ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

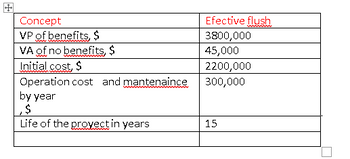

Calculate the B/C ratio for the following cash flow estimates, using a discount rate of 6% per year. Is the project justified?

Transcribed Image Text:+

Concept

VP of benefits, $

VA of no benefits, $

Initial cost, $

Operation cost and mantenaince

by year

,$

Life of the proyect in years

Efective flush.

3800,000

45,000

2200,000

300,000

15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Calculate the conventional B/C ratio for the following cash flow estimates at a discount rate of 10% per year. Is the project justified? Item Estimate PW of Benefits, $ AW of Disbenefits, $/year PW Cost, $ Life, Years 4,150,000 45,000 1,325,000 20arrow_forwardThe estimated annual cash flows for a proposed municipal government project are costs of $750,000 per year, benefits of $950,000 per year, and disbenefits of $200,000 per year. Calculate the conventional B/C ratio at an interest rate of 10% per year, and determine if it is economically justified. The B/C ratio is The project is economically justifiedarrow_forwardThe El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows: A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit. Create a new spreadsheet in which total fixed cost increases to $5,000. What price should the manager charge? How many papers should be sold in the short run?arrow_forward

- a. Based on PW method, Design Z is more economical. b. The modified B/C ratio of Design Y is The modified B/C ration of Design Z is (Round to two decimal places) (Round to two decimal places) c. The incremental B/C ratio is (Round to two decimal places) Therefore, based on the B/C ratio method, Design Z is more economical d. The discounted payback period of Design Y is The discounted payback period of Design Z is years (Round to one decimal place) years (Round to one decimal place) Investment cost Annual revenue Annual cost Useful life Salvage value Net PW Therefore, based on the payback period method, Design y would be preferred. (e) Why could the recommendations based on the payback period method be different from the other two methods? ⒸA. because the payback period method ignores the cash flows after the payback period O B. because the payback period gives more weight to the cash flows after the payback period C Design Y Design Z $140,000 $275,000 $57,659 $96.354 $17.618 $31,687 15…arrow_forwardThe El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows: A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit. Two firms, Small and Large, compete by price. Each can choose either a low price or a high price. The following payoff table shows the profit (in thousands of dollars) each firm would earn in each of the four possible decision situations: a) Is there a dominant strategy for…arrow_forwardThe El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows: A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit. What is the total fixed cost for the El Dorado Star? Explain how you arrived at this conclusion.arrow_forward

- The city of Valley View, California, is considering various proposals regarding the disposal of used tires. All proposals involve shredding, but the benefits differ in each plan. An incremental B/C analysis was initiated, but the engineer conducting the study left recently. Using a 20 year study period and an interest rate of 8% per year, a. Fill in the blanks in the incremental B/C columns of the table below b. Which alternative should be selected? Alternative P Q R S PW of Cost $ Million 10 40 50 80 B/C Ratio 1.1 2.4 1.4 1.8 AB/C Ratio (when compared with Alternative) P R Q 2.83 2.83 Sarrow_forwardThe B/C ratio for a flood control project along the Swanee River was calculated to be 1.1. If the benefits were $610,000 per year and the maintenance costs were $221,000 per year, determine the initial cost of the project at an interest rate of 11% per year and a 50- year life. The initial cost of the project is $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education