FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

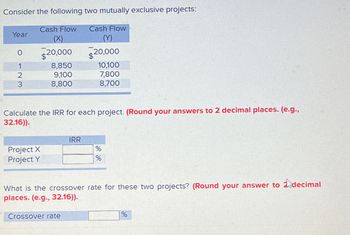

Transcribed Image Text:Consider the following two mutually exclusive projects:

Year

Cash Flow

(X)

Cash Flow

(Y)

0

$20,000

$20,000

1

8,850

10,100

23

9,100

7,800

8,800

8,700

Calculate the IRR for each project. (Round your answers to 2 decimal places. (e.g.,

32.16)).

IRR

Project X

Project Y

%

%

What is the crossover rate for these two projects? (Round your answer to 2 decimal

places. (e.g., 32.16)).

Crossover rate

%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- please be soecific w answer pls complete the boxarrow_forward19arrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 −$350,000 −$35,000 1 25,000 17,000 2 70,000 11,000 3 70,000 17,000 4 430,000 11,000 Assume you require a 15 percent return on your investment and a payback of 4 years. a. If you apply the discounted payback criterion, which investment will you choose? Why? b. If you apply the NPV criterion, which investment will you choose? Why? c. Based on your answers in (a) and (b), what you can say anything about the IRR of both projects? which project will you finally choose? Why?arrow_forward

- Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) -$ -$ 0 1235 4 NO a- Whichever project you choose, if any, you require a return of 14 percent on your investment. Project A Project B 357,000 38,000 58,000 58,000 433,000 a-1. What is the payback period for each project? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) 46,500 23,300 21,300 18,800 13,900 Project A Project B Payback period If you apply the payback criterion, which investment will you choose? 2. O Project A O Project B years years b- What is the discounted payback period for each project? (Do not round intermediate 1. calculations and round your answers to 2 decimal places, e.g., 32.16.) Discounted payback period years yearsarrow_forwardProblem 7: NPV versus IRR. Consider the following two mutually exclusive projects: Year Cash flow Cash flow (X) (Y) O 1 2 3 -9500 5800 4000 4000 PART 7A: The NPV for X is $ Answer: 2083.77 -9500 3500 5000 6000 if the required rate of return is 10%.arrow_forwardF2 please help.....arrow_forward

- Hansabenarrow_forwardConsider the following information: Cash Flows ($) Project C0 C1 C2 C3 C4 A –5,300 1,300 1,300 2,700 0 B –700 0 600 2,300 3,300 C –5,200 3,400 1,700 800 300 a. What is the payback period on each of the above projects? (Round your answers to 2 decimal places.)arrow_forwardConsider projects A and B with the following cash flows: C0 C1 C2 C3 A − $ 27 + $ 16 + $ 16 + $ 16 B − 52 + 27 + 27 + 27 a-1. What is the NPV of each project if the discount rate is 10%? (Do not round intermediate calculations. Round your answers to 2 decimal places.) a-2. Which project has the higher NPV? b-1. What is the profitability index of each project? (Do not round intermediate calculations. Round your answers to 2 decimal places.) b-2. Which project has the higher profitability index? c. Which project is most attractive to a firm that can raise an unlimited amount of funds to pay for its investment projects? d. Which project is most attractive to a firm that is limited in the funds it can raise?arrow_forward

- 3. You are analyzing the following two mutually exclusive projects and have developed the following Which information. Please calculate the IRRS for the two projects and the crossover rate. project should you accept if the cost of capital is 5%, and which project should you accept if the cost of capital is 10%? Year 0 1 3 Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 IRR A: IRR B: Crossover Rate: If WACC-5%, accept If WACC=10%, accept Project B Cash Flow -$76,900 $25,000 $35,000 $26,000 Jarrow_forwardYou are evaluating two projects with the following cash flows: Year Project X 0 -$539,400 H23 & 1 4 219,900 229,800 237,000 196,700 Multiple Choice O What is the crossover rate for these two projects? O 12.76% Project Y .59% -$510,000 209,600 219,400 227,300 188,100arrow_forwardCan you please check my work it keeps showing I'm miarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education