ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

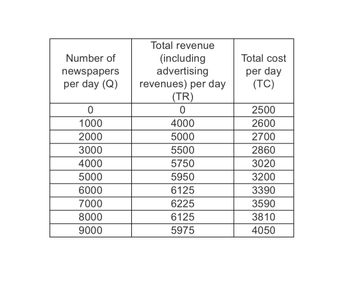

The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows:

A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit.

At the price and output level you answered in the previous question, is the EI Dorado Star making the greatest possible amount of total revenue? Is this what you expected? Explain why or why not.

Transcribed Image Text:Number of

newspapers

per day (Q)

0

1000

2000

3000

4000

5000

6000

7000

8000

9000

Total revenue

(including

advertising

revenues) per day

(TR)

0

4000

5000

5500

5750

5950

6125

6225

6125

5975

Total cost

per day

(TC)

2500

2600

2700

2860

3020

3200

3390

3590

3810

4050

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the EI Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Use the appropriate formulas to create two new columns (7 and 8) for total profit and profit margin, respectively. What is the maximum profit the EI Dorado Star can earn? What is the maximum possible profit margin? Are profit and profit margin maximized at the same point on demand?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows: A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit. Two firms, Small and Large, compete by price. Each can choose either a low price or a high price. The following payoff table shows the profit (in thousands of dollars) each firm would earn in each of the four possible decision situations: a) Is there a dominant strategy for…arrow_forwardThe El Dorado Star is the only newspaper in El Dorado, New Mexico. Certainly, the Star competes with The Wall Street Journal, USA Today, and the New York Times for national news reporting, but the Star offers readers stories of local interest, such as local news, weather, high-school sporting events, and so on. The El Dorado Star faces the revenue and cost schedules shown in the spreadsheet that follows: A template for the spreadsheet is provided in the Course Materials. You may download my template or create your own. Since we are using dollars and cents, be sure to go out two decimal places on your calculations. Add columns to show, respectively, marginal cost (MC), marginal revenue (MR), and total profit. What is the total fixed cost for the El Dorado Star? Explain how you arrived at this conclusion.arrow_forwardClassify the following costs into either being product cost or period cost:(a) Raw material costs(b) Income taxes paid(c) Interest expenses on borrowed funds(d) Wages incurred in producing products(e) Fire insurance premium paid on factory buildings(f) Electric bill for the warehouse operation(g) Salary paid for engineers(h) Material handling cost related to production(i) Salary paid for plant managerU) Leasing expense for forklift trucks in warehouse operation(k) Mortgage payments on factory buildingsarrow_forward

- The wages lost when you leave your job to attend school full-time is an example of a(n) Blank 1 cost. (Only one word required and correct spelling required also. Do not type in the word "cost")arrow_forwardIf the total fixed cost is $420 and a total variable cost is $ 180 what would be the average cost when a given amount of the quantity is $20arrow_forwardA study of 86 savings and loan associations in six northwestern states yielded the following cost function. C� = 3.69 - 0.007999Q� + 0.000005359Q2�2 + 25.0X1�1 (3.69) (3.08) (3.42) (3.50) where C� = average operating expense ratio, expressed as a percentage and defined as total operating expense ($ million) divided by total assets ($ million) times 100 percent. Q� = output; measured by total assets ($ million) X1�1 = ratio of the number of branches to total assets ($ million) Note: The number in parentheses below each coefficient is its respective t-statistic. Holding constant the effects of bank branching (X1�1), what is the level of total assets that minimizes the average operating expense ratio? $746.31 million $1,562.70 million $1,492.63 million $461.31 million What is the average operating expense ratio for a savings and loan association with the level of total assets determined in the previous part and 1 branch?…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education