FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please answer all or leave answer with all work

The accounting records of Allen Insulation, Inc. reflected the following balances as of January 1, 20x0:

Beginning Inventory: $190 units @ $120

The following transactions occurred in 20X0:

January 30th Purchase (cash): 230 units @ $124

March 12th Purchase (cash): 180 units @$128

June 3rd Sale (cash): 350 units @$320

Paid $24,000 of operating expenses.

Paid cash for income tax at the rate of 40 percent of income before tax.

Compute the cost of goods sold, ending inventory, gross profit, income tax expense and net income assuming:

FIFO cost flow

LIFO cost flow

Weighted-average cost flow

RAW DATA:

Transcribed Image Text:Beginning Inventory

30-Jan purchase

12-Mar purchase

Total

Sales

Ending Inventory (In Units)

Tax Rate

40%

Units

Units

Per unit cost Total Cost

190 S

230 S

180 S

120.00 S

124.00 S

128.00 $

22,800.00

28,520.00

23,040.00

Per Unit Price Total Sales

350 S 320.00 S

112,000.00

FIFO

Ending Inventory

Goods Available for Sale

Deduct ending Inventory

Cost of Goods Sold

Sales

Cost of Goods Sold

Gross Profit

Operating Expense

Operating Income before tax

Income Tax

Net Income

Tax Rate

Units

Per unit cost Total Cost

Total Cost

$24,000.00

LIFO

Ending Inventory

Goods Available for Sale

Deduct ending Inventory

Cost of Goods Sold

Sales

Cost of Goods Sold

Gross Profit

Operating Expense

Operating Income before tax

Income Tax

Net Income

Tax Rate

Units

Per unit cost Total Cost

Total Cost

$24,000.00

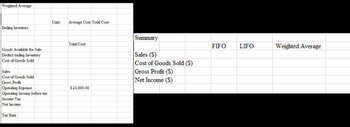

Transcribed Image Text:Weighted Average

Ending Inventory

Goods Available for Sale

Deduct ending Inventory

Cost of Goods Sold

Sales

Cost of Goods Sold

Gross Profit

Operating Expense

Operating Income before tax

Income Tax

Net Income

Tax Rate

Units Average Cost Total Cost

Total Cost

$24,000.00

Summary

Sales (S)

Cost of Goods Sold (S)

Gross Profit (S)

Net Income (S)

FIFO

LIFO

Weighted Average

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gladstone Company tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions Units Unit Cost Beginning inventory, January 1 3,200 $ 45 Transactions during the year: a. Purchase, January 30 4,550 55 b. Sale, March 14 ($100 each) (2,850 ) c. Purchase, May 1 3,250 75 d. Sale, August 31 ($100 each) (3,300 ) Assuming that for the Specific identification method (item 1d) the March 14 sale was selected two-fifths from the beginning inventory and three-fifths from the purchase of January 30. Assume that the sale of August 31 was selected from the remainder of the beginning inventory, with the balance from the purchase of May 1.arrow_forwardProvide correct answer for this questionarrow_forwardi need the answer quicklyarrow_forward

- The accounting records of Wall's China Shop reflected the following balances as of January 1, Year 2 Cash Beginning inventory Common stock Retained earnings $ 17,600 14,260 (155 units @ $92) 14,700 17,160 The following five transactions occurred in Year 2 1. First purchase (cash): 120 units @ $94 2. Second purchase (cash): 205 units @ $102 3. Sales (all cash): 425 units @ $197 4. Paid $15,000 cash for salaries expenses 5. Paid cash for income tax at the rate of 40 percent of income before taxes Required a. Compute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted-average cost flow. Compute the income tax expense for each method. b. Record the above transactions in general journal form and post to T-accounts assuming each of the cost flows listed. Assume perpetual inventory system is used. 1. FIFO 2 LIFO 3. Weighted Average c. Use a vertical model to show the Year 2 income statement, balance sheet, and statement of cash flows…arrow_forward97) A company had the following purchases and sales during its first month of operations: Date January 1 January 9 January 17 January 27 A) $84.00. B) $60.71. Activities C) $23.35. D) $46.70. E) $37.36. Purchase Sales Purchase Sales Units Acquired at Cost 10 units @ $4.00 = $40.00 8 units @ $5.50 = $44.00 Units Sold at Retail 6 units @ $12.00 Using the Periodic weighted average method, what is the value of cost of goods sold? (Round weighted average cost per unit to 2 decimal places.) 7 units @ $12.00arrow_forwardanswer step by steparrow_forward

- Hemming Company reported the following current-year purchases and sales for its only product. Date Activities March 14 January 1 Beginning inventory January 10 Sales Purchase Sales Purchase Sales Purchase March 15 July 30 October 5 October 26 Totals Units Acquired at Cost @$10 200 units 350 units 450 units 100 units 1,100 units Goods Purchased @ $15 @ $20 $25 Complete this question by entering your answers in the tabs below. $ 2,000 5,250 9,000 1. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. 2. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. 3. Compute the gross profit for FIFO method and LIFO method. Required 1 Required 2 Required 3 Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO: Cost of Goods Sold 2,500 $ 18,750 Exercise 5-8 (Static) Perpetual: Inventory costing methods-FIFO and LIFO LO P1 Required: Hemming uses a perpetual inventory system. Units…arrow_forward[The following information applies to the questions displayed below.] Hemming Co. reported the following current-year purchases and sales for its only product. Date Activities Units Acquired at Cost Units Sold at Retail Jan. 1 Beginning inventory 195 units @ $13.80 = $ 2,691 Jan. 10 Sales 185 units @ $43.80 Mar. 14 Purchase 345 units @ $18.80 = 6,486 Mar. 15 Sales 235 units @ $43.80 July 30 Purchase 495 units @ $23.80 = 11,781 Oct. 5 Sales 205 units @ $43.80 Oct. 26 Purchase 695 units @ $28.80 = 20,016 Totals 1,730 units $ 40,974 625 units Required: Hemming uses a perpetual inventory system. Compute the gross margin for FIFO method. Sales revenue Less: cost of goods sold Gross Margin…arrow_forwardThe Shirt Shop had the following transactions for T-shirts for Year 1, its first year of operations: Jan. 20 Apr. 21 July 25 Sept. 19 Purchased Purchased Purchased Purchased Required A During the year, The Shirt Shop sold 810 T-shirts for $20 each. Required a. Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. b. Compute the difference in gross margin between the FIFO and LIFO cost flow assumptions. 400 units 200 units 280 units 90 units Complete this question by entering your answers in the tabs below. Required B Ending inventory @ @ FIFO $8 = $3,200 $10 = 2,000 $13 = 3,640 $15 = 1,350 Compute the amount of ending inventory The Shirt Shop would report on the balance sheet, assuming the following cost flow assumptions: (1) FIFO, (2) LIFO, and (3) weighted average. (Round intermediate calculations to 2 decimal places and final answers to nearest whole dollar…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education