ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

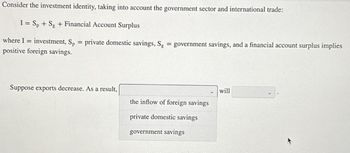

Transcribed Image Text:Consider the investment identity, taking into account the government sector and international trade:

I = Sp + Sg + Financial Account Surplus

where I = investment, Sp

positive foreign savings.

=

private domestic savings, Sg = government savings, and a financial account surplus implies

Suppose exports decrease. As a result,

the inflow of foreign savings

private domestic savings

government savings

will

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the government deficit is 20, interest on the government debt is 15, taxes are 55, government expenditures are 50, consumption expenditures are 65, ne factor payments are 25, the current account surplus is - 10, and national saving is 40. Calculate the following (not necessarily in the order given): a. Private disposable income = b. Transfers from the government to the private sector = c. Gross national product d. Gross domestic product : e. The government surplus = f. Net exports %D g. Investment expenditures =arrow_forwardIf national income Y = 10,000, disposable income Yd = 8,000 , consumption is C = 7,500, transfer payments TR = 100 and the budget deficit is BD = 150, what is the level of private domestic investment, I ? (please insert the round number without the Euro symbol)arrow_forwardConsider two large open economies - U.S. and Europe. If expansionary fiscal policy is adopted in Europe, what happens in the U.S? net capital outflow rises, the real interest rate falls and investment spending rises. net capital outflow falls, the real interest rate rises and investment spending rises. net capital outflow falls, the real interest rate rises and investment spending falls. net capital outflow rises, the real interest rate rises and investment spending falls. In a large open economy, if political instability abroad lowers the net capital outflow function, then the real interest rate: rises, while the real exchange rate falls and net exports rise. falls, while the real exchange rate rises and net exports fall. rises, while the real exchange rate rises and net exports fall. falls, while the real exchange rate rises and net exports rise. Political instability in the U.S. Political instability in the U.S.arrow_forward

- In algebraic terms, contrast the national savings and investment identities noted below: I) Private savings + Trade deficit + Government surplus = Private investmentII) Private savings = Private investment + Government budget deficit + Trade surplus.arrow_forwardImagine that the U.S. economy finds itself in the following situation: a government budget deficit of $100 billion, total domestic savings of $1,500 billion, and total domestic physical capital investment of $1,600 billion. According to the national saving and investment identity, what will be the trade balance? What will be the trade balance if investment rises by $50 billion, while the budget deficit and national savings remain the same?arrow_forwardSaving-Investment Diagram Real Interest Rate, r(percent Saving Curve Investment Curve DE F GH Desired Saving and Investment (in billions of dollars) Based on the Saving-Investment Diagram, if the world real interest rate is indicated by C, then the difference between values H and D measures the net capital outflow the difference between values H and F measures the trade deficit the difference between values H and D measures the trade deficit the domestic real interest rate is indicated by B none of the abovearrow_forward

- Graphs and questions in images. Thank you!arrow_forwardIf the economy enters a recessionary gap, then incomes in the economy decrease, which reduce income tax revenues earned by the government. When the economy enters a recession, unemployment compensation increases due to an increase in jobless claims. In other words, the government budget deficit increases. Begin with the open economy financial market in equilibrium. What will happen to the U.S. savings and net capital inflow function if the U.S. budget deficit increases? What will to the investment function if the U.S. budget deficit increases? What will happen to the real rate of interest if the U.S. budget deficit increases? What will happen to the quantity saved/invested if the U.S. budget deficit increases? Given the change in the level of savings, what would happen to the level of consumption?arrow_forwardAn open economy with absolute mobility of capital is described as follows: consumption function is given as C = 50 + 0, 8(Y T), where Y is output, andT is net taxes. Investment function is given as I = 20–10i, where I is nominal interest rate. Government spending G = 20, taxTr = 10, export Ex = 6E+ 10, import Im= 22-4E+0, 3Y where E - nominal exchange rate (price of foreign currency in terms of domestic currency). For one unit of foreign currency, you can get 3 units of domestic currency. The real money supply is M /P=50. The demand for real money is described by the following function: L(Y, i) = 0, 5Y-10i. Find IS curve in the form Y=a-bi+cE, where a,b,c are constants. Type in the answer these constants with spaces and commas between them, that is: a, b, c.arrow_forward

- 1) Consider a large open economy that engages in a fiscal contraction. In response to this policy change, what will happen to (a) national savings (b) the real rate of interest (c) net capital flows (d) the real exchange rate and (e) net exports?arrow_forwardConsider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate National Saving Domestic Investment Net Capital Outflow (Percent) (Billions of dollars) (Billions of dollars) (Billions of dollars) 7 60 25 -10 6 55 30 -5 5 50 35 0 4 45 40 5 3 40 45 10 2 35 50 15 Given the information in the preceding table, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. On the following graph, plot the relationship between the real…arrow_forwardWhich of the following would be part of Canada's capital and financial account? dividend payments received by a Canadian on his foreign stock holdings one hundred shares of Tesla stocks purchased by a Canadian investor a Disney tour taken by a Canadian in Florida the interest payment on foreign government bonds held by the Bank of Canadaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education