FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Compute the following: (5 points each)

1. Book Value as of December 31, 2019.

2. Book Value per share as of December 31, 2019

3. Book value as of December 31, 2020

4. Book value per share as of December 31, 2020

please provide solutions

thanks!

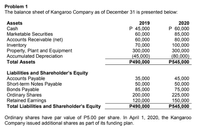

Transcribed Image Text:Problem 1

The balance sheet of Kangaroo Company as of December 31 is presented below:

Assets

2019

2020

P 45,000

60,000

60,000

70,000

300,000

(45,000)

P490,000

P 60,000

85,000

80,000

100,000

300,000

(80,000)

P545,000

Cash

Marketable Securities

Accounts Receivable (net)

Inventory

Property, Plant and Equipment

Accumulated Depreciation

Total Assets

Liabilities and Shareholder's Equity

Accounts Payable

Short-term Notes Payable

Bonds Payable

Ordinary Shares

Retained Earnings

Total Liabilities and Shareholder's Equity

35,000

50,000

85,000

200,000

120,000

P490,000

45,000

50,000

75,000

225,000

150,000

P545,000

Ordinary shares have par value of P5.00 per share. In April 1, 2020, the Kangaroo

Company issued additional shares as part of its funding plan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- E2.17 Broad Company reported the following selected financial results for 2019 and 2020. 2019 2020 $48,700 $57,300 11,600 27,900 19,400 Operating assets Financial assets . 13,500 Operating liabilities. Financial liabilities. 31,300 25,400 NOPAT.... $2,550 1,050 1,500 FEAT. Comprehensive Income (C). b. Calculate Broad's FCF, FCFFIN and FCFEO for 2020.arrow_forwardPlease help me with all answers thankuarrow_forwardQuestion Content Area A company reported the following information: Interest receivable, December 31, 2023: $8,000 Interest receivable, December 31, 2022: $11,500 Interest revenue for 2023: $16,000 Interest receivable, December 31, 2023 $8,000 Interest receivable, December 31, 2022 11,500 Interest revenue for 2023 16,000 How much cash was received for interest during 2023?arrow_forward

- Hh1. Prepare a Balance Sheet and be sure to show the Excel formulas in the textbox.arrow_forward1. What this ratio tells us about? 2016 2017 2018 2019 Number of days of payables (purch.) Net operating cycle Operating cycle 82.50 days 66.95 days 54.02 days 47.23 days 2. Do you like the situation in this company? 3. What are your recommendationd to improve the situation?arrow_forwardQuestion 1The following information was extracted from the financial statement of Barryfor the year ended 31 December 2020. RMSales 437,500Opening inventories 17,500Closing inventories 26,250Cost of sales 262,500Other income 3,750Expenses 61,250Current liabilities 47,250Trade receivables 39,375Bank 8,750Cash 31,500Required:(a) Show the formulae and compute the value of the following for Barry:(i) Purchases(ii) Gross profit(iii)Net Profitarrow_forward

- Ludwig Company's prepaid rent was $9,000 at December 31, 2020, and $13,500 at December 31, 2021. Ludwig reported rent expense of $19,000 on the 2021 income statement. What amount would be reported in the statement of cash flows as rent paid using the direct method? Multiple Choice $19,000. $14,500. $23,500. < Prev 3 of 10 www Check m Next sarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardNeed help please. Thank youarrow_forward

- hi, this is my finance question. i need asnwer asap. thxxarrow_forwardif you post that transaction and run a Balance Sheet report in 2021, Accrued other expenses will be negative. How do you fix the negative balance? if the old transaction is Debit : Electricity 6550 : 1000$ Debit: Accrued Other Expenses 1000$ Credit: Account Payable: 2000$ . Thanks,arrow_forwardB7. Please use both formulas and Excel! thank youarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education