Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

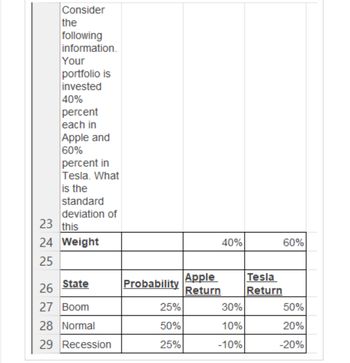

Transcribed Image Text:Consider

the

following

information.

Your

portfolio is

invested

40%

percent

each in

Apple and

60%

percent in

Tesla. What

is the

standard

deviation of

23 this

24 Weight

40%

60%

25

Apple

Tesla

State

Probability

26

Return

Return

27 Boom

25%

30%

50%

28 Normal

50%

10%

20%

29 Recession

25%

-10%

-20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- The expected return and standard deviation of a portfolio that is 30 percent invested in 3 Doors, Incorporated, and 70 percent invested in Down Company are the following: Down 3 Doors, Incorporated Company 13% 10% Expected return, E(R) Standard deviation, o 46 35 What is the standard deviation if the correlation is +1? 0? -1? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Standard Deviation Correlation +1 % Correlation 0 Correlation-1 % %arrow_forwardUse the following information to calculate the expected return and standard deviation of a portfolio that is 60 percent invested in 3 Doors, Incorporated, and 40 percent invested in Down Company: Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Expected return, E(R) Standard deviation, o Correlation Expected return Standard deviation 3 Doors, Incorporated 16% 46 0.31 2.00% 2.00% Down Company 24% 48arrow_forwardYou are given the following expected returns for a share under various scenarios. Scenario Probability Expected returnBoom16 % 34.6%Normal41 % 4.4% Recession 43% - 5.2% Calculate the expected return as a percent. Please enter the number as a percentage without the % sign (as you do for the interest rate in the calculator). For example, if your answer is 7.89%, then simply answer "7.89".arrow_forward

- Portfolio X has an actual return of 20% Beta = 1.30 Market return = 15% Risk free = 4% Calculate Alpha. Show the arbitrage portfolio to capture Alpha. If you can borrow on margin $1,000,000, what is your arbitrage profit in dollars?arrow_forwardThe expected return and standard deviation of a portfolio that is 60 percent invested in 3 Doors, Incorporated, and 40 percent invested in Down Company are the following: Expected return, E(R) Standard deviation, o 3 Doors, Down Incorporated Company 10% 33 Correlation +1 Correlation 0 Correlation-1 What is the standard deviation if the correlation is +1? 0? -1? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. 11% 44 Standard Deviation % % %arrow_forward4. Consider the following information. Your portfolio is invested 30 percent each in A and C, and 40 percent in B. What is the expected return and standard deviation of this portfolio? (10 marks) State of Probability of Rate of Return if State Occurs Economy State of Economy Stock A Stock B Stock C Boom 0.15 0.30 0.45 0.33 Good 0.45 0.12 0.10 0.15 Poor 0.35 0.01 -0.15 -0.05 Bust 0.05 -0.06 -0.30 -0.09arrow_forward

- Q1. One of your company's customer has approached you and the customer says that he wishes to invest 20,000 OMR. Following data is provided for your reference Company name Expected returns R Standard Deviations o Euro Foods 20 | 10 Sohar Foods 14 8. A. Calculate the expected returns for the suggested portfolios as below, Portfolio Euro Foods Sohar Foods 1. 25% 1 75% 75% 25% 3. 50% 50% B. Calculate the coefficient of variation of shares on Euro Foods and Sohar Foods. C. 89 F C H/2arrow_forwardK Consider an economy with two types of firms, S and I. S firms all move together. I firms move independently. For both types of firms, there is a 29% probability that the firm will have a 24% return and a 71% probability that the firm will have a -11% return. What is the volatility (standard deviation) of a portfolio that consists of an equal investment in: a. 40 firms of type S? b. 40 firms of type I? a. What is the volatility (standard deviation) of a portfolio that consists of an equal investment in 40 firms of type S? Standard deviation is%. (Round to two decimal places.) b. What is the volatility (standard deviation) of a portfolio that consists of an equal investment in 40 firms of type I? Standard deviation is %. (Round to two decimal places.)arrow_forwardSample Problem: Investment Market Rate 12% 10% ? 15% A B с D Beta 1.5 (.5) 1.0 ? CAPM ? ? 10% 12% If risk free rate is at 2%, supply the missing values of the summarized table for the portfolio of investment.arrow_forward

- 14. John Lewis of Hungerford plc may have returns next year as follows: Return probability 10% 30% 20% 20% -10% 30% -20% 20% What is the standard deviation of returns for John Lewis? A. 24.65% B. 15.86% C. 14.83% D. 22.25%arrow_forwardQuestion a The expected return and standard deviation of a portfolio that is 50 percent invested in 3 Doors, Incorporated, and 50 percent invested in Down Company. are the following: 3 Doors, Incorporated Down Company Expected return, E(R) 14% 10% Standard deviation, σ 42 31 What is the standard deviation if the correlation is +1? 0? −1? Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardConsider an economy with two types of firms, S and I. S firms all move together. I firms move independently. For both types of firms, there is a 64% probability that the firm will have a 25% return and a 36% probability that the firm will have a -2% return. What is the volatility (standard deviation) of a portfolio that consists of an equal investment in: a. 40 firms of type S? b. 40 firms of type l? a. What is the volatility (standard deviation) of a portfolio that consists of an equal investment in 40 firms of type S? Standard deviation is%. (Round to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education