ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

![cans and charge

so the daily total industry profit in the beer market is

When they act as a profit-maximizing cartel, each company will produce

information, each firm earns a daily profit of 5

per can. Given this

Oligopolists often behave noncooperatively and act in their own self-interest even though this decreases total profit in the market. Again, assume the

two companies form a cartel and decide to work together. Both firms initially agree to produce half the quantity that maximizes total industry profit.

Now, suppose that Mays decides to break the collusion and increase its output by 50%, while McCovey continues to produce the amount set under the

collusive agreement. Using the demand curve shown in the previous graph, find the price associated with this new total level of combined output (the

price at which this new level of output would be purchased by consumers).

Mays's deviation from the collusive agreement causes the price of a can of beer to

], while McCovey's profit is now 5

Mays increases its output beyond the collusive quantity.

per can. Mays's profit is now

when

]. Therefore, you can conclude that total industry profit](https://content.bartleby.com/qna-images/question/eee20bf5-99b3-4b37-aed8-c13423944632/7d294bc2-86ef-4cbf-93f6-81de4814c642/ioeuvun_thumbnail.png)

Transcribed Image Text:cans and charge

so the daily total industry profit in the beer market is

When they act as a profit-maximizing cartel, each company will produce

information, each firm earns a daily profit of 5

per can. Given this

Oligopolists often behave noncooperatively and act in their own self-interest even though this decreases total profit in the market. Again, assume the

two companies form a cartel and decide to work together. Both firms initially agree to produce half the quantity that maximizes total industry profit.

Now, suppose that Mays decides to break the collusion and increase its output by 50%, while McCovey continues to produce the amount set under the

collusive agreement. Using the demand curve shown in the previous graph, find the price associated with this new total level of combined output (the

price at which this new level of output would be purchased by consumers).

Mays's deviation from the collusive agreement causes the price of a can of beer to

], while McCovey's profit is now 5

Mays increases its output beyond the collusive quantity.

per can. Mays's profit is now

when

]. Therefore, you can conclude that total industry profit

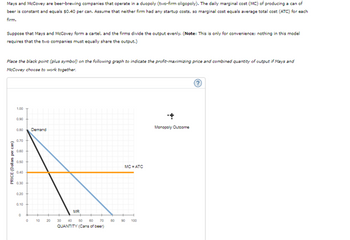

Transcribed Image Text:Mays and McCovey are beer-brewing companies that operate in a duopoly (two-firm oligopoly). The daily marginal cost (MC) of producing a can of

beer is constant and equals $0.40 per can. Assume that neither firm had any startup costs, so marginal cost equals average total cost (ATC) for each

firm.

Suppose that Mays and McCovey form a cartel, and the firms divide the output evenly. (Note: This is only for convenience: nothing in this model

requires that the two companies must equally share the output.)

Place the black point (plus symbol) on the following graph to indicate the profit-maximizing price and combined quantity of output if Mays and

McCovey choose to work together.

PRICE (Dollars per can)

1.00

0.90

0.70

0.60

0.50

0.40

0.30

0.20

0.10

0

Demand

20

MR

30 40 50

70

QUANTITY (Cans of beer)

80

MC-ATC

100

Monopoly Outcome

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 6. Deviating from the collusive outcome Mays and McCovey are beer-brewing companies that operate in a duopoly (two-firm oligopoly). The daily marginal cost (MC) of producing a can of beer is constant and equals $0.40 per can. Assume that neither firm had any startup costs, so marginal cost equals average total cost (ATC) for each firm. Suppose that Mays and McCovey form a cartel, and the firms divide the output evenly. (Note: This is only for convenience; nothing in this model requires that the two companies must equally share the output.) Place the black point (plus symbol) on the following graph to indicate the profit-maximizing price and combined quantity of output if Mays and McCovey choose to work together.arrow_forwardthe question is in the image attached.arrow_forwardWould it be answer 1? Imagine a duopoly in which two firms, A and B, produce the monopoly profit-maximizing output and equally share the economic profit. If firm A increases output, 1)both firms' profits increase. 2)firm A's profits increase and firm B's profits decrease. 3)firm B's profits increase and firm A's profits decrease. 4)both firms' profits decrease. 5)firm A's profits increase and firm B's profits do not change.arrow_forward

