ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

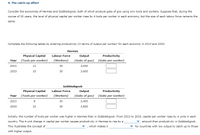

Consider the economies of Hermes and Gobbledigook, both of which produce gobs of goo using only tools and workers. Suppose that, during the course of 20 years, the level of physical capital per worker rises by 4 tools per worker in each economy, but the size of each labour force remains the same.

first dropdown question options are (larger or smaller), second dropdown question options are (the brain drain, inward orietned growth, diminishing returns, constant returns, increasing returns), the third dropdown question oprions are (more diffucult or easier)

Transcribed Image Text:4. The catch-up effect

Consider the economies of Hermes and Gobbledigook, both of which produce gobs of goo using only tools and workers. Suppose that, during the

course of 20 years, the level of physical capital per worker rises by 4 tools per worker in each economy, but the size of each labour force remains the

same.

Complete the following tables by entering productivity (in terms of output per worker) for each economy in 2013 and 2033.

Hermes

Physical Capital

Labour Force

Output

Productivity

Year (Tools per worker)

(Workers)

(Gobs of goo) (Gobs per worker)

2013

11

30

3,000

2033

15

30

3,600

Gobbledigook

Physical Capital

Labour Force

Output

Productivity

Year (Tools per worker)

(Workers)

(Gobs of goo) (Gobs per worker)

2013

8

30

2,400

2033

12

30

3,600

Initially, the number of tools per worker was higher in Hermes than in Gobbledigook. From 2013 to 2033, capital per worker rises by 4 units in each

country. The 4-unit change in capital per worker causes productivity in Hermes to rise by a

amount than productivity in Gobbledigook.

This illustrates the concept of

, which makes it

for countries with low output to catch up to those

with higher output.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In class we argued that if people could accumulate human as well as physical capital, the production function would look like the “AK” production function. • (a) If the production function is AK and the savings rate is constant at rate “s”, and the rates of depreciation and populati on growth are δ and n respectively, what would the growth rate of the economy be? • (b) What would be the macroeconomic consequences of decreasing the savings rate in this economy? • (c) What would be the consequences of an increase in fertility in this economy? • (d) Would the consequences of decreasing fertility be UNAMBIGUOUSLY GOOD? • (e) Can human capital grow without bounds? Explain why or why not (make sure you discuss the physical nature of human capital). • (f) What is the growth rate of the economy (in the absence of technological progress) if human capital cannot grow without bounds?arrow_forwardPlease correct answer and don't use hand ratingarrow_forward6.5 Exercises Exercise 6.1 (Technological Progress and Long-Run Growth). Consider a Solow economy with population growth and technological progress. The evolution of the capital stock per efficiency unit of labor, denoted k1, is given by the law of motion (1+n)(1+ g)kt+1 = (1 – 8)kt +of(kt). Capital per efficiency unit of labor is defined as k, = Kt/(LEt), where Kt denotes the stock of physical capital, L, denotes population, and E is a tech- nological factor. Population grows at the rate n and the technological factor grows at the rate g. The subscript t denotes time, measured in years. The parameters d E (0, 1) and o > 0 denote, respectively, the depreciation rate of capital and the savings rate. The function f(k;) represents the produc- tion technology. Specifically, let Y, denote output and yt = Yt/(LEt) denote output per efficiency unit of labor. Then yt = f(kt). Assume that f(kt) = /k. 1. Find the steady-state stock of capital per efficiency unit of labor, de- noted k*, as a…arrow_forward

- Why don’t wages measure the full return to labor? Why is human capital the most important factor of production in a modern economy?arrow_forward2arrow_forwardConsider the hypothetical economies of Thalassa and Pelheim, both of which produce cases of argo using only workers and tools. Suppose that, during the course of 25 years, the level of physical capital per worker rises by 4 tools per worker in each economy, but the size of each labor force remains the same. Complete the following tables by entering productivity (in terms of output per worker) for each economy in 2018 and 2043. Physical Capital Year (Tools per worker) 2018 13 2043 17 Year 2018 2043 Physical Capital (Tools per worker) 10 14 Thalassa Labor Force (Workers) 60 60 Output (Cases of argo) 6,000 7,200 Pelheim Labor Force (Workers) 60 60 Output (Cases of argo) 4,800 7,200 Productivity (Cases per worker) Productivity (Cases per worker) Initially, the number of tools per worker was higher in Thalassa than in Pelheim. From 2018 to 2043, capital per worker rises by 4 units in each country. The 4-unit change in capital per worker causes productivity in Thalassa to rise by a amount…arrow_forward

- Economics Suppose output per worker in the US is four times (4.0) output per worker in China. Suppose capital per worker in the US is twice that of China. You should assume that the share of capital in income is 40 percent for both countries. Total factor productivity (A) for the U.S is. A)Four times higher (4.0) than China B)U.S TFP is beľow China. C)US TFP is twice (2.0) as high. D)U.S TFP is equal to China. EJU.S TFP is 3.2 times higher than China.arrow_forwardOnly typed solutionarrow_forwardPlease answer the following question as soon as possible. Thanks a lot! Imagine we live in a classical world. Suppose that the production function is ? = ?^(1/2)?^(1/2), where L is the amount of labor and K is the amount of capital. The economy has 100 units of labor and 100 units of capital.arrow_forward

- not use ai pleasearrow_forwardThe table below represents Freedonia's macroeconomic data for 2003 and 2004. Year Y K 2003 2000 1700 70 2004 2100 1785 75 a. What is the economic growth rate of Freedonia from 2003 to 2004? Show your calculation. b. What is the capital growth rate from 2003 to 2004? Show your calculation. c. What is labor growth rate from 2003 to 2004? Show your calculation. d. Suppose the production function is given by Y = AKO.25L0.75. Use two %3D approaches to solve for the growth rate of total factor productivity (A) from 2003 to 2004. Show your calculation.arrow_forwardHelp with part D.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education