Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN: 9781337902571

Author: Eugene F. Brigham, Joel F. Houston

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Need help with this question

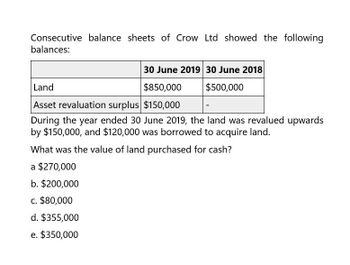

Transcribed Image Text:Consecutive balance sheets of Crow Ltd showed the following

balances:

30 June 2019 30 June 2018

Land

$850,000

Asset revaluation surplus $150,000

$500,000

During the year ended 30 June 2019, the land was revalued upwards

by $150,000, and $120,000 was borrowed to acquire land.

What was the value of land purchased for cash?

a $270,000

b. $200,000

c. $80,000

d. $355,000

e. $350,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- General Accountingarrow_forwardThe following are extracts from the financial statements of Captus Ltd. As at 31 March: 2021 2020 Sh.’000’ Sh.’000’ Sh.’000’ Sh.’000’ Fixed assets: Goodwill Freehold land and building Plant and machinery (NBV) Investment at cost Current assets: Stocks Accounts receivable Investments Cash at hand and bank Current liabilities Bank overdraft Accounts payable Proposed dividends Taxation Net current assets 15% debentures Capital and reserves: Authorised, issued and paid Sh.10 Ordinary shares Share premium Revaluation reserve Retained profit 10,050 6,140 1,710 200 18,100 (2,390) (5,850) (450) (820) (9,510) 2,800 16,800 5,860 3,600 29,060 8,590 37,650 (7,500) 30,150 18,000 1,500 4,500 6,150 8,700 7,800 840 430 17,770 (6,540) (5,250) (380) (600) (12,770) 2,900 12,000 6,350 3,750 25,000 5,000 30,000 (9,000) 21,000 15,000 750 -…arrow_forwardMake the financial analysis. Complete the data below. Show solution for a guide.arrow_forward

- Below is Company A's balance sheet at the end of 2022. What is the gross profits of Company A? 2022 AmountNet sales$1,000.0Variable operating costs 770.0Fixed operating costs 50.0Depreciation and 50.0Interest30.0Taxes20.0Preferred dividends5.0Common dividends25.0 amortization Group of answer choices $130 $230 $180 $1,000arrow_forwardA comparative balance sheet for Carter Fuel Injection Systems, Inc. appears below:Carter Fuel Injection Systems, Inc.Comparative Balance SheetDec. 31, 2020 Dec. 31, 2019AssetsCash $ 34,000 $11,000Accounts receivable 25,000 13,000Inventory 18,000 17,000Prepaid expenses 11,000 9,000Long-term investments -0- 17,000Equipment 55,000 33,000Accumulated depreciation—equipment (20,000) (15,000)Total assets $123,000 $85,000Liabilities and Stockholders' EquityAccounts payable $ 27,000 $ 7,000Bonds payable 35,000 45,000Common stock 31,000 23,000Retained earnings 30,000 10,000Total liabilities and stockholders' equity $123,000 $85,000Additional information:1. Net income for the year ending December 31, 2020 was $35,000.2. Cash dividends of $15,000 were declared and paid during the year.3. Long-term investments that had a cost of $17,000 were sold for $14,000.4. No equipment was sold during 2020.HINT: depreciation expense must be determined. Notice in #4 it states no equipment was “sold”during…arrow_forwardAccountarrow_forward

- a.) Calculate Hasbro's and UHS's ROE for each fiscal year. Verify if the answers below are correct if not, show the correct answer. 2019 2018 Hasbro's ROE: 17% 13% UHS ROE: 15% 15%arrow_forwardComparative balance sheet accounts of Riverbed Company are presented below. RIVERBED COMPANYCOMPARATIVE BALANCE SHEET ACCOUNTSAS OF DECEMBER 31 Debit Balances 2020 2019 Cash $69,300 $51,100 Accounts Receivable 154,900 130,000 Inventory 75,600 60,700 Debt investments (available-for-sale) 54,500 85,100 Equipment 70,600 48,100 Buildings 146,000 146,000 Land 40,200 24,700 Totals $611,100 $545,700 Credit Balances Allowance for Doubtful Accounts $10,100 $7,900 Accumulated Depreciation—Equipment 20,900 13,900 Accumulated Depreciation—Buildings 37,300 28,200 Accounts Payable 66,100 60,600 Income Taxes Payable 12,100 10,000 Long-Term Notes Payable 62,000 70,000 Common Stock 310,000 260,000 Retained Earnings 92,600 95,100 Totals $611,100 $545,700 Additional data: 1.…arrow_forwardRodriquez Corporation’s comparative balance sheets are presented below: RODRIQUEZ CORPORATIONComparative Balance SheetsDecember 31 2020 2019 Cash $16,500 $17,400 Accounts receivable 25,300 22,100 Investments 20,150 15,850 Equipment 59,950 69,850 Accumulated depreciation—equipment (13,850 ) (10,300 ) Total $108,050 $114,900 Accounts payable $14,850 $11,150 Bonds payable 10,600 30,100 Common stock 49,500 45,500 Retained earnings 33,100 28,150 Total $108,050 $114,900 Additional information: 1. Net income was $18,550. Dividends declared and paid were $13,600. 2. Equipment which cost $9,900 and had accumulated depreciation of $1,600 was sold for $3,300. 3. No noncash investing and financing activities occurred during 2020. Prepare a statement of cash flows for 2020 using the…arrow_forward

- Suppose you collected the following information of ABC corp. from the financial statements published in 2019. Entry Total Current Assets 14050001206000 Current Liabilities Notes Payable Earning before Interest and Taxes Depreciation Capital expenditures Tax rate Select one: @a. 1279990X b. 187578 0c Estimate the Free Cash Flow available for ABC corp. at the end of 2019. 60030 2019 d. 1092412 e 30 2018 602000 571500 476990 457912 97680 159000 -30000 40%arrow_forwardXNM Bhd prepared its profit & loss statement and financial position statement as at December 31, 2020 as follows; XNM Bhd Statement of Financial Position As at 31 December 2020 2020 2019 ASSETS RM RM Property, plant and equipment (PPE) 154,000 130,000 Accumulated depreciation – (PPE) (35,000) (25,000) Cash 6,000 9,000 Accounts receivable 62,000 49,000 Short-term investments (Available for sale) 35,000 18,000 Inventories 40,000 60,000 Prepaid rent 5,000 4,000 Copy right 46,000 50,000 Total assets 313,000 295,000 EQUITY AND LIABILITIES Ordinary shares 130,000 130,000 Retained earnings 57,000 36,000 Note payable 8,000 10,000 Long-term loans 60,000 67,000 Interest payable 46,000 42,000 Salaries payable 8,000 4,000 Income tax payable 4,000 6,000 Total liabilities and equity 313,000 295,000 XNM Bhd Statement…arrow_forwardCompute for the ratio that measures Nezuko Inc.'s ability to meet interest payment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...

Finance

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning