Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

A. Consider a stock worth K12.50 that can go up or down by 15% per period. Assume a

period process of one. The risk-free rate is 10%. Find the value of the call option

today, with the strike price of K11.50.

B. What is the price of a European put option on a non-dividend paying stock when the

stock price is K69, the strike price is K70, the risk-free rate is 5% per annum, the

volatility is 35% per annum, and the time to maturity is 6 months?

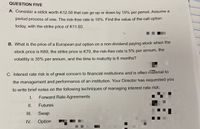

Transcribed Image Text:QUESTION FIVE

A. Consider a stock worth K12.50 that can go up or down by 15% per period. Assume a

period process of one. The risk-free rate is 10%. Find the value of the call option

today, with the strike price of K11.50.

B. What is the price of a European put option on a non-dividend paying stock when the

stock price is K69, the strike price is K70, the risk-free rate is 5% per annum, the

volatility is 35% per annum, and the time to maturity is 6 months?

C. Interest rate risk is of great concern to financial institutions and is often material tO

the management and performance of an institution. Your Director has requested you

to write brief notes on the following techniques of managing interest rate risk:

I.

Forward Rate Agreements

I.

Futures

II.

Swap

IV.

Option

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 3. Consider a one-period binomial model with h = 1, S = 100, r = 0.08, u = 1.5, d = 0.8 and 8 = 0. Calculate the price of an American put option on this stock with strike price K = 100. Does early exercise occur?arrow_forwardWhat is the gamma of a European call option with the following parameters? As a reminder, gamma is defined as the first derivative of delta with respect to the stock price, or alternatively as the second derivative of the option price with respect to the stock price. s0 = $40k = $40 r = 10%sigma = 20%T = 0.75 years In order to avoid precision issues with Excel, please use an epsilon of 0.0001. (required precision 0.0001 +/- 0.0002) Greeks Reference Guide: Delta = ∂π/∂S Theta = ∂π/∂t Gamma = (∂2π)/(∂S2) Vega = ∂π/∂σ Rho = ∂π/∂rarrow_forwardD3(arrow_forward

- QUESTION: 2. What is the fair value for a six-month European call option with a strike price of $135 over a stock which is trading at $138.15 and has a volatility of 42.5% when the risk free rate is 1.85% using the two step binomial tree? a) What is the delta of this option? b) What is the probability of an up movement in this stock? c) What is the probability of a down movement in this stock? d) What is the proportional move up for this stock e) What is the proportional move down for this stock f) What would be the value of the put option with the same strike price?arrow_forwardD3) Finance What is the probability that the put option is OTM at maturity if: the Stock is S = $195.00, no dividend is paid, the risk-free rate is r = 2.40%, the strike price is K = 209.00, the maturity is T = 23 months and the parameters are d1 = 0.2328 and d2 = -0.3175?arrow_forwardplease answer as soon as possible?arrow_forward

- Let S = $100, K = $95, \sigma = 30%, r = 8%, T = 1, and \delta = 0. For simplicity, let u = 1.3, d = 0.8 and n = 2 (that is, 2 periods). When constructing the binomial tree for the European call option, what is A (Stock Share Purchased in the replicating portfolio) at the first node (Time 0)? Question 11 options: 0.1789 0.3886 1.0000 0.2550 0.6912arrow_forwardIn a financial market a stock is traded with a current price of 50. Next period the priceof the stock can either go up with 30 per cent or go down with 25 per cent. Risk-freedebt is available with an interest rate of 8 per cent. Also traded are European optionson the stock with an exercise price of 45 and a time to maturity of 1, i.e. they maturenext period.i) Find prices of Arrow-Debreu securities.arrow_forwardam. 116.arrow_forward

- 5.arrow_forwardb) Suppose you are given the following information: Current market price of a share= R200 000 Option’s exercise price = R300 000 Time until the option expires= 5 yrs Risk free rate =4% Standard deviation of the returns on the share= 0.35 Required: i. Calculate d1 and d2 ii. Suppose N(d1) =0.7517 and N(d2) =0.4602; calculate the price of the call option on the sharearrow_forwardSuppose there is also a 1-year European put option on the same stock as in Question 3 with exercise price $30. The current stock price is also $25 and the stock price, in 1 year, will be either $35 (up by 40%) or $20 (down by 20%). The interest rate is 8%. This stock does not pay dividend. What is the value of the put option? Please use risk neutral probability method and assume discrete discounting. (2) What is put-call parity in option pricing? What needs to be true in order for put-call parity to hold?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education