FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

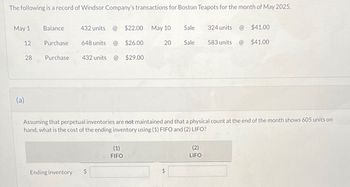

Transcribed Image Text:The following is a record of Windsor Company's transactions for Boston Teapots for the month of May 2025.

May 1

12

(a)

28

Balance

Purchase

Purchase

432 units

Ending inventory

$22.00 May 10 Sale

648 units @ $26.00

432 units @ $29.00

(1)

FIFO

20

Sale

LA

324 units

Assuming that perpetual inventories are not maintained and that a physical count at the end of the month shows 605 units on

hand, what is the cost of the ending inventory using (1) FIFO and (2) LIFO?

(2)

LIFO

583 units

@

$41.00

$41.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oahu Kiki tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each month, as if it uses a periodic inventory system. Assume Oahu Kiki's records show the following for the month of January. Sales totaled 330 units. Unit Cost $ 90 Date Units Total Cost $ 27,000 Beginning Inventory Purchase January 1 January 15 January 24 300 400 100 40, 000 36,000 Purchase 300 120 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. 3. Calculate the cost of ending inventory and cost of goods sold using the (a) FIFO, (b) LIFO, and (C) weighted average cost methods. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the number and cost of goods available for sale. Number of Goods Available for Sale units Cost of Goods Available for Salearrow_forwardThe following is a record of Larkspur Company’s transactions for Boston Teapots for the month of May 2017. May 1 Balance 476 units @ $20 May 10 Sale 357 units @ $37 12 Purchase 714 units @ $27 20 Sale 643 units @ $37 28 Purchase 476 units @ $31 Assuming that perpetual inventories are not maintained and that a physical count at the end of the month shows 666 units on hand, what is the cost of the ending inventory using (1) FIFO and (2) LIFO? (1)FIFO (2)LIFO Ending Inventory $ $ LINK TO TEXT Assuming that perpetual records are maintained and they tie into the general ledger, calculate the ending inventory using (1) FIFO and (2) LIFO. (1)FIFO (2)LIFO Ending Inventory $ $ Click if you would like to Show Work for this question: Open Show Workarrow_forwardThe units of an item available for sale during the year were as follows: Date Line Item Description Value Jan. 1 Inventory 2,900 units at $5 Feb. 17 Purchase 2,800 units at $7 Jul. 21 Purchase 3,200 units at $9 Nov. 23 Purchase 1,100 units at $11 There are 1,400 units of the item in the physical inventory at December 31. The periodic inventory system is used. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. a. Determine the inventory cost by the first-in, first-out method. b. Determine the inventory cost by the last-in, first-out method. c. Determine the inventory cost by the weighted average cost method. Round your answer to the nearest dollararrow_forward

- s Orion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $41 per unit) e. Sale, July 3 (sold for $41 per unit) f. Operating expenses (excluding income tax expense), $18,100 Required: 1. Calculate the number and cost of goods available for sale. 2. Calculate the number of units in ending inventory. Units Unit Cost 300 $ 13 900 11 800 14 300 620 3. Compute the cost of ending inventory and cost of goods sold under (a) FIFO, (b) LIFO, and (c) weighted average cost. 4. Prepare an income statement that shows under the FIFO method, LIFO method and weighted average method. 6. Which inventory costing method minimizes…arrow_forwardThe following is a record of Blossom Company’s transactions for the month of May 2022. May 1 Balance 320 units @ $20 May 10 Sale 240 units @ $38 12 Purchase 480 units @ $25 20 Sale 430 units @ $38 (a) Compute the ending inventory under the perpetual system using FIFO. FIFO Ending inventory $ 3250 (b) Compute the ending inventory under the perpetual system using LIFO. LIFO Ending inventory $arrow_forwardPlease help me with show all calculation thankuarrow_forward

- The units of an item available for sale during the year were as follows: Jan 1 Inventory 15 units at 122 April 15 Purchase 140 units at 116 September 9 Purchase 26 units at 122 There are 31 units of the item in the physical inventory at December 31. The periodic inventory system is used. Determine the inventory cost using the last-in, first-out (LIFO)arrow_forwardplease all answerarrow_forwardPlease helparrow_forward

- Domesticarrow_forwardOrion Iron Corporation tracks the number of units purchased and sold throughout each year but applies its inventory costing method perpetually at the time of each sale, as if it uses perpetual inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Transactions a. Inventory, Beginning For the year: b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $47 per unit) e. Sale, July 3 (sold for $47 per unit) f. Operating expenses (excluding income tax expense), $18,700 Required: Units 300 Unit Cost $ 19 900 17 800 20 300 680 Calculate the cost of ending inventory and the cost of goods sold using the FIFO and LIFO methods. FIFO LIFO Cost of Ending Inventory $ 19,740 Cost of Goods Sold $ 17,260 $ 18,700arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education