cost of equity is 12.5 percent, and its pretax cost of debt is 7.2 percent. If the tax rate is 25 percent, what is the company’s WACC? WACC: (by %)arrow_forwardCorcovado Pharmaceuticals. Corcovado Pharmaceutical’s cost of debt is 7%. The risk-free rate of interest is 3%. The expected return on the market portfolio is 8%. After effective taxes, Corcovado’s effective tax rate is 25%. Its optimal capital structure is 60% debt and 40% equity. If Corcovado’s beta is estimated at 1.1, what is its weighted average cost of capital? If Corcovado’s beta is estimated at 0.8, significantly lower because of the continuing profit prospects in the global pharma sector, what is its weighted average cost of capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education