Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

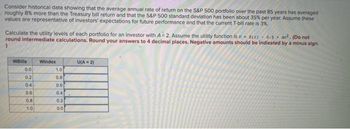

Transcribed Image Text:Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged

roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 35% per year. Assume these

values are representative of investors' expectations for future performance and that the current T-bill rate is 3%.

Calculate the utility levels of each portfolio for an investor with A 2. Assume the utility function is u 8(2)-0.5 A². (Do not

round intermediate calculations. Round your answers to 4 decimal places. Negative amounts should be indieated by a minus sign.

WBills

0.0

0.2

04

0.6

0.8

1.0

Windex

1.0

0.8

0.6

0.4

0.2

0.0

U(A=2)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mansukharrow_forwardSuppose rRF = 6%, rM = 12%, and bi = 1.1. What is ri, the required rate of return on Stock i? Round your answer to one decimal place. % 1. Now suppose rRF increases to 7%. The slope of the SML remains constant. How would this affect rM and ri? rM will remain the same and ri will increase by 1 percentage point. rM will increase by 1 percentage point and ri will remain the same. Both rM and ri will decrease by 1 percentage point. Both rM and ri will remain the same. Both rM and ri will increase by 1 percentage point. 2. Now suppose rRF decreases to 5%. The slope of the SML remains constant. How would this affect rM and ri? rM will remain the same and ri will decrease by 1 percentage point. Both rM and ri will increase by 1 percentage point. Both rM and ri will remain the same. Both rM and ri will decrease by 1 percentage point. rM will decrease by 1 percentage point and ri will remain the same. 1. Now assume that rRF remains at 6%, but rM increases to 13%.…arrow_forwardIf D, = S1.75, g (which is constant) = 3.6%, and P. =$40.00, what is the stock's expected total return for the coming year? 6.42% O 8.13% 9.92% 7.64% O 7.48%arrow_forward

- Consider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 27% per year. Assume these values are representative of investors' expectations for future performance and that the current T-bill rate is 3%. Calculate the expected return and variance of portfolios invested in T-bills and the S&P 500 index with weights as shown below. Note: Round your "Expected Return" answers to 2 decimal places and "Variance" answers to 4 decimal places. WBills 0.0 0.2 0.4 0.6 0.8 1.0 WIndex 1.0 0.8 0.6 0.4 0.2 0.0 Expected Return 11.00 % % % % % % Variance 0.0729 Examplearrow_forwardSuppose that the standard deviation of returns on each individual stock is 80% per annum and that the covariance between each pair of stocks is 0.25. What is the annual standard deviation of an equally weighted well - diversified portfolio?arrow_forwardConsider historical data showing that the average annual rate of return on the S&P 500 portfolio over the past 85 years has averaged roughly 8% more than the Treasury bill return and that the S&P 500 standard deviation has been about 33% per year. Assume these values are representative of investors' expectations for future performance and that the current T-bill rate is 4%. Calculate the utility levels of each portfolio for an investor with A = 2. Assume the utility function is U = E(r) Note: Do not round intermediate calculations. Round your answers to 4 decimal places. Negative amounts should be indicated by a minus sign. - 0.5 × Ag². X Answer is complete but not entirely correct. WIndex U(A = 2) 0.0111 0.0504 0.0808 x 0.1026 0.1164 X 0.1200 X WBills 0.0 0.2 0.4 0.6 0.8 1.0 1.0 0.8 0.6 0.4 0.2 0.0arrow_forward

- 11. Changesto the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows. (Tool tip: Mouse over the points in the graph to see their coordinates.) REQUIRED RATE OF RETURN (Percent) 20.0 16.0 12.0 8.0 4.0 O Do 0.5 ■ 1.0 RISK (Beta) 1.5 2.0 (?)arrow_forwardCalculate the required rate of return for Best Inc., assuming that (1) investors expect a 1.5% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 3.0%, (4) the firm has a beta of 1.2, and (5) its realized rate of return has averaged 10.0% over the last 5 years.arrow_forwardAssume that the CAPM is true, Rf = 5%, Rm= 15% σm = 0.1. An investor with $10,000 to invest builds a portfolio, Q, of T-bills and the market portfolio. This means that: a) it would be possible for the investor to obtain a return of 17% on portfolio Q b) if portfolio Q were composed of short-selling $2,000 in T-bills and the remainder is the market portfolio, then Pqm = 1, βq = 1.2 and σq = 0.12 c) to obtain a return of 17% from portfolio Q the investor would need to invest $12,000 in the market portfolio d) all of the above are true e) only a) and b) above are true. Pls show procedure, thanksarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education