ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

In the Cournot equilibirum, what is the market

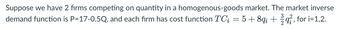

Transcribed Image Text:Suppose we have 2 firms competing on quantity in a homogenous-goods market. The market inverse

demand function is P=17-0.5Q, and each firm has cost function TC; = 5 +8qi+q, for i=1,2.

3 2

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- When firms face downward sloping demand curves for their products,arrow_forwardUse the photo at exercise 14 to solve the problem below With the Firm Y response function Qy=600-1/2Qx and the Firm XX response function Qx=600-1/2Qy Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here? [You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]arrow_forwardDoes a market equilibrium exist in an oglipolistic market? If so, how is it determined?arrow_forward

- Please explain how to graph this. From the curve of the demand and supply and the factors that affects the grapharrow_forwardProfit is the incentive that drives our market economy. Firms make production, pricing, andhiring decisions based on their quest for profit. But what happens when a firm discoversthat it can make dramatically higher profits by stopping production altogether? In December2000, due to wild swings in the market for electricity, Kaiser Aluminium faced just such adecision.Kaiser Aluminium had contracted with Bonneville power for all of its electricity needs andfound itself in the unique position of being an electricity consumer and, potentially, anelectricity reseller. By December 2000, Kaiser faced a difficult decision of continuing itscurrent aluminium production and profit levels, or closing the plant to dramatically increaseits profit by simply reselling its electricity.When making production decisions, firms must consider both their costs and revenues. Oneimportant concern for many firms is utility costs. In 1996, Kaiser Aluminium Corporation inSpokane, Washington, entered into a…arrow_forwardThe firm ACME, Inc. operates in a competitive market because OACME, Inc. is one of a few firms and entry in this market is easy OACME, Inc. can influence the market price and sells a product different from other firms in the market OACME, Inc. is one of many firms selling the same product and, market entry is easy OACME, Inc. is one of many firms selling the same product and, market entry is blockedarrow_forward

- Use the photo at exercise 14 to solve the problem below With the Firm Y response function Qy=600-1/2Qx and the Firm XX response function Qx=600-1/2Qy Imagine that firm X chooses their quantity first, then firm Y observes the quantity of firm X and chooses their own quantity. What quantities will they end up choosing? Is there a first or second-mover advantage here? [You may assume that firm X can only choose quantities that are multiples of 200. This prevents you from having to deal with prices that are not on the schedule. just a little thinking about how equilibrium works in a sequential-move game. Oh, and just give me the quantity for each firm, don't worry about giving me a complete strategy for firm Y.]arrow_forwardThe widget market is competitive and includes no transaction costs. Five suppliers are willing to sell one widget at the following prices: $26, $14, $10, $5, and $3 (one seller at each price). Five buyers are willing to buy one widget at the following prices: $10, $14, $26, $34, and $42 (one buyer at each price). For each price shown in the following table, use the given information to enter the quantity demanded and quantity supplied. Price Quantity Demanded Quantity Supplied ($ per widget) (widgets) (widgets) $3 $5 $10 $14 $26 $34 $42 In this market, the equilibrium price will be per widget, and the equilibrium quantity will be widgets.arrow_forwardApple is famously secretive about the details of upcomingproduct launches, leaving consumers and industry insidersto speculate on the features and functions of new models.What effect might this have on demand?arrow_forward

- The setting is a Ralph Lauren outlet store, and the product line is Polo golf shirts. A product manager and the General Manager for Outlet Sales are analyzing the discounted price to be offered at the outlet stores. Let’s work through the decision at the level of one color of golf shirts sold per outlet store per day. The decision being made is how low a price to select at the start of any given day to generate sales at that price throughout the day. The demand, revenue, and variable cost information is collected on the following spreadsheet:Questions1. Identify the change in total revenue (the marginal revenue) from the fourth shirt per day. What price reduction was necessary to sell four rather than three shirts?2. Does this fourth shirt earn an operating profit or impose an operating loss? How large is it?3. What is the change in total revenue from lowering the price to sell seven rather than six shirts in each color each day? In what sense is the decision to sell this seventh shirt…arrow_forwardJohnson's Household Products has a division that produces two types of toothpaste: a regular toothpaste and a whitening tooth paste. The demand equations that relate the prices, p and q (in dollars per thousand units), to the quantities demanded weekly, x and y (in units of a thousand), of the regular toothpaste and the whitening toothpaste are given by p=3000-20 x-10 yp=3000−20x−10y and q=4000-10 x-30 yq=4000−10x−30y respectively. The fixed cost attributed to the division is $20,000/week, and the cost for producing 1000 tubes of regular and 1000 tubes of whitening toothpaste is$400 and $500, respectively. a. What is the weekly total revenue function R(x, y)? b. What is the weekly total cost function C(x, y)? c. What is the weekly profit function P(x, y)? d. How many tubes of regular and whitening toothpaste should be produced weekly to maximize the division's profit? What is the maximum weekly profit?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education