ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

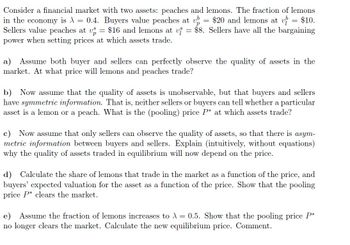

Transcribed Image Text:Consider a financial market with two assets: peaches and lemons. The fraction of lemons

in the economy is λ = 0.4. Buyers value peaches at up = $20 and lemons at v= $10.

Sellers value peaches at vs = $16 and lemons at vi = $8. Sellers have all the bargaining

power when setting prices at which assets trade.

a) Assume both buyer and sellers can perfectly observe the quality of assets in the

market. At what price will lemons and peaches trade?

b) Now assume that the quality of assets is unobservable, but that buyers and sellers

have symmetric information. That is, neither sellers or buyers can tell whether a particular

asset is a lemon or a peach. What is the (pooling) price P* at which assets trade?

c) Now assume that only sellers can observe the quality of assets, so that there is asym-

metric information between buyers and sellers. Explain (intuitively, without equations)

why the quality of assets traded in equilibrium will now depend on the price.

d) Calculate the share of lemons that trade in the market as a function of the price, and

buyers' expected valuation for the asset as a function of the price. Show that the pooling

price P* clears the market.

e) Assume the fraction of lemons increases to λ = 0.5. Show that the pooling price P*

no longer clears the market. Calculate the new equilibrium price. Comment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1a) I have a budget of 10 million. I want to buy a house and some cars (x) to fill up my garage. The size of the house is measured in squared metres with a price of 1000 per square metre (y). My utitility follows a quaslinear function, u(x,y) = 2√x + 2y. What are the demand functions for the number of cars and the land coverage of my house? 1b) If a land tax of 10% per square metre is implemented, what is the income effect? What is the substitutiion effect?arrow_forward1) A key difficulty facing insurance companies is that people know more about their health than do insurance companies, and that those people who are seriously ill are the most likely to want to obtain health insurance. What is this phenomenon called? A) moral hazard B) economic irrationality C) asymmetric information D) adverse selection 2) An insurance company is likely to attract customers like Clancy who want to purchase insurance because he knows better that the company that he is more likely to make a claim on a policy. What is the term used to describe the situation above? A) moral hazard B) adverse selection C) asymmetric information D) economic irrationality 3) The term that is used to refer to a situation in which one party to an economic transaction has less information than the other party is A) inefficient market hypothesis. B) moral hazard. C) information disparity. D) asymmetric information. 4) Which of the following parties is…arrow_forwardCan someone please help? Thank you.arrow_forward

- Suppose you get two job offers when you graduate. First offer is in LA and pays $6000 permonth. The price of food in LA is $3 and price of housing is $5. The second offer is in SanFrancisco and pays $10000. Both food and housing is more expensive in SF at PF = 4 and PH = 6respectively. If your utility function is U (F, H) = F1/4 H 3/4 which job offer should you accept?arrow_forward8. Suppose that the world can be described using two states and two stocks Yand 2 are available. We assume the stocks' future prices have the following distribution State Future Prices Stock Y Future Prices Stock Z $10 $20 $15 $11 1 The initial prices for the stocks are: Y(1) = $13, Z(1) = $10. Our utility function in (w1, w2) space is U(w1, w2) = w1 X w2, where U represents the utility level. Now we have an initial endowment of $420. How many shares and what positions of Y and Z should we choose to build our portfolio so that we actually maximize our utility function? (Assume fractional shares are permitted.) %3D Whot oMOarrow_forwardTyler buys a futures contract from Alex that gives him the right to buy 1,000 barrels of oil at $125 per barrel in 48 months. What happens in 48 months if the actual price per barrel of oil is $100? A.) Tyler must pay Alex $25,000. B.) Tyler makes a profit of $25 per barrel, or $25,000. C.) The contract becomes void because the price turned out lower than expected. D.) Alex must give Tyler $10,000.arrow_forward

- (1) Consider a small exchange economy with two consumers, A and B, and two commodities, ₁ and 2. Consumer A's initial endowment is 3 units of ₁ and 2 unit of 2. Consumer B's initial endowment has 5 units of 2₁ and 4 units of r2. Consumer A's utility function is given by U(₁, ₁) = x^x^. Consumer B's utility function is given by U(x,x) = 2x² + x2. Note that and are the amounts of the two goods for Consumer A, and rf and are amounts of the two goods for Consumer B. (a) Draw an Edgeworth box, showing the initial allocation. Label it as E. Measure Consumer A's consumption from the lower left and Consumer B's from the upper right. Also measure the number of ₁ on the horizontal axis and the number of r2 on the vertical axis. (b) Draw Consumer A's indifference curve (ICA) going through E. (c) Draw Consumer B's indifference curve (ICB) going through E.arrow_forwardTwo restaurants are on the same block. One has been opened for 10 years and is a thriving business. The other one has been open for only a year. They both want to expand. When the two owners go to the local bank looking for a loan, which one is likely to get a lower interest rate? Explain in terms of the risk-return principle.arrow_forward20) This decision tree represents the expected profits and the standard deviations associated with three decisions facing a mobile phone producer (All figures are in millions of dollars). The root node (the one on the left) represents the decision of whether to produce the phones in China or North America. The second pair of nodes represent the decision of whether to market the phones in China or North America; and the final nodes represent the choice of selling price: if the phones are sold in China, they will be sold for either $30 or $40, whereas if they are sold in North America, they will be sold for either $40 or $50. Based on the calculated values, what is the company's best strategy? Mean $30 1.250, sd 750 Sell China $40 Mean 375, sd = 625 Make in China Mean= -1,000, sd = 1,500 $40 Sell NA S50 Mean =-1,500, sd = 1,250 Sell China $30 $40 Make in NA Mean 1,250, sd.- 2,137 Sell NA $40 S50 Mean --250, sd-1.639arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education