ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

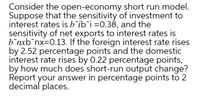

Transcribed Image Text:Consider the open-economy short run model.

Suppose that the sensitivity of investment to

interest rates is b'ib¯i =0.38, and the

sensitivity of net exports to interest rates is

b¯nxb¯nx=0.13. If the foreign interest rate rises

by 2.52 percentage points and the domestic

interest rate rises by 0.22 percentage points,

by how much does short-run output change?

Report your answer in percentage points to 2

decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How do fluctuating exchange rates benefit MNCs and how do they affect them negatively? Give an example of both.arrow_forwardConsider the relationship among exchange-rate changes, aggregate demand, and monetary policy. Assume we begin in a situation with real GDP equal to Y∗.Y*. Suppose the world price for raw materials rises because of growing demand for these products. Given that Canada is a net exporter of raw materials, what is the likely effect on Canadian aggregate demand? Show this in an AD/AS diagram (assuming no change in the exchange rate). Suppose instead that there is an increase in the demand by foreigners for Canadian financial assets such as government bonds. What is the direct effect on Canadian aggregate demand? Show this in an AD/AS diagram (assuming again no change in the exchange rate). Both of the shocks described above are likely to cause an appreciation of the Canadian dollar on foreign-exchange markets. As the Canadian dollar appreciates, what are the effects on aggregate demand in part (a) and in part (b)? Show these “secondary” effects in your diagram and explain. Given your…arrow_forwardSuppose that a vaccine manufacturing company owned entirely by U.S. citizens opens a new facility in Canada. Answer all three parts below. In each case, carefully explain your answer. a) What sort of foreign investment would this represent? b) What would be the effect of this investment on current Canadian Gross Domestic Product (GDP) and U.S. GDP? c) What would be the effect of this investment on future per capita incomes in Canada?arrow_forward

- Show the effects of expansionary policy on output and the price level in an open economy when there is full employment.arrow_forwardWe have the following data for a hypothetical open economy: GNP = $10,000 Consumption (C) = $8,000 Investment (I) = $1,200 Government Purchases (G) = $1,600 What is the value of the current account balance? $. (Enter your answer as an integer. Include a minus sign if necessary).arrow_forwardWhich of the following would not be counted in the U.S. BOP current account? Martha receives a $50 dividend check on stock she owns in business in Germany. A wealthy Italian purchases numerous antiques in the United States for his villa. Helen, an American oil engineer, is a paid adviser to Middle Eastern countries in the area of petroleum extraction. General Motors Corporation owns buildings that are situated in Mexico. France purchases a new jet fighter aircraft from the Boeing Company in the U.S.arrow_forward

- Consider the following equations for a small open economy for both the goods and money markets.Goods Market: C = 3000 + 0.8Yd; T = 1000 + 0.3Y; G = 6000; TR = 500; I = 4000 + 0.24Y – 100r; M = 3000 + 0.2Y; X = 2000.Money market: LP = 1000 + 0.15Y; LT = 2000 + 0.25Y – 15r; Ls = 1000 – 35r; MS = 40,000; P= 4a. Derive both the IS and LM equations for the economy and compute the Equilibrium level of Income and Interest Rate.arrow_forwardSuppose that an economy starts with a net foreign asset to GDP ratio NFA/Y equal to -0.3. After one year, the ratio of net exports to output has been 0. What will the NFA/Y ratio become after this year due to this effect? Suppose that an economy starts with a net foreign asset to GDP ratio NFA/Y equal to -30%. After one year, the real interest rate has been -10%. What will the NFA/Y ratio become after this year due to this effect?arrow_forwardSuppose policy makers want to increase net exports (NX) and keep output (Y) constant. Which of the following policies would most likely achieve this? A.an increase in government spending B.a real depreciation C.an increase in government spending and a decrease in the real exchange rate D.a decrease in the real exchange rate and a tax increasearrow_forward

- Help with a few subparts would be great!arrow_forwardWhich of the following statements is true? A)The open-economy IS curve is derived in the same way that the closed-economy IS curve is derived. B)The closed-economy IS curve is downward sloping, but the open-economy IS curve is upward sloping. C)Some factors that shift the IS curve in the closed economy in one direction will shift the IS curve in the open economy in the opposite direction. D)Factors that raise a country's current net exports, given domestic output and the domestic real interest rate, shift the open-economy IS curve up.arrow_forwardConsider a country with no capital mobility and flexible exchange rates. a. Solve for the exchange rate that clears the trade balance as a function of the level of income, Y. (Assume that the trade balance is in the form T =T, + øq– mY where øis a positive constant and q = (eP*/P)). b. Solve for the level of income as a function of all exogenous variables. In what way does the multiplier differ from all other open economy multipliers computed before?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education