- consider the market for oil. Suppose for simplicity that there are only two oil roducing countries-Saudi Arabia and Kuwait. Both countries must choose hether to produce a low output or a high output. These output strategies with corresponding profits are depicted in the ayoff matrix to the right. Kuwait's profits are in red and Saudi Arabia's are in blue. Kuwait Suppose the two countries form a cartel. What is the cooperative equilibrium? Low Output High Output O A. The cooperative equilibrium is for Saudi Arabia to produce a high output and Kuwait to produce a high output. $125 $75 Low Output $8 $13 O B. A cooperative equilibrium does not exist for this game. O C. The cooperative equilibrium is for Saudi Arabia to produce a low output and Kuwait to produce a high output. Saudi Arabia $98 $70 O D. The cooperative equilibrium is for Saudi Arabia to produce a high output and Kuwait to produce a low output. High Output $5 $8 O E. The cooperative equilibrium is for Saudi Arabia to produce…arrow_forwardRussia, Iran and Qatar made the first serious moves in October 2008 toward forming an OPEC-style cartel for natural gas. Each of the countries can comply with the cartel agreement or to cheat on the cartel agreement. If all countries comply, the economic profit for each will be $140 million. If one country cheats, that country earns $200 million in economic profit and the other countries will have economic losses of $10 million. If all countries cheat, they break even. What are the strategies in this game? Earn between $140 and $200 million in profits. Cheat on the cartel agreement and earn -$10 million in profits. Comply with the agreement and earn $140 million in profit. Comply with the cartel agreement or to cheat on the cartel agreement.arrow_forwardIsolated Island has two wind turbines producing electricity, one owned by Dick and the other owned by Harry. Quantity demanded (units per day) Price (dollars per unit) The marginal cost of producing electricity is $4 a unit. 12 11 1 The table gives the demand schedule for electricity in this area. 10 2 9 3 If Dick and Harry form a cartel and maximize their joint profit, what will be the price of electricity and the total quantity produced? 8 4 7 5 If Dick and Harry form a cartel and maximize their joint profit, the price of a unit of electricity is $ and the quantity produced is units a day. 6 7arrow_forward

- If in theory collusion is good for the members of a cartel, give at least three reasons why in practice collusion is not widespreadarrow_forwardConsider the following The city of College Station, TX has a median home price of around $335,000 in December 2022. Market value is not necessarily the same as its assessed valuation for purposes of taxation (in fact they can be quite different), but for the purposes of this activity, the Brazos County Appraiser (an officer of the county government) has also assessed the value of the property and found it to be the same. Note: The appraiser may overvalue one's property. Higher property values = Higher tax base = higher property tax revenues for local governments = higher property tax bill for you! Many Texans appeal their assessment! This property is taxed at the following rates (from the Brazos Central Appraisal District)Links to an external site. levied by various local governments. (These rates are not represented as traditional mill rates, but are represented as dollars per $100 of assessed valuation.) Brazos County: $0.429411 City of College Station: $0.524613 College…arrow_forward4arrow_forward

- Firms like Papa John’s, Domino’s, and Pizza Hut sell pizza and other products that aredifferentiated in nature. While numerous pizza chains exist in most locations, thedifferentiated nature of these firms’ products permits them to charge prices abovemarginal cost. Given these observations, is the pizza industry most likely a monopoly,perfectly competitive, monopolistically competitive, or an oligopoly industry? Use thecausal view of structure, conduct, and performance to explain the role of differentiationin the market for pizza. Then apply the feedback critique to the role of differentiation inthe industry.arrow_forwardMa3. You operate in a duopoly in which you and a rival must simultaneously decide what price to charge for the same homogeneous product. Assume each you and your rival can choose a “low price” or a “high price”. If you each charge a low price, you each earn zero profits. If you each charge a high price, you each earn profits of $3 million. If you charge different prices, the one charging the high price loses $5 million and the one charging the low price makes $5 million. What is the Nash equilibrium for the non-repeated version of this game? Now suppose the game is infinitely repeated. If the interest rate is 10%, can you do better than you could in the non-repeated version of this game? If your answer is “yes”, provide the players’ strategies and any other conditions that must hold.arrow_forward1arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education