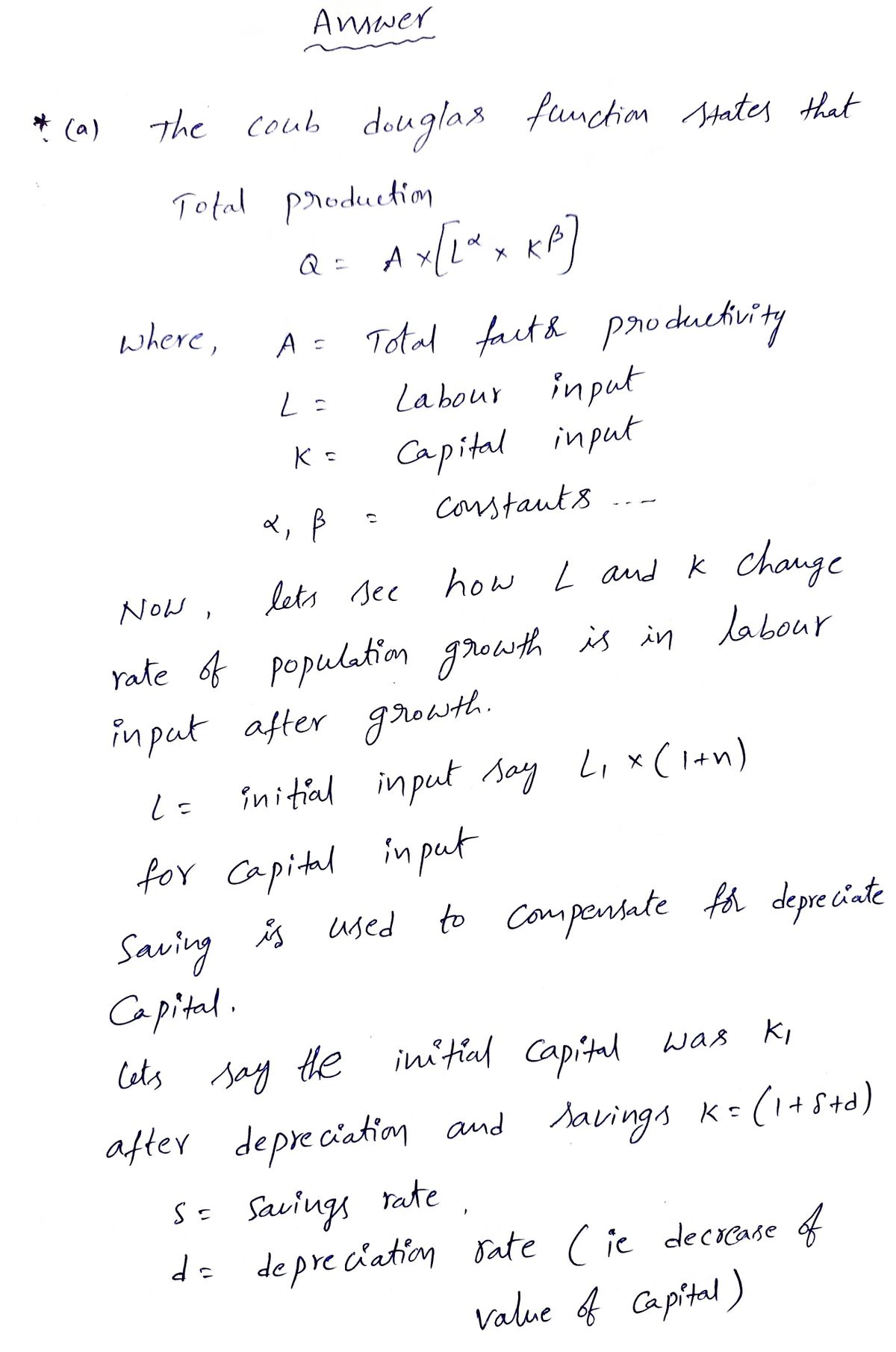

In class we argued that if people could accumulate human as well as physical capital, the production function would look like the

“AK” production function.

• (a) If the production function is AK and the savings rate is constant at rate “s”, and the rates of

growth are δ and n respectively, what would the

• (b) What would be the

• (c) What would be the consequences of an increase in fertility in this economy?

• (d) Would the consequences of decreasing fertility be UNAMBIGUOUSLY GOOD?

• (e) Can human capital grow without bounds? Explain why or why not (make sure you discuss the physical nature of human

capital).

• (f) What is the growth rate of the economy (in the absence of technological progress) if human capital cannot grow without

bounds?

