FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Compute the product margins for the B300 and T500 under the company’s traditional costing system.

2. Compute the product margins for B300 and T500 under the activity-based costing system.

3. Prepare a quantitative comparison of the traditional and activity-based cost assignments.

Transcribed Image Text:Hi-Tek Manufacturing, Inc., makes two types of industrial component parts-the B300 and the T500. An absorption costing income

statement for the most recent period is shown:

Hi-Tek Manufacturing Inc.

Income Statement

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

$ 1,657,500

1,224,620

432,880

620,000

Net operating loss

$ (187,120)

Hi-Tek produced and sold 60,500 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $40 per unit. The

company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor

dollars as the allocation base. Additional information relating to the company's two product lines is shown below:

в300

T500

Total

$ 400,600

$ 120,400

Direct materials

$ 162,700

$ 42,000

563,300

162,400

498,920

Direct labor

Manufacturing overhead

Cost of goods sold

$ 1,224,620

The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation

team concluded that $55,000 and $101,000 of the company's advertising expenses could be directly traced to B300 and T500,

respectively. Thb remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also

distributed the company's manufacturing overhead to four activities as shown below:

Manufacturing

Activity

Overhead

B300

T500

Total

Activity Cost Pool (and Activity Measure)

Machining (machine-hours)

Setups (setup hours)

Product-sustaining (number of products)

Other (organization-sustaining costs)

90,100 62,300

76

152,400

306

$ 205,740

131,580

101,600

60,000

230

1.

NA

NA

NA

Total manufacturing overhead cost

$ 498,920

Required:

%24

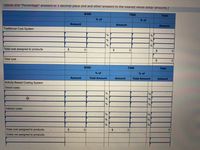

Transcribed Image Text:places and "Percentage" answers to 1 decimal place and and other answers to the nearest whole dollar amounts.)

B300

T500

Total

% of

% of

Amount

Amount

Amount

Traditional Cost System

Total cost assigned to products

2$

Total cost

B300

T500

Total

% of

% of

Amount

Total Amount

Amount

Total Amount

Amount

Activity-Based Costing System

Direct costs:

Indirect costs:

Total cost assigned to products

24

0.

0.

Costs not assigned to products:

%24

%24

%24

%24

%%一%

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Activity-based costing can be used to allocate period costs to various products that the company sells. False Truearrow_forwarda. 1. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. a. 2. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement? The increase in income from operations under absorption costing is caused by the allocation of overhead cost over a number of units. Thus, the cost of goods sold is . The difference can also be explained by the amount of overhead cost included in the inventory.arrow_forwardHi-Tek Manufacturing, Incorporated, makes two industrial component parts-B300 and T500. An absorption costing income statement for the most recent period is shown below: Hi-Tek Manufacturing, Incorporated Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating loss Hi-Tek produced and sold 60,400 units of B300 at a price of $21 per unit and 12,800 units of T500 at a price of $39 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: Direct materials Direct labor Manufacturing overhead Cost of goods sold $ 1,767,600 1,212,922 554,678 610,000 $ (55,322) 8300 T500 $ 400,300 $ 162,400 $ 120,100. $ 42,400 Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other…arrow_forward

- Great Outdoze Company manufactures sleeping bags, which sell for $66.10 each. The variable costs of production are as follows: Direct material Direct labor Variable manufacturing overhead $19.10 10.30 7.40 k Budgeted fixed overhead in 20x1 was $157,500 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 21,300 were sold. Variable selling and administrative costs were $1.30 per unit sold; fixed selling and administrative costs were $22,000. atarrow_forward4) Design ABC system for EON and Brothers (discuss steps) 5) What are the Costs per unit of Alfa and Beta under traditional and ABC costing systems?What would be the prices of Alpha and Beta traditional and ABC costing systems? Comparethe costs and prices calculated in the two systems (Calculations should be shown in theappendix) and for analysis 6) Discuss your recommendation on the viability of ABC for EON and Brothers Ltd., given thefinancial director's concerns.arrow_forwardCool Sky reports the following costing data on its product for its first year of operations. During this first year, the company produced 44,000 units and sold 36,000 units at a price of $140 per unit. Manufacturing costs Direct materials per unit Direct labor per unit Variable overhead per unit Fixed overhead for the year Selling and administrative costs Variable selling and administrative cost per unit Fixed selling and administrative cost per year 60 24 24 $ 528,000 22 8 $4 $ 105,000 11 la. Assume the company uses absorption costing. Determine its product cost per unit. Absorption costing Per unit product cost using:arrow_forward

- The Dorilane Company produces a set of wood patio furniture consisting of a table and four chairs. The company has enough customer demand to justify producing its full capacity of 3,800 sets per year. Annual cost data at full capacity follow: Direct labor Advertising Factory supervision Property taxes, factory building Sales commissions Insurance, factory Depreciation, administrative office equipment Lease cost, factory equipment Indirect materials, factory Depreciation, factory building Administrative office supplies (billing) Administrative office salaries Direct materials used (wood, bolts, etc.) Utilities, factory $ 89,000 $ 103,000 $70,000 $ 23,000 $ 65,000 $ 6,000 $ 2,000 $ 17,000 $ 18,000 $ 106,000 $ 5,000 $ 111,000 $ 426,000 $ 46,000 Required: 1. Enter the dollar amount of each cost item under the appropriate headings. Note that each cost item is classified in two ways: first, as variable or fixed with respect to the number of units produced and sold; and second, as a selling…arrow_forwardInfo in images Required: 1. Compute the product margins for the B300 and T500 under the company’s traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. 1. Compute the product margins for the B300 and T500 under the company’s traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) B300 T500 Total Product margin $0 2. Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) B300 T500 Total Product margin $0 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to 2…arrow_forwardThe following data have been extracted from the records of Puzzle Incorporated: Production level, in units Variable costs Fixed costs Mixed costs Total costs Required A Required B Required: a. Calculate the missing costs. b. Calculate the cost formula for mixed cost using the high-low method. c. Calculate the total cost that would be incurred for the production of 12,880 units. d. Identify the two key cost behavior assumptions made in the calculation of your answer to part c. Required C Production level, in units Variable costs Fixed costs Mixed costs Total costs Complete this question by entering your answers in the tabs below. Calculate the missing costs. Note: Do not round intermediate calculations. February 9,200 $ 19,320 ? 16,312 $ 71,532 February 9,200 $ 19,320 $ 2 X 16,312 $ 71,532 Required D August August 20, 240 $? 35,900 ? $ 106,970 Answer is not complete. 20,240 34,255 35,900 52,475 $ 106,970arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education