ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

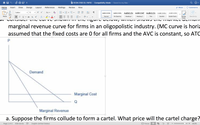

Consider the curve shown in the figure below, which shows the market demand, marginal cost, and marginal revenue curve for firms in an oligopolistic industry. (MC curve is horizontal because it is assumed that the fixed costs are 0 for all firms and the

- Suppose the firms collude to form a cartel. What

price will the cartel charge? What quantity will the cartel supply? How much profit will the cartel earn? - Suppose now that the cartel breaks up and the oligopolistic firms compete as vigorously as possible by cutting the price and increasing sales. What will the industry quantity and price be? What will the collective profits be of all firms in the industry?

- Compare the

equilibrium price , quantity, and profit for the cartel and cutthroat competition outcomes.

Transcribed Image Text:**Educational Text:**

**Title: Understanding Market Dynamics in Oligopolistic Industries**

Consider the curve shown in the figure below, which illustrates the market demand and marginal revenue curve for firms in an oligopolistic industry. Here, it's assumed that the fixed costs are zero for all firms and the average variable cost (AVC) is constant, making the average total cost (ATC) also constant.

**Diagram Explanation:**

- The vertical axis represents the price (P), and the horizontal axis represents the quantity (Q).

- The downward-sloping line labeled "Demand" illustrates how the quantity demanded decreases as the price increases.

- The "Marginal Revenue" curve also slopes downward and lies below the demand curve, indicating that marginal revenue decreases with an increase in quantity sold.

- A horizontal line labeled "Marginal Cost" represents the constant marginal cost for firms in this market.

**Problem:**

a. Suppose the firms collude to form a cartel. What price will the cartel charge?

---

This graph effectively demonstrates key concepts in oligopolistic market structures, including demand, marginal revenue, and marginal cost. Understanding these interactions is crucial in determining a firm's pricing and output strategies within such industries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A Cournot Oligopoly (duopoly) exists where the market demand function facing each of the two firms is P = 4 - (Q1 + Q2) , where Q = (Q1 + Q2) and the MC facing each firm is zero. If the two firms form a cartel, what is the market quantity (Q) and market price (P) that will prevail? 4/3, 4/3 3,1 1,3 2,2arrow_forwardConsider a market that is a Bertrand oligopoly with 5 firms in the market. Each of these firms produce an identical product and each have the same cost function of C(Q) = 80Q. The inverse market demand for this product is P = 2480 – 2Q. What is the equilibrium market price?arrow_forwardSuppose firms A, B, and C set prices while facing per-period demand of Q = 200 - P, which yields a MR curve MR = 200 – 2Q for a monopolist. When setting prices non-cooperatively, the firms choose their prices simultaneously. All firms have MC = 20. The firms are currently involved in a cartel that sets the monopoly price and divides quantity evenly among the firms. The firms enforce their cartel arrangement with a grim trigger strategy. The Department of Justice (DOJ) has just started an antitrust division that is designed to break up cartels. The DOJ successfully detects and prosecutes a cartel with probability s, and prosecuted cartels receive the fine F and are prevented from ever colluding again. The firms believe that their interaction will continue forever (p = 1.0), and they discount future periods at R 0.80. I. Which strategic variable are the firms choosing? What type of competition is this? O A. Quantity; Cournot O B. Quantity; Bertrand C. Price; Cournot O D. Price; Bertrand…arrow_forward

- In an industry with inverse demand curve there are five firms, each of which has a constant marginal cost given by p = 100 - 2Q, MC = 20. If the firms form a profit-maximizing cartel and agree to operate subject to the constraint that each firm will produce the same output level, how much does each firm produce? Each firm will produce q = units. (Enter your response as a whole number.)arrow_forwardIf Gulfstream and Bombardier, both producers of upscale jet airplanes, were to collude rather than compete, consumers could expect: Group of answer choices A) higher prices and higher quantities offered for sale. B) higher prices and lower quantities offered for sale. C) one firm to emerge as the price leader in the oligopoly. D) lower prices and lower quantities offered for sale. E) each firm to cheat on the cartel agreement.arrow_forwardNonearrow_forward

- Consider a duopolistic market with an inverse demand curve P(Q) = 460 − 4Qand constant marginal costs for each firm that are given by MC(Q) = 10.Assume fixed costs are negligible. The two identical firms are competing in this market by choosing their production quantities simultaneously. In the equilibrium, each firm produces 37.5 units and the prevailing market price is 160. How would the joint profits of these two firms change if they successfully formed a cartel? Change in joint profits: ? (Enter your answer rounded to two decimal places; include a negative sign if appropriate.)arrow_forwardOutline the characteristics of an oligopoly and explain why firms in this particular market structure face a choice between competition and collusion.arrow_forwardAirline Manufacturer A and Airline Manufacturer B are duopolists in their industry. Explain how the two firms could collectively benefit if they were to collude and form a cartel. Why might collusion be difficult?arrow_forward

- Which of the features of an oligopoly market most directly creates the potential for long-run profits? Cartels Interdependent pricing Homogeneous products Barriers to entry Collusionarrow_forwardConsider an industry that consists of 4 firms, all competing over the same market, given by the following demand equation: P=80-3Q All firms have the same Total Cost Function, given by: TC₁=10q,+2q Suppose the firms decide to collude and voluntarily restrict output and raise price, in order to increase profits. a) What price will be charged by the members of the cartel? Assume the head of the cartel is fair and distributes output q, equally among the 4 firms (since they have identical costs). b)What is the output of each individual firm? c) What is each individual firm's profit? We know that there is a built-in incentive for cartel members to cheat on the cartel. If, as a result, the cartel breaks down: d) What price will be charged in the market? e) Assuming each firm captures an equal share of the market, what now is each firm's output, q? f) What now is individual firm profit? g) Illustrate your answerarrow_forwardThree major means of collusion by oligopolists are Multiple Choice cartels, informal understandings, and price leadership. market sharing, mutual interdependence, and product differentiation. cartels, kinked-demand pricing, and product differentiation. informal understandings, P = MC pricing, and mutual interdependence.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education