* Answer :-

Step by stepSolved in 4 steps with 4 images

- 6.5 Exercises Exercise 6.1 (Technological Progress and Long-Run Growth). Consider a Solow economy with population growth and technological progress. The evolution of the capital stock per efficiency unit of labor, denoted k1, is given by the law of motion (1+n)(1+ g)kt+1 = (1 – 8)kt +of(kt). Capital per efficiency unit of labor is defined as k, = Kt/(LEt), where Kt denotes the stock of physical capital, L, denotes population, and E is a tech- nological factor. Population grows at the rate n and the technological factor grows at the rate g. The subscript t denotes time, measured in years. The parameters d E (0, 1) and o > 0 denote, respectively, the depreciation rate of capital and the savings rate. The function f(k;) represents the produc- tion technology. Specifically, let Y, denote output and yt = Yt/(LEt) denote output per efficiency unit of labor. Then yt = f(kt). Assume that f(kt) = /k. 1. Find the steady-state stock of capital per efficiency unit of labor, de- noted k*, as a…arrow_forwardI need help with parts (f) and (g) of question 2arrow_forward1. Consider an economy that operates under competitive markets and meets the assumptions of the Solow model. The production function is given as follows: Y(t) = K (t) 0.3 (A(t)L(t)) ⁰.7 Assume a saving rate of 15%, labor force growth rate of 2% and depreciation rate of 5% and effectiveness of labor growth rate of 8%. a. Show that the production function exhibit constant return to scale? b. Derive the production function for output per capita. c. Derive the production function for output per effective unit of labor. d. Find equilibrium real wage as a function of capital per unit of effective labor and effectiveness of labor. e. Find equilibrium real rental price of capital as a function of capital per unit of effective labor and effectiveness of labor. f. Solve for steady state level of capital per unit of effective labor. g. Find steady state level of output per unit of effective labor. h. Find growth rate of output and output per worker on the balanced growth path. i. Which one would…arrow_forward

- please answer the following, I have attached an image of the question for better format. Thanks! 3. Suppose that the production function of a country is given by Y=KaL1-a, where 0<a<1, Y is output, L is labour, and K is capital, Derive the equation for steady state capital per worker, output per worker, and consumption per worker in terms of the saving rate (s) and depreciation rate (d).arrow_forwardQuestion 2Assume production function is given by:Y= K(1/2) L(1/2)a. Write the production function in per worker terms (y=f(k))b. Assume that the per worker level of capital in the steady state is 4, the depreciation rate is 5% per year, and population growth is 5% per year. Does this economy have “too much” or “too little” capital? How do you know? [Show your work].arrow_forward7. Suppose that the economy's production function is Y = √K√LA where K is capital, L is labor, and A is the state of technology. Suppose that the saving rate (s) is equal to 6%, the rate of depreciation of capital (8) is equal to 5%, the number of workers grow at 5% per year and the rate of technological progress is 4%. (a) Find the steady state values of: iv. growth rate of output per worker growth rate of output v. (b) Suppose that the saving rate increases. What is its short-run and the long-run effect on the growth rate of per-capita output?arrow_forward

- Please no written by hand and graph Consider a small world that consists of two different countries, a developed and a developing country. In both countries, assume that the production function takes the following form: Y = F (K, LE) = K¹/4 (LE) 3/4, where Y is output, K is capital stock, L is total employment and E is labour augmenting technology. (a) Does this production function exhibit constant returns to scale in K and L? Explain. (b) Express the above production function in its intensive form (i.e., output per-effective worker y as a function of capital per effective worker k). (c) Solve for the steady-state value of y as a function of saving rate s, population growth rate n, technological progress g, and capital depreciation rate 6. (d) The developed country has a savings rate of 30% and a population growth rate of 2% per year. Meanwhile, the developing country has a savings rate of 15% and population growth rate of 5% a year. Technology evolves at the rate of 8% and 2% in…arrow_forwardProblem 5 A “miraculous" Asian economy has an aggregate wage bill of 300 billion dollars and an aggregate GDP of 500 billion. The annual growth rate of aggregate GDP for this economy over the last 10 years was 7 percent (that is AY/Y=0.07) and the growth rate of labor was 6 percent (AL/L=0.06). Imagine that the production function is given by the standard Cobb-Douglas AK“L“. ,а, 1-а Y What are the "capital share (a)" and the "labor share (1 – a)"? b. Imagine that the government controls the national accounts. In its quest to improve its reputation, the government mistakenly thinks that having "a lot of investment" will make it look good so it "inflates" its growth of capital number to 12% (AK/K=0.12). When researchers estimate the rate of productivity growth (AA/A), what will they find? Is the growth rate of technology positive or negative? Does your result in (b) make sense? d. The actual truth is that the growth rate of capital was one half of what it announced. That is, instead of…arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education