FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

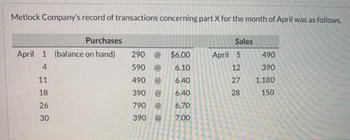

Transcribed Image Text:Metlock Company's record of transactions concerning part X for the month of April was as follows.

Purchases

April 1 (balance on hand)

4

11

18

26

30

290 (@ $6.00

590 @

6.10

490 @

6.40

6.40

6.70

7.00

390 @

790 @

390 @

Sales

April 5

12

27

28

490

390

1,180

150

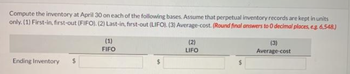

Transcribed Image Text:Compute the inventory at April 30 on each of the following bases. Assume that perpetual inventory records are kept in units

only. (1) First-in, first-out (FIFO). (2) Last-in, first-out (LIFO). (3) Average-cost. (Round final answers to 0 decimal places, e.g. 6,548.)

Ending Inventory $

(1)

FIFO

(2)

LIFO

(3)

Average-cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Compute the cost assigned to ending inventory using FIFO. 2. Compute the cost assigned to ending inventory using Weighted Average. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost assigned to ending inventory using Weighted Average. (Round average cost per unit to 2 decimal places.) Average Cost Ending Inventory Date March 1 March 5 March 18 March 25 Total Cost of Goods Available for Sale Cost of Goods Available for Sale $5,000.00 100 400 $ 22,000.00 120 $ 7,200.00 200 $ 12,400.00 820 $59.80 $ 46,600.00 # of units Average Cost per unit # of units sold Cost of Goods Sold Average Cost per Unit 580 $ 59.80 240 Average Cost per unit $59.80 Ending Inventory $ 14,352arrow_forwardPlease do not give image formatarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- If the perpetual inventory record is kept in dollars, and costs are computed at the time of each withdrawal, what amount would be shown as ending inventory under (1) FIFO. (2) LIFO and (3) Average-cost? (Round average cost per unit to 4 decimal places, e.g. 2.7621 and final answers to 0 decimal places, e.g. 6,548.) Ending Inventory $ (1) FIFO S (2) LIFO $ (3) Average-costarrow_forwardLong Answer Problem - Inventory Triangular Scone Inc. sells just one product and had the following transactions during the month: Units Unit Cost/Price Мay: inventory Beginning 280 4.00 11 Purchase 150 2$ 6.00 16 Sale 125 $4 25.00 18 Purchase 130 2$ 15.00 20 Sale 150 2$ 25.00 23 Purchase 75 24 6.00arrow_forwardOriole Company's record of transactions concerning part WA6 for the month of September was as follows. Purchases September 1 (balance on hand) 3 (a1) نا 12 292 2 16 300 200 @ 300 @ 300 @ 500 @ 300 @ $13.00 Average-cost per unit $ @ 13.10 13.25 13.30 13.30 13.40 Sales September 4 17 27 30 400 600 300 200 Calculate average-cost per unit. Assume that perpetual inventory records are kept in units only. (Round answer to 2 decimal places, eg. 2.76.)arrow_forward

- Compute the ending inventory using lower-of-average-cost-or-market. (Round ratios for computational purposes to 0 decimal places, e.g 78% and final answer to 0 decimal places, e.g. 28,987.) Ending Inventory at Lower-of-Average-Cost-Or-Market $ ____________arrow_forwardJames's Televisions produces television sets in three categories: portable, midsize, and flat-screen. On January 1, 2025, James adopted dollar-value LIFO and decided to use a single inventory pool. The company's January 1 inventory consists of: Category Portable Midsize Flat-screen Category Portable Midsize Quantity Cost per Unit $100 Flat-screen 3,000 4,000 1,500 8,500 Quantity Purchased 7,500 During 2025, the company had the following purchases and sales. 10,000 5,000 250 22,500 400 Cost per Unit $110 300 Total Cost 500 $300,000 1,000,000 600,000 $1,900,000 Quantity Sold 7,000 12,000 3,000 22,000 Selling Price per Unit $150 400 600arrow_forwardProblem 1 of 2 (note additional problem below): Calculate the cost of goods sold dollar value and the value of ending inventory for En Cee Yo0 Company for the sale on March 11, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for (a) first-in, first-out (FIFO); (b) last-in, first-out (LIF0); and (c) weighted average (AVG). You must show your work and calculations--answers that are correct but do not show calculations are graded as a zero grade. Place your answers in the shaded cells. Number of Units Unit Cost 110 $ Beginning inventory, March 1 Purchased inventory, March 8 86 140 $ 90 Sold inventory for $110 per unit, March 11 95 If you use the FIFO method, the dollar value of COGS is → and the dollar value of ending inventory is- If you use the LIFO method, the dollar value of COGS is - and the dollar value of ending inventory is- If you use the Weighted Average method, the dollar value of…arrow_forward

- Please do not give solution in image format thankuarrow_forwardRequired information [The following information applies to the questions displayed below.] A company began January with 8,000 units of its principal product. The cost of each unit is $7. Inventory transactions for the month of January are as follows: Date of Purchase January 10 January 18 Totals Sales Units Date of Sale January 5 January 12 January 20 Total 6,000 8,000 14,000 * Includes purchase price and cost of freight. Units Purchases Unit Cost* 4,000 2,000 5,000 11,000 $8 9 11,000 units were on hand at the end of the month. Total Cost $ 48,000 72,000 $ 120,000arrow_forwardCheck my work mode : This shows what is correct or incorrect for the work you have completed so far. It does nct indice Problem 6-3A Perpetual: Alternative cost flows LO P1 Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Date Activities Units Acquired at Cost 660 units@ $60 per unit 330 units@ $57 per unit 110 units @ $45 per unit Units Sold at Retail Jan. 1 Beginning inventory Feb. 10 Purchase 13 Purchase 15 Sales 21 Purchas Mar. Mar. 715 units@ $70 per unit 160 units @ $65 per unit 570 units @ $61 per unit Aug. Sept. 5 Purchase Sept. 10 Sales 730 units @ $70 per unit Totals 1,830 units 1,445 units Required: 1. Compute cost of goods available for sale and the number of units available for sale. Answer is complete but not entirely correct. 2$ 20,133 Cost of goods available for sale Number of units available for sale 1,830 units Prev 1 of 3 Next >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education