Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

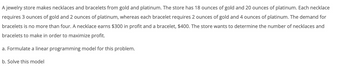

Transcribed Image Text:A jewelry store makes necklaces and bracelets from gold and platinum. The store has 18 ounces of gold and 20 ounces of platinum. Each necklace

requires 3 ounces of gold and 2 ounces of platinum, whereas each bracelet requires 2 ounces of gold and 4 ounces of platinum. The demand for

bracelets is no more than four. A necklace earns $300 in profit and a bracelet, $400. The store wants to determine the number of necklaces and

bracelets to make in order to maximize profit.

a. Formulate a linear programming model for this problem.

b. Solve this model

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- A jewelry store sells diamond rings, silver charms, gold bracelets and pearl necklace. The proprietor Amanda usually sets a selling price for silver charms based on a markup on cost of 80%. Pearl necklaces have a markup og 60%. All other items are sold 100%. She buys gold bracelets for $125 each. Use this information. What is the selling price of a diamond ring that Amanda purchases for $1,400?arrow_forwardAnna sells a certain pair of earrings at her store for $45.20 per pair. Her overhead expenses are $5.00 per pair and she makes 40.00% operating profit on selling price., Round to the nearest cent a. What is her amount of markup per pair of earrings? b. How much does it cost her to purchase each pair of earrings? Company A and Company B sell the same model camera for $110 and $135, respectively. During a sale, Company A offers a discount of 10% on the camera. What should Company B's rate of markdown be on the camera to match Company A's sale price?arrow_forwardA clothing retailer is going to mail out 10,000 catalogues. It costs $2 to mail out each catalogue. When a customer places an order from a catalogue assume a profit of $50 per order is earned. It is assumed that 5% of those who receive a catalogue will place an order however, this number can vary. Use the file below to help you with your tables. Assume that: [total profit = total profit made from the orders – the amount spent on mailing out the catalogues]. a) Use a one-variable data table to determine how the total profit earned from the mailing will vary depending on a response rate between 4% and 10% (with increments of 2%). b) Create a two-variable data table to show how the total profit changes with a varying response rate and number of catalogues mailed. Vary the response rate between 4% and 10% with increments of 2% and vary the number of catalogues mailed from 10,000 to 30,000 at increments of 5000.arrow_forward

- What is the financial advantage (disadvantage) of accepting the special order from the wedding party?arrow_forwardThe Cycle Shoppe has decided to offer credit to its customers during the spring selling season. Sales are expected to be 330 bicycles. The average cost to the shop of a bicycle is $300. The owner knows that only 93 percent of the customers will be able to make their payments. To identify the remaining 7 percent, she is considering subscribing to a credit agency. The initial charge for this service is $540, with an additional charge of $6 per individual report. What is the amount of the net savings from subscribing to the credit agency? A. $3,790 B. $3,920 C. $4,080 D. $4,410 E. $4,950arrow_forwardDirection: Read and understand the given problem. Problem: Rhea is engaged in a buy-and-sell business of signature perfumes. She buys 10 boxes of perfumes. Each box costs 12,000.00 and contains a dozen of perfume bottles. She plans to sell one perfume bottle at P1,500. What is her expected profit on the 10 boxes of perfumes? Note: Getting the difference between the amount of money earned from selling 10 boxes containing a dozen of perfume bottles and the cost of those 10 boxes gives the profit." Еxplore! 1. How much profit does Rhea earn? 2. What do you think of Rhea's business? 3. Is it good for a beginner? Why? 4. What do you think should Rhea do in order to flourish in her business?arrow_forward

- Faster Stationery would like to sell a box of gel pens at the price of RM45. There are 12 gel pens in a box. The operating expenses are RM1.50 for a gel pen. If the company want to have 25% of net profit based on cost, a) Find the cost of a gel pen. b) Determine whether there is any profit or loss incurred if the company want to sell a box of gel pens at RM42.arrow_forwardCharlotte sells widgets which cost $50 each to purchase and prepare for sale. Annual sales are 10,000 widgets, carrying cost are 15% of inventory costs, and Charlotte incurs a cost of $25 each time an order is placed. Suppose her supplier decides to offer a 3% cash discount if products are ordered in increments of 1250. How many widgets should Charlotte order each time an order is placed to minimize costs? I have submitted this question twice and both times was answered with how many orders of 1250 will satisfy the demand of 10,000 widgets. I need to know how to figure out HOW MANY WIDGETS PER ORDER to minimize costs.arrow_forwardHow many units does Eddie the Entrepreneur need to sell to breakeven in a day? He rents a kiosk in the mall for $300 a day. He creates artworks that cost him $47 each in materials and sells them for $100 each. He pays one of his friends $10 an hour to man the booth and he has to pay mall management 3% of his sales. The mall is open daily from 10 am to 8 pm.arrow_forward

- A computer store sells two types of laptops, an all-purpose laptop and a gaming laptop. The supplier demands that at least 150 of these laptops be sold each month. Experience shows that most consumers prefer all-purpose laptops, but some younger consumers prefer gaming laptops. The result is that the number of all-purpose laptops sold is at least twice the number of gaming laptops sold. The store pays its sales staff a $52.86 commission for each all-purpose laptop sold and a $49.4 commission for each gaming laptop sold. How many of each type of laptop should be sold to minimize commission? What is that minimum monthly commission? All-purpose laptops: Gaming laptops: Commission (dollars): 000arrow_forwardCharlotte sells widgets that cost $50 each to purchase and prepare for sale. Annual sales are 10,000 widgets, carrying cost are 15% of invenory costs and Charlotte incurs a cost of $25 each time an order is placed. Suppose that Charlottes' supplier decides to offer a 3% cash discount if products are ordered in increments of 1250. How many WIDGETS should Charlotte order each time an order is placed to minimize total inventory costs?arrow_forwardHenry Sweet Company currently makes 6-inch candy sticks that it sells for $0.20 each. Henry can make 12-inch candy sticks out of two 6-inch candy sticks by melting them together, which costs an additional $0.03 per 12-inch stick. Henry can sell the 12-inch sticks for $0.45. Henry has enough capacity to make 10,000 6-inch candy sticks per month, and enough demand to sell all of the candy sticks it can manufacture, whether 6- inch or 12-inch. Should Henry sell 6-inch or 12-inch candy sticks, and how much additional profit will its decision bring in per month? Multiple Choice O O Sell 6-inch sticks, additional $100 Sell 6-inch sticks, additional $250 Sell 12-inch sticks, additional $100 Sell 12-inch sticks, additional $250arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education