ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

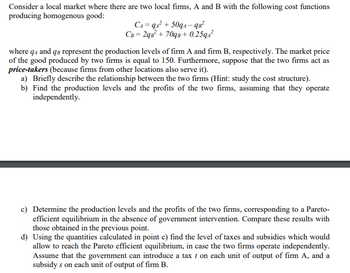

Transcribed Image Text:Consider a local market where there are two local firms, A and B with the following cost functions

producing homogenous good:

CA=qA² +509A-9B²

CB= 2qB² + 70qB+0.25qA²

where q4 and qв represent the production levels of firm A and firm B, respectively. The market price

of the good produced by two firms is equal to 150. Furthermore, suppose that the two firms act as

price-takers (because firms from other locations also serve it).

a) Briefly describe the relationship between the two firms (Hint: study the cost structure).

b) Find the production levels and the profits of the two firms, assuming that they operate

independently.

c) Determine the production levels and the profits of the two firms, corresponding to a Pareto-

efficient equilibrium in the absence of government intervention. Compare these results with

those obtained in the previous point.

d) Using the quantities calculated in point c) find the level of taxes and subsidies which would

allow to reach the Pareto efficient equilibrium, in case the two firms operate independently.

Assume that the government can introduce a tax t on each unit of output of firm A, and a

subsidy s on each unit of output of firm B.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Interpret the given information

VIEW Step 2: A) Describe the relationship between the two firms

VIEW Step 3: B) Find the production levels and profits

VIEW Step 4: C) Determine the levels corresponding to Pareto efficient equilibrium

VIEW Step 5: D) Interpret the level of taxes and subsidies

VIEW Solution

VIEW Step by stepSolved in 6 steps with 17 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a duopoly with homogenous goods where Firm 1 has the following production function: Q1 = F1(L,K) = L1/2 K1/2, where Q and K are measured in units and L in hours. Firm 2 uses labour and capital as well but has a different production function, given by Q2 = F2(L,K) = L1/3 K2/3. You may assume that the market for labour and capital is perfectly competitive and the current wage rate is £40 and the rental rate on capital is £10. Both firms sell their products on the same market with inverse demand function P = 52 – (Q1 + Q2), where P is measured in pound sterling. Which production function(s) exhibit(s) decreasing returns to scale? Suppose Firm 1 wishes to produce 6 units. What is the cost minimising input mix for Firm 1? Suppose Firm 2 wishes to produce 4 units. What is the cost minimising input mix for Firm 2? Assume both firms now have the option to produce either 4 units or 6 units. We will consider the situation where both firms simultaneously, but independently,…arrow_forward1. Consider a market where there are only two firms that produce a homogeneous product. The two firms face the direct market demand curve given Q = 15-p, where Q = 9₁ +92 and 9₁ and q2 are the quantities of firm 1 and firm 2, respectively. Suppose firm 1's total cost is C₁ = 9₁ and firm 2's total cost function is C₂ = 2q2. Suppose that the two firms act independently and choose their outputs simultaneously as in the Cournot model. Show the basis and briefly explain what is going on as you answer each of the following questions. Your mark will depend upon the correctness of your basis and explanation. 1. What is the equation of the demand curve faced by firm 1? What is the equation of the demand curve faced by firm 2? Find the output reaction function of each firm. 2. 3. Find the Nash-Cournot equilibrium quantity that each firm will produce. 4. At the Nash-Cournot equilibrium, at what price does each firm sell its output? 5. Find the consumer surplus, producer surplus at the…arrow_forwardTwo firms compete on price every year. The inverse demand function each firm faces depends on which firm has chosen the lowest price that year. The one that did captures the entire market. If, on the other hand, both prices are the same then they split the market evenly. Consumers round up prices to the nearest integer. For the firm with the lowest price p, demand is given by: q = 24-2p: Marginal costs are constant and equal to $4 for both firms. a. Define the Normal form of the stage game and determine the Nash Equilibria, the Cooperative Equilibrium and the Optimal Deviation from cooperation. b. For the once repeated (2 stages) game, determine if a Nash Equilibrium exists that improves on simply playing the (better) Nash Equilibrium of the stage game twice c. For the infinitely repeated game, determine what the interest rate would have to be to prevent the firms from cooperating. d*. Determine the relation between the interest rate and the number of punishment periods in a…arrow_forward

