FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

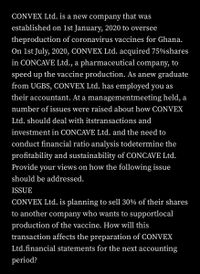

Transcribed Image Text:CONVEX Ltd. is a new company that was

established on 1st January, 2020 to oversee

theproduction of coronavirus vaccines for Ghana.

On 1st July, 2020, CONVEX Ltd. acquired 75%shares

in CONCAVE Ltd., a pharmaceutical company, to

speed up the vaccine production. As anew graduate

from UGBS, CONVEX Ltd. has employed you as

their accountant. At a managementmeeting held, a

number of issues were raised about how CONVEX

Ltd. should deal with itstransactions and

investment in CONCAVE Ltd. and the need to

conduct financial ratio analysis todetermine the

profitability and sustainability of CONCAVE Ltd.

Provide your views on how the following issue

should be addressed.

ISSUE

CONVEX Ltd. is planning to sell 30% of their shares

to another company who wants to supportlocal

production of the vaccine. How will this

transaction affects the preparation of CONVEX

Ltd.financial statements for the next accounting

period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Precision Castparts, a manufacturer of processed engine parts in the automotive and airline industries, borrows $40.4 million cash on October 1, 2024, to provide working capital for anticipated expansion. Precision signs a one-year, 9% promissory note to Midwest Bank under a prearranged short-term line of credit. Interest on the note is payable at maturity. Each company has a December 31 year-end. Required: 1. Prepare the journal entries on October 1, 2024, to record (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. 2. Record the adjusting entry on December 31, 2024, for (a) Precision Castparts and (b) Midwest Bank. 3. Prepare the journal entries on September 30, 2025, to record payment of (a) the notes payable for Precision Castparts and (b) the notes receivable for Midwest Bank. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries on October 1, 2024, to record (a) the…arrow_forwardOn October 1, 2024, Halsey Company issued stock options for 300,000 shares to a division manager. The options have an estimated fair value of $3 each. To provide additional incentive for managerial achievement, the options are not exercisable unless divisional revenue increases by 6% in three years. Halsey initially estimates that it is probable the goal will be achieved. How much compensation will be recorded in each of the next three years? A.$0 B.$100,000 C.$300,000 D.$900,000arrow_forwardOn January 1, 2020, Xiamen Company made amendments to its defined benefit pension plan that resulted in 61,400 yuan of past service cost. The plan has 5,280 active employees with an average expected remaining working life of 10 years. There currently are no retirees under the plan. SE Assume that Xiamen Company is a foreign company using IFRS and is owned by a company using US GAAP Thus, IFRS balances must be converted to U.S. GAAP to prepare consolidated financial statements. Ignore income taxes. Required: a. Prepare journal entries for the past service cost for the years ending December 31, 2020, and December 31, 2021, under (1) IFRS and (2) U.S. GAAP. b. Prepare the entry(ies) that the U.S. parent would make on the December 31, 2020, and December 31, 2021, conversion worksheets to convert IFRS balances to U.S. GAAParrow_forward

- Please help me with this question cuz most of the responses are wrong. Thanksarrow_forwardGravity Services Ltd (GS) is a company set up in Hong Kong providing the region with cloud computingservices like servers, storage, networking and software, to help customers to meet their business challenges. During the year ended 30 September 2020, it enters into two contracts.(i) Data Tab Ltd (DT) enters into a contract with GS for the use of an identified server for three years.GS delivers and installs the server at DT’s premises in accordance with DT’s instructions, and provides repair and maintenance services for the server, as needed, throughout the period of use. GSsubstitutes the server only in the case of malfunction. DT can decide which data to be stored and howto integrate the server to its operation. DT can change its decisions on how to operate the serversthroughout the period of use (a) advise GS whether the contract (i) falls within HKFRS 16 as a lease.arrow_forwardOn May 1, 2021 Race Cars Inc. enters into a contract with a major U.S. racing program to design and distribute training equipment. Under the terms of the contract, Race Cars will deliver the training equipment on August 1, 2022. The customer will pay $300,000 to Race Cars, Inc. on May 15, 2021. Interest incurred on similar financing agreements in the industry is $35,000. What is the transaction price Which should Race Cars, Inc. recognize: interest expense or interest income for this transaction?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education