Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

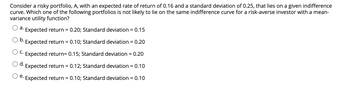

Transcribed Image Text:Consider a risky portfolio, A, with an expected rate of return of 0.16 and a standard deviation of 0.25, that lies on a given indifference

curve. Which one of the following portfolios is not likely to lie on the same indifference curve for a risk-averse investor with a mean-

variance utility function?

a. Expected return = 0.20; Standard deviation = 0.15

b. Expected return

= 0.10; Standard deviation = 0.20

Expected return= 0.15; Standard deviation = 0.20

Expected return = 0.12; Standard deviation = 0.10

Expected return = 0.10; Standard deviation = 0.10

C.

d.

e.

Expert Solution

arrow_forward

Step 1

Given:

Expected return is 0.16

Standard deviation is 0.25

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume a utility function of ? = ?[?] − 1 ?? 2. Which statement(s) is/are correct about investors with this utility function? [I] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher risk premium [II] An investor with a higher degree of risk aversion chooses the optimal portfolio with lower risk [III] An investor with a higher degree of risk aversion chooses the optimal portfolio with a higher sharpe ratio [IV] The extent to which the investor dislikes risk is captured by ? 2 A. [II] only B. [I], [II] only C. [III] , [IV] only D. [II], [IV] only E. [I], [II], [III] onlyarrow_forwardAssume the CAPM holds and consider stock X, which has a return variance of 0.09 and a correlation of 0.75 with the market portfolio. The market portfolio's Sharpe ratio is 0.30 and the the risk-free rate is 5%. (a) What is Stock X's expected return? (b) What proportion of Stock X's return volatility (i.e. standard deviation) is priced by the market? Explain why this number is less than 1.arrow_forwardSuppose the utility function is U = E(r) - 0.5Ao2. Draw the indifference curve corresponding to a utility level of 0.2 for an investor with a risk aversion coefficient of 3. Please note the vertical line indicates expected return, and plot standard deviation on the horizontal line.arrow_forward

- Suppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forwardplease help me check my work and anything unsolved, thanksarrow_forward

- Portfolios that offer the highest expected return for a given variance (or standard deviation) are known as efficient portfolios. O true falsearrow_forwardExplain well all question with proper answer. And type the answer step by step.arrow_forwardWhich of the following measures the total risk of a portfolio? A. Standard Deviation B. Correlation Coefficient C. Beta D. Alphaarrow_forward

- Return on a portfolio of two risky assets which are perfectly negatively correlated is equivalent to a. Risk-free rate b. Return on market portfolio c. Zero return d. -1%arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A(A) to beta of B(B).arrow_forwardThe portfolio with the highest Sharpe Ratio is I. The minimum-variance point on the efficient frontier II. The tangency point of the capital market line and the efficient frontier III. The maximum-return point on the efficient frontier IV. The line with the steepest slope that connects the risk-free rate to the efficient frontier Select one: a. II and IV only b. I and IV only c. III and IV only d. Only IV e. I and II onlyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education