- In the Cournot equilibirum, what is the market price and units produced by firm 1 and firm 2?arrow_forwardIn this question you will work out a model of price competition (Bertrand competition) with differentiated products, i.e., when the two firms that compete produce slightly different products. Consider two price-setting firms, 1 and 2, each with marginal cost c, that produce goods, 1 and 2, that are imperfect substitutes. Some customers are loyal to a particular variety of the good so both firms can still have positive sales when they set different prices. Demand for firm 1's output, q1, as a function of the prices of both products, p1 and p2 , is given by q1 = 2 – 3p1 + 3p2. And the demand for firm 2's output, q2, is given by q2 = 6 – 2p2 + P1. a. How can we tell, by looking at the demand functions above, that in the preferences of consumers the two products are substitutes? Explain your answer.. b. Write this strategic situation as a simultaneous game between the two firms, specifying the set of players, the set of alternatives and the preferences of each firm. Write down the profit…arrow_forwardAnswer 1, 2 and 3, see the question properly.arrow_forward

- Economics: Industrial Economics Question: In a market that operates under quantity competition there are 2 firms (Cournot duopoly). The inverse demand function is P = A - B Q. The cost structure of firm 1 is given by C1(q1) = F1 + c1 q1 and that of firm 2 is given by C2(q2) = F2 + c2 q2. Prior to competing, the two firms can engage in research at levels (x1, x2) respectively in order to lower their marginal costs. As a result, marginal costs are c1 = c - x1 - β2x2 and c2= C - x2 - β1 X1. where β1 = β2 > ½. Finally, the research costs are F1 = a1 (x1)^2 /2 and F2 = a2 (x2)^2 /2, where a1 > 0 and a2> 0. 1. The Nash Equilibrium research levels are Choices: A. Higher than the cooperative research levels for both firms. B. Higher than cooperative research levels for firm 1 but lower for... C. Lower than the cooperative research levels for both firms. D. Higher than cooperative research levels for firm 2 but lower for... 2. An increase in the value of a2 would Choices: A.…arrow_forwardTwo firms, A and B, sell the same good X in a market with total demand Q = 100 – P. The two firms compete on quantities and decides how much to produce simultaneously. Firm A cost function is C(qA) = 40qA. Firm B cost function is C(qB) = 60qB. 1. Find the best reply functions of both firms and represent them in a graph. 2. Find the quantity produced by each firm in a Nash equilibrium. 3. Find the firms and consumers surplus. 4. Compare the surplus of firms found above with the surplus arising when both firm cooperate to sustain a monopoly outcome. 5. Assume now that A and B compete as in a Stackelberg model. A chooses first and B chooses after observing the choice of A. Find equilibrium quantities produced by each firm and the market equilibrium price.arrow_forwardFirm A and Firm B are the only two firms in a market where price is determined by the inverse demand function: P = 147 - Q. Q is the sum of Firm A and Firm B's output, so Q = 9A + 9B Firm A's total cost function is given by TCA(9A) = 39A Firm B's total cost function is given by TCB(9B) = 89B If these firms Cournot compete (simultaneously setting quantities), what will market price be when both firms are maximizing profits in equilibrium? (Note: The answer may not be a whole number, so round to the nearest hundredth)arrow_forward

- Two firms sells an identical product. The demand function for each firm is given: Q = 20 - P, where Q = q1 + q2 is the market demand and P is the price. The cost function for reach firm is given: TCi = 10 + 2qi for i = 1, 2. a) If these two firms collude and they want to maximize their combined profit, how much are the market equilibrium quantity and price? b) If these two firms decide their production simultaneously, how much does each firm produce? What is the market equilibrium price? c) If Firm 1 is a leader who decides the production level first and Firm 2 is a follower, how much does each firm produce? What is the market equilibrium price?arrow_forwardSuppose that firms A and B have the same product in the same market, where Qd = Qa + Qb = 300 - 2p is demand And the firms have a simple cost curves of TCa = 5Qa and TCb = 10Qb Find Cournot Equilibrium & Find the Stackelberg equilibrium if A is the leader. Thanks!arrow_forwardConsider a market with two firms. Call them firm 1 and firm 2. The demand function describing the market is P = 216 – 0.4Q. Firms are initially identical, with the cost function C(q) = 140 + 40q. Calculate the total profits in the market. Under what conditions, the two firms may succeed to collude? How much would each firm earn if they could collude?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education