ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

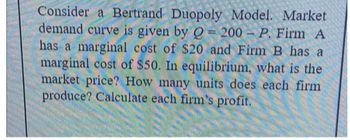

Transcribed Image Text:Consider a Bertrand Duopoly Model. Market

demand curve is given by Q = 200- P. Firm A

has a marginal cost of $20 and Firm B has a

marginal cost of $50. In equilibrium, what is the

market price? How many units does each firm

produce? Calculate each firm's profit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the differentiated goods Bertrand price competition model where firms A and B produce similar goods and sell them at pA and pB. The demand for each firm’s product is given byqA =60−2pA +pB andqB =60–2pB +pA ,and there are NO costs of producing either good (all costs are 0). (a)Calculate the (Bertrand) equilibrium prices and the net profits of each firm (b) Now suppose that -instead of competing to maximize their own individual profits- the firms decide to “collude” and set prices pA and pB to maximize their joint profits (sum of their profits). What would be each firm’s optimal price and net profits? Compare these prices and profits with what you found in (a) (greater/smaller/the same?).arrow_forwardonsider a homogenous good industry with four firms. Total demand is given by D(p)=200-p.The variable (=marginal) cost of each of the firms is c1=10, c2=20, c3=30 and c4=35. Firms compete in prices. Suppose firms 1 and 2 merge into one entity and produce with a marginal cost of 15. Which of the following statements is correct? After the merger, total welfare increases by $500. After the merger, total welfare decreases by $500. After the merger, total welfare increases by $1000. After the merger, total welfare decreases by $1000. None of the above.arrow_forwardSuppose the global market for personal computers is monopolistically competitive. If a country engages in a two-way trade in personal computers, such trade is usually based on Multiple Choice comparative advantage. constant returns to scale. product differentiation. external scale economies.arrow_forward

- Consider a duopoly with homogenous goods where Firm 1 has the following production function: Q1 = F1(L,K) = L1/2 K1/2, where Q and K are measured in units and L in hours. Firm 2 uses labour and capital as well but has a different production function, given by Q2 = F2(L,K) = L1/3 K2/3. You may assume that the market for labour and capital is perfectly competitive and the current wage rate is £40 and the rental rate on capital is £10. Both firms sell their products on the same market with inverse demand function P = 52 – (Q1 + Q2), where P is measured in pound sterling. Which production function(s) exhibit(s) decreasing returns to scale? Suppose Firm 1 wishes to produce 6 units. What is the cost minimising input mix for Firm 1? Suppose Firm 2 wishes to produce 4 units. What is the cost minimising input mix for Firm 2? Assume both firms now have the option to produce either 4 units or 6 units. We will consider the situation where both firms simultaneously, but independently,…arrow_forwardJuanita owns a plot of land in the desert that isn't worth much. One day, a giant meteorite falls on her property, making a large crater. The event attracts scientists and tourists, and Juanita decides to sell nontransferable admission tickets to the meteor crater to both types of visitors: scientists (Market A) and tourists (Market B). The following graphs show daily demand (D) curves and marginal revenue (MIR) curves for the two markets. Juanita's marginal cost of providing admission tickets is zero.arrow_forwardIn the Cournot equilibirum, what is the market price and units produced by firm 1 and firm 2?arrow_forward

- There are two identical firms in an industry, 1 and 2, each with cost function , i = 1,2. The industry demand curve is P = 100 − 5X where industry output, X, is the sum of the two firms’ outputs (X1 + X2). (a) If each firm makes its output decisions on the assumption that the other will not react to its choices (the Cournot assumption), what is the equilibrium output for each firm? What is the equilibrium price? (b) Suppose that each firm takes it in turn to choose its level of output, on the assumption that the other’s output level is fixed. Would the process of adjustment be stable? (c) Suppose that firm 1 introduces a cost-saving innovation, so that its cost curve becomes C1 = 8X1. Firm 2’s cost curve and the industry demand curve are unchanged. What happens to the equilibrium quantity produced by each firm and to market price?arrow_forwardConsider a duopoly where firms compete in prices and firms do not have any capacity constraints. Market demand is P(Q)=45-4Q, and each firm faces a marginal cost of $9 per unit. How much is each firm's total variable cost if firms equally divide the market at Nash equilibrium?arrow_forwardConsider a BERTRAND duopoly where each firm's price MUST BE IN WHOLE DOLLARS. Each firm incurs a $50 fixed costs and can produce any quantity without additional cost. Market demand is P(Q)=100-Q. Firm 1 has chosen $25 and Firm 2 has chosen $50. What are Firm 1's profit? Do not enter the $.arrow_forward

- In the Stackelberg model, the firm that sets output first has an advantage. Explain why using your own words.arrow_forwardConsider an industry comprised of three identical firms faced with a linear cost function given by: C(qi) = cqi; for i = 1; 2; 3. Let inverse market demand be given by: P(Q) = a - bQ; where Q = q1 + q2 + q3.a. Compute the Cournot equilibrium; that is, find prices, quantities, and profits.b. Suppose that firms 1 and 2 merge, converting the market into a duopoly consisting of the “superfirm” and firm 3. Compute the new Cournot equilibrium. Once again find prices, quantities, and profits.c. Suppose that all three firms merge. Compute quantities, prices, and profits for the cartel solution.d. Suppose that firm 1 and 2 represent two members of OPEC – Saudi Arabia and Venezuela, say – while firm 3 is a non-OPEC oil exporting country – Russia, say. Describe the dynamics of OPEC. (Hint: re-interpret the solution to part 2, as 1 firm deviating from the fully cartelized solution. Is it convenient to have a partial cartel?)arrow_forwardConsider a Bertrand duopoly where market demand is P(Q)=5-9Q. Each firm faces a marginal cost $2 and no fixed cost. How much is the dead weight loss in a Nash equilibrium?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education