FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

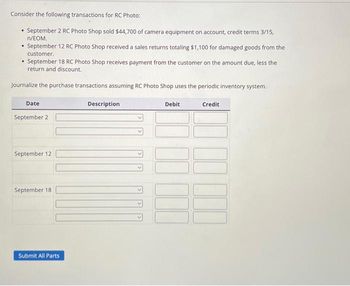

Transcribed Image Text:Consider the following transactions for RC Photo:

• September 2 RC Photo Shop sold $44,700 of camera equipment on account, credit terms 3/15,

n/EOM.

.

September 12 RC Photo Shop received a sales returns totaling $1,100 for damaged goods from the

customer.

.

September 18 RC Photo Shop receives payment from the customer on the amount due, less the

return and discount.

Journalize the purchase transactions assuming RC Photo Shop uses the periodic inventory system.

Credit

Date

September 2

September 12

September 18

Submit All Parts

Description

Debit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Journalize the following merchandise transactions: a. Sold merchandise on account, $94,800 with terms 2/10, n/30. The cost of the merchandise sold was $56,900. b. Received payment less the discount. c. Issued a $500 credit memo for damaged merchandise. The customer agreed to keep the merchandise.arrow_forwardJournalize the following merchandise transactions. The company uses the perpetual inventory system. a. Sold merchandise on account, $14,900 with terms 2/10, net 30. The cost of the goods sold was $9,685. If an amount box does not require an entry, leave it blank. b. Received payment within the discount period. If an amount box does not require an entry, leave it blank.arrow_forward1arrow_forward

- Create General Journal entriesarrow_forwardOnly typed solutionarrow_forwardOn April5, a customer returns 20 bicycles witha sales price of $250 per bike to Barrio Bikes. Each bike cost Barrio Bikes $100. The customer had yet to pay on their account . The bikes are in sellable condition. Prepare the journal entry or entries to recognize this return if the company uses A. the perpetual inventory system B. the periodic inventory systemarrow_forward

- On April 3, a customer returned $600 of merchandise that had been purchased withcash to Ryan Supplies. Ryan’s cost of the goods returned was $200. Which journal entry orentries should Ryan prepare? (No sales discount was offered for early payment.)a. One entry to debit Cash and credit Sales Refunds Payable for $600; another entry todebit Inventory Returns Estimated and credit Inventory for $200.b. One entry to debit Sales Refunds Payable and credit Cash for $600; another entry todebit Inventory and credit Inventory Returns Estimated for $200.c. One entry to debit Sales Revenue for $600 and credit Cash for $600.d. One entry to debit Sales Revenue for $400, debit Refund Expense for $200, and creditCash for $600.arrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forwardCurrent Attempt in Progress Prepare the necessary journal entries to record the following transactions, assuming Cullumber Company uses a perpetual inventory system. (a) Cullumber sells $57,500 of merchandise, terms 1/10, n/30. The merchandise cost $39,220. (b) The customer in (a) returned $5,300 of merchandise to Cullumber. The merchandise returned cost $3,710. (c) Cullumber received the balance due within the discount period. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Transactions Account Titles and Explanation (a) (To record credit sale.) (To record cost of goods sold.) Debit Credit SUarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education