FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

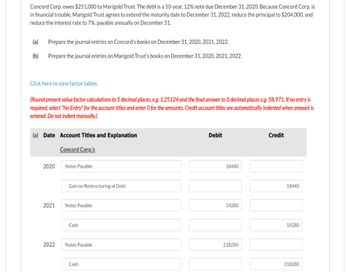

Transcribed Image Text:Concord Corp. owes $251,000 to Marigold Trust. The debt is a 10-year, 12% note due December 31, 2020. Because Concord Corp. is

in financial trouble, Marigold Trust agrees to extend the maturity date to December 31, 2022, reduce the principal to $204,000, and

reduce the interest rate to 7%, payable annually on December 31.

(a)

Prepare the journal entries on Concord's books on December 31, 2020, 2021, 2022.

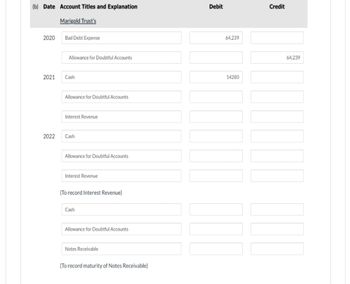

(b) Prepare the journal entries on Marigold Trust's books on December 31, 2020, 2021, 2022.

Click here to view factor tables.

(Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971. If no entry is

required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is

entered. Do not indent manually.)

(a) Date Account Titles and Explanation

Concord Corp.'s

2020

2021

2022

Notes Payable

Gain on Restructuring of Debt

Notes Payable

Cash

Notes Payable

Cash

Debit

18440

14280

218280

Credit

18440

14280

218280

Transcribed Image Text:(b) Date Account Titles and Explanation

Marigold Trust's

2020

2021

2022

Bad Debt Expense

Allowance for Doubtful Accounts

Cash

Allowance for Doubtful Accounts

Interest Revenue

Cash

Allowance for Doubtful Accounts

Interest Revenue

(To record Interest Revenue)

Cash

Allowance for Doubtful Accounts

Notes Receivable

(To record maturity of Notes Receivable)

Debit

64,239

14280

Credit

64,239

000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carla Vista Company issues a 8%, 7-year mortgage note on January 1, 2022, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semi-annual installment payments of $46,900. What are the cash proceeds received from the issuance of the note?arrow_forwardExcel Corporation is experiencing financial difficulty and has met with their creditor (BMO) to explore their options related to a $1.5 million, 6% note payable that is outstanding. The note was issued on September 1, 2020 when the market rate of interest was 6%. There are two years remaining on the note and the current market rate of interest is 8%. Excel and BMO prepare financial statements in accordance with IFRS. For each of the following independent situations prepare the journal entry that both Excel and BMO would on their books. BMO agrees to accept Excel common shares valued at $1,000,000 as settlement of the debt. BMO agrees to accept land as settlement of the debt. The land is on the books of Excel for $500,000 and has a market value of $1,250,000. BMO agrees to modify the terms so that Excel is not paying any interest on the note for the remaining two years. BMO agrees to reduce the principal balance to $1,000,000 and requires interest only payments for the next two years…arrow_forwardOn july 1, 2021 I borrowed 50,000 with notes payable with an interest of 6 percent a year. The note and interest are due on December 31st, 2021. On December 31st 2021 I paid 51,500 to settle the debt in full. Assuming no accruals for interest have been made during the year, what is the entry that I need to record?arrow_forward

- Carla Vista Electronics issues a $353,500, 3%, 15-year mortgage note on December 31, 2019. The proceeds from the note are to be used in financing a new research laboratory. The terms of the note provide for annual installment payments, exclusive of real estate taxes and insurance, of $41,441. Payments are due on December 31. Prepare an installment payments schedule for the first 4 years. (Round answers to 0 decimal places, e.g. 15,250.) Annual Interest Period Cash Payment Interest Expense Reduction of Principal Principal Balance Issue Date $enter a dollar amount 1 $enter a dollar amount $enter a dollar amount $enter a dollar amount enter a dollar amount 2 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 3 enter a dollar amount enter a dollar amount enter a dollar amount enter a dollar amount 4 enter a dollar amount enter a dollar amount…arrow_forwardCoulson Company is refinancing long-term debt. Accessed March 15, 2022. Its fiscal year ends December 31, 2021. The refinancing is scheduled to be completed on December 15, 2021. What if it's finished on January 15, 2022?arrow_forward16. On October 1, 2020, Zachary's Balloons borrowed S4,000 on a 12%, one-year note payable. Interest was payable semiannually. A correct adjusting entry was made on December 31, 2020, and a correct reversing entry was made on January 1, 2021. The entry that should be made on March 31, 2021, is a. Interest Payable 240 Cash 240 b. Interest Expense Interest Payable 120 120 Cash 240 c. Interest Expense 240 Cash 240 d. Interest Expense 120 Cash 120arrow_forward

- On January 1,2021, Eagle Company borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal payments of $29,523, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Prepare an amortization table for this installment note.arrow_forwardOn February 10, 2021, after issuance of its financial statements for 2020, Sunland Company entered into a financing agreement with Cleveland Bank, allowing Sunland Company to borrow up to $8060000 at any time through 2023. Amounts borrowed under the agreement bear interest at 3% above the bank's prime interest rate and mature two years from the date of loan. Sunland Company presently has $3100000 of notes payable with Star National Bank maturing March 15, 2021. The company intends to borrow $4910000 under the agreement with Cleveland and liquidate the notes payable to Star National Bank. The agreement with Cleveland also requires Sunland to maintain a working capital level of $12050000 and prohibits the payment of dividends on common stock without prior approval by Cleveland Bank. From the above information only, the total short-term debt of Sunland Company as of the December 31, 2020 balance sheet date is $8060000. $0. $3990000. $3100000.arrow_forwardSunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On January 1, 2021, Eagle Company borrows $31,000 cash by signing a four-year, 8% installment note. The note requires four equal payments of $9,360, consisting of accrued interest and principal on December 31 of each year from 2021 through 2024. Exercise 10-12 (Algo) Installment note amortization table LO C1 Prepare an amortization table for this installment note. (Round all amounts to the nearest whole dollar.) Payments Period Ending (A) Beginning (B) Debit Interest (C) Debit Notes Balance Expense Payable Date 2021 2022 2023 2024 Total $ 0arrow_forwardAt January 1, 2024, Rothschild Chair Company, Incorporated, was indebted to First Lincoln Bank under a $35 million, 12% unsecured note. The note was signed January 1, 2021, and was due December 31, 2027. Annual interest was last paid on December 31, 2022. Rothschild Chair Company was experiencing severe financial difficulties and negotiated a restructuring of the terms of the debt agreement. Required: Prepare all journal entries by Rothschild Chair Company, Incorporated, to record the restructuring and any remaining transactions relating to the debt under each of the independent circumstances below: 1. First Lincoln Bank agreed to settle the debt in exchange for land having a fair value of $31 million but carried on Rothschild Chair Company's books at $26.5 million. 2. First Lincoln Bank agreed to (a) forgive the interest accrued from last year, (b) reduce the remaining four interest payments to $1 million each, and (c) reduce the principal to $28.5 million. 3. First Lincoln Bank…arrow_forwardCryer, Inc. has a $45,000,000 note payable on its balance sheet as of 12/31/19, of which $6,000,000 is due in 2020. Cryer will report the liability as what on its 12/31/19 balance sheet: O A $6,000,000 current liability and a $45,000,000 long-term liability O A $45,000,000 long-term liability O A $45,000,000 current liability O A $6,000,000 current liability and a $39,000,000 long-term liabilityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education