FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

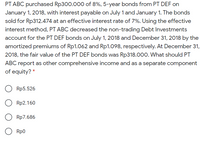

Transcribed Image Text:PT ABC purchased Rp300.000 of 8%, 5-year bonds from PT DEF on

January 1, 2018, with interest payable on July 1 and January 1. The bonds

sold for Rp312.474 at an effective interest rate of 7%. Using the effective

interest method, PT ABC decreased the non-trading Debt Investments

account for the PT DEF bonds on July 1, 2018 and December 31, 2018 by the

amortized premiums of Rp1.062 and Rp1.098, respectively. At December 31,

2018, the fair value of the PT DEF bonds was Rp318.000. What should PT

ABC report as other comprehensive income and as a separate component

of equity? *

Rp5.526

Rp2.160

Rp7.686

O Rp0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An investor company purchased $427,000 of 8% bonds from the investee company on January 1, 2020, with interest payable on December 31. The bonds were classified as Available-for-Sale. The bonds sold for $706,390. Using the effective-interest method, the investor company revised the Available-for-Sale Debt Securities account on December 31, 2020 and December 31, 2021 by the amortized discount/premium of $6,470. and $8,200, respectively. At December 31, 2020, the fair value of the investee company bonds was $912,000. At December 31, 2021, the fair value of the investee company bonds was $843,000. What is the amount of unrealized holding gain/loss related to this investment in 2021? (Very important: Just enter the amount. DO NOT put a plus or minus sign in front of the amount.)arrow_forwardThe following partial amortization schedule is available for Crane Company who sold $1200000, 5-year, 10% bonds on January 1, 2020 for $1248000 and uses annual straight-line amortization. BOND AMORTIZATION SCHEDULE Interest Periods Interestto be paid Interestexpense PremiumAmortization UnamortizedPremium Bond CarryingValue January 1, 2020 $48000 $1248000 January 1, 2021 (i) (ii) (iii) (iv) (v) Which of the following amounts should be shown in cell (v)? $1238400 $1243200 $1252800 $1257600arrow_forwardBlossom Company purchased $1180000 of 8%, 5-year bonds from Carlin, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $1230096 at an effective interest rate of 7%. Using the effective interest method, Blossom Company decreased the Available-for-Sale Debt Securities account for the Carlin, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortízed premiums of $4048 and $4192, respectively. At February 1, 2022, Blossom Company sold the Carlin bonds for $1215800. After accruing for interest, the carrying value of the Carlin bonds on February 1, 2022 was $1220500. Assuming Blossom Company has a portfolio of available-for-sale debt investments, what should Blossom Company report as a gain (or loss) on the bonds? $-4700. $0. $-9596. $-14296.arrow_forward

- The 12% bonds payable of Amman Co. had a carrying amount of €166,400 on December 31, 2018. The bonds, which had a face value of €160,000, were issued at a premium to yield 10%. Amman uses the effective-interest method of amortization. Interest is paid on June 30 and December 31. On June 30, 2019, several years before their maturity, Amman retired the bonds at 104 plus accrued interest. The loss on retirement, ignoring taxes, isarrow_forwardWildhorse Company purchased $1290000 of 8%, 5-year bonds from Blossom, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $1339896 at an effective interest rate of 7%. Using the effective interest method, Wildhorse Company decreased the Available-for-Sale Debt Securities account for the Blossom, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $5148 and $5292, respectively.At December 31, 2021, the fair value of the Blossom, Inc. bonds was $1353000. What should Wildhorse Company report as other comprehensive income and as a separate component of stockholders’ equity? $0 $23544 $10440 $13104arrow_forwardPharoah Company purchased $3200000 of 9%, 5-year bonds from Wildhorse, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3320740 at an effective interest rate of 8%. Using the effective-interest method, Pharoah Company decreased the Available-for-Sale Debt Securities account for the Wildhorse, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $11020 and $11380, respectively.At April 1, 2022, Pharoah Company sold the Wildhorse bonds for $3290000. After accruing for interest, the carrying value of the Wildhorse bonds on April 1, 2022 was $3297440. Assuming Pharoah Company has a portfolio of Available-for-Sale Debt Securities, what should Pharoah Company report as a gain or loss on the bonds?arrow_forward

- On June 30, 2021, Waterway Industries had outstanding 8%, $8020000 face amount, 15-year bonds maturing on June 30, 2031. Interest is payable on June 30 and December 31. The unamortized balance in the bond discount account on June 30, 2021 was $361000. On June 30, 2021, Waterway acquired all of these bonds at 94 and retired them. What net carrying amount should be used in computing gain or loss on this early extinguishment of debt? $7538800. $7659000. $7939000. $7739200.arrow_forwardOn 1 January 2014, Company B purchased 100 5 year, R100 bonds from TP Limited at par. The bonds are redeemable at par and bear interest at 5% per annum. The market rate on equivalent bonds i s 5% on 1 January 2014 and 4.2% on 31 December 2014. On 1 January 2014, Company B incurred direct costs on this transaction of R1 000. On 1 January 2014, the risk of TP defaulting on payments to Company B was assessed as low (2%). At the end of the year (31 December 2014) the risk of default increased significantly to 20%. You are required to: Prepare the journal entries that Company B is required to process in respect of the expected credit losses for the year ended 31 December 2014 assuming the asset is held at amortized cost.arrow_forwardCullumber Company purchased $3050000 of 9%, 5-year bonds from Vaughn, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $3173740 at an effective interest rate of 8%. Using the effective-interest method, Cullumber Company decreased the Available-for-Sale Debt Securities account for the Vaughn, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $10720 and $11080, respectively.At April 1, 2022, Cullumber Company sold the Vaughn bonds for $3140000. After accruing for interest, the carrying value of the Vaughn bonds on April 1, 2022 was $3147440. Assuming Cullumber Company has a portfolio of Available-for-Sale Debt Securities, what should Cullumber Company report as a gain or loss on the bonds? $-7440. $-123740. $-21800. $ 0.arrow_forward

- Sheridan Company purchased $1250000 of 8 %, 5-year bonds from Pina, Inc. on January 1, 2025, with interest payable on July 1 and January 1. The bonds sold for $1299896 at an effective interest rate of 7%. Using the effective interest method, Sheridan decreased the Available for - Sale Debt Securities account for the Pina bonds on July 1, 2025 and December 31, 2025 by the amortized premiums of $4748 and $4892, respectively. At December 31, 2025, the fair value of the Pina bonds was $1317000. What should Sheridan report as other comprehensive income and as a separate component of stockholders' equity (assuming that this is Sheridan's first investment in available - for - sale debt securities)? Select answer from the options below $0 $26744 $9640 $17104arrow_forwardsanjuarrow_forwardOn January 1, 2024, Tiny Tim Industries had outstanding \$1,000,000 of 10% bonds with a book value of $ 971,000 The indenture specified a call price of $987,500 The bonds were issued previously at a price to yield 12% and interest payable semiannually on July 1 and January 1. Tiny Tim called the bonds (retired them) on July 12024. What is the amount of the loss on early extinguishment? Choice $ 7,888 $ 8.260 $ 0 8.240arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education