Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

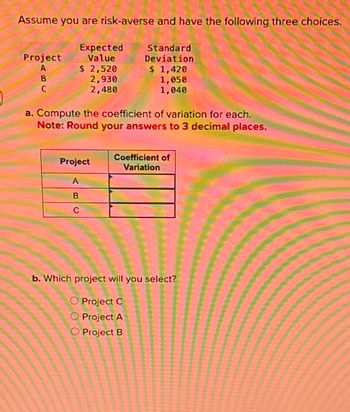

Transcribed Image Text:Assume you are risk-averse and have the following three choices.

Standard

Deviation

Project

A

B

C

Expected

Value

$ 2,520

2,930

2,480

$ 1,420

1,050

1,040

a. Compute the coefficient of variation for each.

Note: Round your answers to 3 decimal places.

Project

A

B

C

Coefficient of

Variation

b. Which project will you select?

O Project C

O Project A

O Project B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- K Internal rate of return and modified internal rate of return For the project shown in the following table,, calculate the internal rate of return (IRR) and modified internal rate of return (MIRR). If the cost of capital is 13.04%, indicate whether the project is acceptable according to IRR and MIRR. The project's IRR is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CFO) Year (t) $80,000 Cash inflows (CF₂) 1 $10,000 2345 $25,000 $10,000 $15,000 $45,000 Print Done -arrow_forwardThe NPV of a project is negative when the discount rate at 8%, but is positive when the discount rate is at 6%, which of the following choices could be the IRR for the project? Select one: a.8% b.9% C.5% d.7%arrow_forwardThere are two types of projects in the market: A (safer) and B (riskier). At time 1, the payoff of A will be either $500 (probability 0.75) or $300 (probability 0.25). The appropriate discount rate for project A is 12%. The minimum price A can accept is $350. The payoff of B will be either $800 (probability 0.2) or $100 (probability 0.8). The appropriate discount rate for project B is 20%. In this simple economy, there are 90% chance that the project will be A. Evaluate the funding situation, i.e., which type of project will be funded and the price, based on the following scenarios: If a bank can tell whether the entrepreneur is endowed with project A or B, but cannot stop A from switching to B after A has receive the fund. What is the maximum face value of loan that the bank can lend to A without incur any monitoring costs, i.e., A will not have incentive to switch to B given this incentive compatible amount of loan and limited liability.arrow_forward

- Suppose your firm is considering two mutually exclusive, required projects with the cash flows shown below. The required rate of return on projects of both of their risk class is 8 percent, and that the maximum allowable payback and discounted payback statistic for the projects are 2 and 3 years, respectively. Time Project A Cash Flow Project B Cash Flow Use the payback decision rule to evaluate these projects, which one(s) should it be accepted or rejected? Multiple Choice 0 -35,000 -45,000 1 25,000 25,000 2 45,000 5,000 3 16,000 65,000arrow_forwardSuppose that you found the probabilities and expected NPVs of 3 scenarios for a timing option: E(NPV) probability $0.15 0.30 $10.35 0.50 $42 0.20 1. What is the expected NPV of the timing option? Show your work. 2. Suppose, that the expected NPV of the project if proceeding today is $14. Should the project be delayed based on your finding in part 1 or should the management implement it today? Briefly explain.arrow_forwardUsing image: a-1. What is the payback period for each project a-2. If you apply the payback criterion, which investment will you choose? b-1. What is the discounted payback period for each project? b-2. If you apply the discounted payback criterion, which investment will you choose? c-1. What is the NPV for each project? c-2. If you apply the NPV criterion, which investment will you choose? d-1. What is the IRR for each project? d-2. If you apply the IRR criterion, which investment will you choose? e-1. What is the profitability index for each project? e-2. If you apply the profitability index criterion, which investment will you choose? f. Based on your answers in (a) through (e), which project will you finally choose?arrow_forward

- The decision tree below describes a “sure thing” investment and a “risky” investment. Use backward induction to evaluate which is the better investment. Assume all values are already given in present value terms.arrow_forwardCalculate the project's coefficient of variation. (Hint: Use the expected NPV.) Squared dev. Prob. NPV NPVI - E(NPV) Squared deviation times probability 0.24 $6,289.81 $5,829 S$ 0.24 -$2.390.74 -$2,852 S$ 0.32-$1,233.33 -S1,694 $S 0.20 -$ 400.00 -$861 $S 100 $ 461.1i Variance $. Standard deviation S 5.87 6.52 7.25 7.97 8.77arrow_forwardMike Riskless is considering two projects. He has estimated the IRR for each under three possible scenarios and assigned probabilities of occurrence to each scenario. State of Economy Probability Estimated BTIRR Investment I Estimated BTIRR Investment II Optimistic 0.20 0.15 0.20 Most likely 0.60 0.10 0.15 Pessimistic 0.20 0.05 0.05 1.00 Riskless is aware that the pattern of returns for Investment II looks very attractive relative to Investment I; however, he believes that Investment II could be more risky than Investment I. He would like to compare the two investments considering both the risk and return on each. Required: a. Compute BTIRR under each of the three possible scenarios. b. Compute variance and standard deviation of the IRRs.arrow_forward

- a. Find the expected return for each project. b. Find the proportion of funds in each project to achieve an expected portfolio return of 20%. (c) Calculate the correlation coefficient between projects A and B. d) Find the portfolio risk.arrow_forwardOxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: Life of Net the Internal Project (years) of Return Investment Present Rate Project Required $970,000 $730,000 $670,000 $830,000 Value $176,514 $175,933 $185,782 $129,082 A 6. 16% В 11 15% C 19% 17% The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first, second, and so forth.arrow_forwardYou are setting up the shown ONE-WAY data table to calculate the NPV of a hotel project at various rates of return (8.25% to 12.5%). What range would you highlight before selecting: Data → What-if Analysis → Data Table… Question 51 options: B15:C32 C14:C32 B14:B32 B14:C32arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education