ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

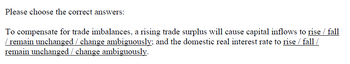

Transcribed Image Text:Please choose the correct answers:

To compensate for trade imbalances, a rising trade surplus will cause capital inflows to rise / fall

/ remain unchanged / change ambiguously; and the domestic real interest rate to rise / fall /

remain unchanged / change ambiguously.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that the amount of dollar (domestic) assets is fixed in the foreign exchange market. Explain the effects of an increase in the domestic interest rate, holding all other factors constant, on the exchange rate. Draw a diagram for the foreign exchange market to support your explanation.arrow_forwardAn economy with a strong export sector has been accumulating large surpluses in its current account. While this indicates a competitive export sector, it also leads to appreciation of the domestic currency, making exports more expensive and imports cheaper. This situation could potentially harm domestic industries and create economic imbalances. The government is contemplating measures to manage the current account surplus and maintain economic stability. The question is: In this scenario, the government's intervention should primarily focus on: A) Continuously increasing the current account surplus B) Managing the current account surplus to prevent economic imbalances C) Restricting all forms of imports D) Devaluing the domestic currencyarrow_forwardRapid increases in the U.S. exports of goods and services will result in a(n) U.S. dollars in the foreign exchange foreign currency and a(n). market. increase in the demand for; increase in the supply of increase in the supply of; increase in the demand for shortage of foreign currency; surplus of decrease in the supply of; decrease in the demand forarrow_forward

- A small, open economy with a fixed exchange rate system faces a balance of payments deficit due to a combination of high import levels and capital outflows. The central bank is using its foreign exchange reserves to support the fixed exchange rate, but these reserves are rapidly depleting. The government is considering policy options such as moving to a flexible exchange rate system, implementing capital controls, or seeking external financial assistance. In this case, the policy choices are primarily aimed at: A) Maintaining the fixed exchange rate at all costs B) Addressing the balance of payments deficit and stabilizing the exchange rate C) Completely closing off the economy from international trade D) Ignoring the balance of payments deficitarrow_forwardConsider the investment identity, taking into account the government sector and international trade: I = Sp + Sg + Financial Account Surplus where I = investment, Sp positive foreign savings. = private domestic savings, Sg = government savings, and a financial account surplus implies Suppose exports decrease. As a result, the inflow of foreign savings private domestic savings government savings willarrow_forwardSuppose a country has an overall balance of trade so that exports of goods and services equal imports of goods and services. Does that imply that the country has balanced trade with each of its trading partnersarrow_forward

- Suppose that the Mexican government decides to fix or peg the dollar-peso exchange rate at P20 = $1. If foreign-exchange traders on one day want to exchange $60 million for pesos, to enforce the peg the Mexican government will need to come up witharrow_forwardIn the balance-of-payments of Canada, merchandise imports are recorded as: a positive entry a financial account entry changes in official reserves a current account entry transfersarrow_forwardA trade deficit occurs when a country: A) Has higher exports than imports B) Has higher imports than exports C) Implements strict import quotas D) Lowers tariffs on all importsarrow_forward

- National Saving - Investment = X - IM A country whose National Saving is greater than its Investment will experience a Trade deficit (IM > X) Balanced trade (IM – X) = 0 O Trade surplus (X > IM)arrow_forwardWhich of the following creates a supply of Japanese yen in foreign exchange markets? Multiple Choice A Canadian student purchases a new Japanese car. A Canadian goes on a business trip to Japan. A Japanese company sells an insurance policy to a Canadian citizen. A Japanese tourist takes a trip to the Canadian Rockies. A Japanese investor receives dividends on some Canadian stock,arrow_forwardSuppose total Canadian exports in the month of June were $123.6 billion and total imports from foreign countries were $191.7 billion. What was the balance of trade? Instructions: Round your answer to one decimal place and include a negative sign, if necessary. billion.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education