FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

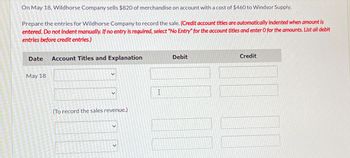

Transcribed Image Text:On May 18, Wildhorse Company sells $820 of merchandise on account with a cost of $460 to Windsor Supply.

Prepare the entries for Wildhorse Company to record the sale. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit

entries before credit entries.)

Date Account Titles and Explanation

Debit

Credit

May 18

(To record the sales revenue.)

I

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- sarrow_forwardCan you help me explain how does it work? what is $5000 stand for and $2400 stand for? A seller uses a perpetual inventory system and on April 4 it sells $5,000 in merchandise with a cost of $2,400 to a customer on credit terms of 3/10, n/30. Complete the two journal entries to record the sales transaction by selecting the account names from the drop-down menus and entering the dollar amounts in the debit or credit columns. The first journal entry is to record the revenue part of the transaction and the second journal entry is to record the cost part.arrow_forwardYou are to enter up the sale, purchases, return inwards and returns outwards day book" from the following details. then to post the items to the relevant accounts in the sales and purchases ledgern, The total of the day books are then to be transferred to the account in the general Ledger. 2009 in drawing May 1 Credit sales: T 0mpson Tshs 56,000; L Rodriguez Tshs 148,000; K Barton Tshs 145.000. 3 Credit purchase: P Potter 144.000'. H Harris Tshs 25000 Spencer Tshs 76.000. 7 credit sales K Kelly 89.000; N Mendes Toho 78.000; N lee Tshs 237,000. 9 Credit purchases: B Perkins 24,000; H Haris Tshs 58000 H miles Tshs 123000 11 Good return by to: p Potter Tshs 12000 B. Spencer Tshs22.000. 14 Goods returned to by: T. Thompson Tshs 5.000; K Barton Tshs 11,000; K Kelly Tshs 14000. 17 Credit purchases: H Harris Tshs 54,000; B Perkins Tshs 65000L Nixon Tshs 75.000. 20 Goods returned by us to B Spences Tshs 14000 24 credit sales: K Muhammed Tshs 57000 , K Kelly Tshs 65000, O . Green Tshs 112000 28…arrow_forward

- Urmilabenarrow_forwardOn March 1, Sally Co. sold merchandise to Buck Co. on account, $58,900, terms 2/15, n/30. The cost of the merchandise sold is $35,200. The merchandise was paid for on March 14. Assume all discounts are taken. Required: Journalize the entries for Sally Co. and Buck Co. for the sale, purchase, and payment of amount due. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a joumal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered.arrow_forwardOn January 10, 2022, Cullumber Co. sold merchandise on account to Robertsen Co. for $16,600, n/30, On February 9, Robertsen Co. gave Cullumber Co.a 11% promissory note in settlement of this account. Prepare the journal entry to record the sale and the settlement of the account receivable. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation) Date Jan 10 4 Feb. 9 # Debit Credit 1000arrow_forward

- Lamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. You are to provide the journal entries for the following transactions assuming a perpetual inventory system. Cash Accounts Payable Purchases Accounts Receivable Merchandise Inventory Sales PLEASE NOTE: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Lamplight purchases thirty light fixtures for $20 each on August 1, invoice date August 1, with no discount terms DR CR Lamplight returns ten light fixtures, receiving a credit amount for the full purchase price on August 3: DR CR Lamplight purchases an additional fifteen light fixtures for $15 each on August 19, invoice…arrow_forwardDengararrow_forwardOn April 5, a customer returns 16 bicycles with a sales price of $270 per bike to Barrio Bikes. Each bike cost Barrio Bikes $100. The customer had yet to pay on their account. The bikes are in sellable condition. Assume the perpetual and periodic methods are used. A. Prepare the journal entries to recognize this return if the company uses the perpetual inventory system. If an amount box does not require an entry, leave it blank. B. Prepare the journal entry to recognize this return if the company uses the periodic inventory system. If an amount box does not require an entry, leave it blank.arrow_forward

- Carla Vista Company uses the allowance method for estimating uncollectible accounts. Prepare journal entries to record the following transactions. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) January 5 April 15 August 21 October 5 Date Sold merchandise to Ryan Seacrest for $2,800, terms n/15. Received $480 from Ryan Seacrest on account. Wrote off as uncollectible the balance of the Ryan Seacrest account when he declared bankruptcy. Unexpectedly received a check for $690 from Ryan Seacrest. V Account Titles and Explanation (To reverse write-off of Ryan Seacrest account) (To record collection from Ryan Seacrest account) Debit Creditarrow_forwardRecord the following transactions on the books of Pharoah Co. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) a. b. C. a. b. С. On July 1, Pharoah Co. sold merchandise on account to Waegelein Inc. for $16,600, terms 4/10, n/30. On July 8, Waegelein Inc. returned merchandise with a sales price of $5,300 to Pharoah Co. On July 11, Waegelein Inc. paid the balance due. Account Titles and Explanation Debit Creditarrow_forwardUse the following sales journal to record the transactions. All credit sales are terms of n/30. (If a box is not used in the journal leave the box empty; do not select information or enter a zero.) A (Click the icon to view the transactions.) Sales Journal Page Invoice Customer Post. Accounts Receivable DR Cost of Goods Sold DR Date No. Account Debited Ref. Sales Revenue CR Merchandise Inventory CR 2024 Jun. More Info Jun. 1 Sold merchandise inventory on account to Fred Jig, $1,270. Cost of goods, $1,000. Invoice no. 101. Jun. 8 Sold merchandise inventory on account to lan Frog, $2,225. Cost of goods, $1,580. Invoice no. 102. Jun. 13 Sold merchandise inventory on account to Jillian Trump, $380. Cost of goods, $300. Invoice no. 103. Jun. 28 Sold merchandise inventory on account to Glen Whitney, $900. Cost of goods, $610. Invoice no. 104. Print Donearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education