ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Small Open Economy Model

Consider the Small Open Economy model studied in class. Answer the following questions by assuming that the

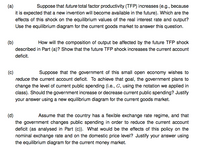

Transcribed Image Text:(a)

Suppose that future total factor productivity (TFP) increases (e.g., because

it is expected that a new invention will become available in the future). Which are the

effects of this shock on the equilibrium values of the real interest rate and output?

Use the equilibrium diagram for the current goods market to answer this question.

(b)

How will the composition of output be affected by the future TFP shock

described in Part (a)? Show that the future TFP shock increases the current account

deficit.

(c)

Suppose that the government of this small open economy wishes to

reduce the current account deficit. To achieve that goal, the government plans to

change the level of current public spending (i.e., G, using the notation we applied in

class). Should the government increase or decrease current public spending? Justify

your answer using a new equilibrium diagram for the current goods market.

(d)

the government changes public spending in order to reduce the current account

deficit (as analysed in Part (c)). What would be the effects of this policy on the

Assume that the country has a flexible exchange rate regime, and that

nominal exchange rate and on the domestic price level? Justify your answer using

the equilibrium diagram for the current money market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The Golden Rule capital-labor ratio maximizes investment per worker in the steady state. capital per worker in the steady state. output per worker in the steady state. consumption per worker in the steady state.arrow_forwardWhat are objects of study of International Macroeconomics? Provide definition of these objects.arrow_forwardWhat are the assumptions in the small open economy.vs closed or largeopen? What would be an example country today?arrow_forward

- Which of the following is TRUE of an open economy? GDP = C+I+G+X- IM O GDP = C+ I+G GDP = T- TR -G GDP = SPrivate + SGovernment %3Darrow_forwardTrue of False and explain: Investment is critical to economic development. Developing countries have immature domestic financial sectors, therefore they should pursue trade policies designed to produced trade surpluses.arrow_forwardFor an open economy, which of the following expressions represents private saving (S)? Group of answer choices investment plus tax revenues less government expenditure plus net exports, I + TG + NX I+T G NX I + G + NX GT+NXI none of the abovearrow_forward

- Consider the following equations for a small open economy for both the goods and money markets.Goods Market: C = 3000 + 0.8Yd; T = 1000 + 0.3Y; G = 6000; TR = 500; I = 4000 + 0.24Y – 100r; M = 3000 + 0.2Y; X = 2000.Money market: LP = 1000 + 0.15Y; LT = 2000 + 0.25Y – 15r; Ls = 1000 – 35r; MS = 40,000; P= 4a. Derive both the IS and LM equations for the economy and compute the Equilibrium level of Income and Interest Rate.arrow_forwardExplain why a developing country with a fixed exchange rate Explain why a developing country with a fixed exchange rate and foreign exchange controls in place (perfectly immobile capital) may find itself dependent on growth in exports, foreign investment, or foreign aid to attain economic growth. Explain why a developing country with a fixed exchange ratearrow_forward1 True/false questions Give a one sentence justification. 1. Adjusting for purchasing power parity tends to increase the measured income differences be- tween poor and rich countries. 2. According to the Malthusian model, an increase in productivity will lead to a larger population in the long run, but won't affect the level of income per capita in the long-run. 3. The decline in child mortality is the leading explanation for the decrease in fertility during the demographic transition. 4. Suppose that unobservable climate characteristics predict both the number of domesticable animal species and population density. Then the number of domesticable animals in a region doesn't satisfy condition 1 (relevance for being an instrumental variable for the number of years since the Neolithic transition.arrow_forward

- Aggregate expenditure in an open economy equals a) C + I + G + S - M b) C + I + G + T - M c) C + I + G + (X - M) d) C + I + G + (M - X)arrow_forwardThe following question is based on the international factor movement problem. Suppose the capital movement is allowed across borders and the amount of movement from home to abroad is K*K. Under such circumstance, how much is the change of the output for foreign country? (Hint: you need to calculate the foreign output before and after the capital movement) A. d+e+f+g B. d+e C. fD. d E. f+g MPKH a b с F K* d K H h MPKFarrow_forwardAnswer These Three Sub Parts i) In an open economy, Y = C + I + G + NX. Using symbols from this identity, write anexpression that defines national saving, S, in an open economy.S = _________________________ . ii) True or False? In an open economy, the following is always true: S = I + NCO, where I isinvestment spending and NCO is net capital outflow. iii) In an open economy, a country’s net capital outflow is:a.) the value of domestic assets purchased by foreigners minus the value of foreign assetspurchased by domestic residentsb.) the value of foreign assets purchased by domestic residents minus the value of domesticassets purchased by foreigners.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education