FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Compute

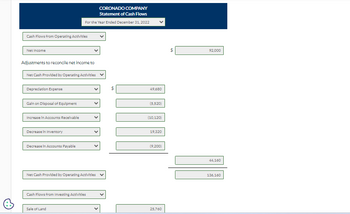

Transcribed Image Text:Cash Flows from Operating Activitles

Net Income

Adjustments to reconcile net income to

Net Cash Provided by Operating Activities ✓

Depreciation Expense

Gain on Disposal of Equipment

Increase In Accounts Receivable

CORONADO COMPANY

Statement of Cash Flows

For the Year Ended December 31, 2022

Decrease in Inventory

Decrease in Accounts Payable

Net Cash Provided by Operating Activities ✓

Cash Flows from Investing Activities

Sale of Land

69

$

49,680

(5,520)

(10,120)

19,320

(9,200)

25,760

659

92,000

44,160

136,160

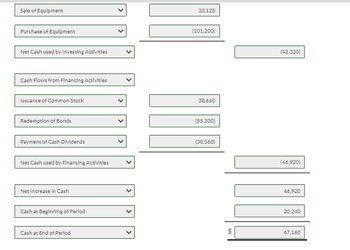

Transcribed Image Text:Sale of Equipment

Purchase of Equipment

Net Cash used by Investing Activities

Cash Flows from Financing Activities

Issuance of Common Stock

Redemption of Bonds

Payment of Cash Dividends

Net Cash used by Financing Activities

Net Increase in Cash

Cash at Beginning of Perlod

Cash at End of Perlod

33,120

(101,200)

38,640

(55,200)

(30,360)

(42,320)

(46,920)

46,920

20,240

67,160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please give answer for A and Barrow_forwardTaggart Inc. is considering a project that has the following cash flow data. What is the project's payback in years? Year 0 1 2 3 Cash flows -$1,175 $460 $460 $460 Please explain and provide calculations.arrow_forwardHow to solve a problem when they give you the liability amount $120000 and the equity $232k and they ask to fund the total assets?arrow_forward

- What is the present value of a savings account that is expected to pay $1,250 of cash inflow at the end of year 1, $0 cash inflow at the end of year 2 and $1,050 cash inflow at the end of 3rd year given the rate of return 10% in the first and second year and 12% in the third year? Please Show the workarrow_forwardCan someone please help me to solve the following question showing all work and formulas neatly. And please show the cash flow diagram as well. PLEASE ANS THANK YOU!!!!!arrow_forwardA. Assume that you have completed your plans and proformas for the next year of operations. The upcoming year looks promising. What would you most likely do from the following list? a. From your proformas project your company’s weighted average cost of capital and return on assets, and compare the two b. Take a vacation because you have been working so hard c. Purchase a new house for your personal use because the future is looking so good d. Make sure that your company’s weighted average cost of capital exceeds your company’s return on assets, if not, rework your plans and proformas B. Assume that all sales are on account. If the average accounts receivable balance was $1,000,000 and accounts receivable turnover was 12 for the last year of operations, what was sales revenue? a. $10,000,000 b. $15,000,000 c. $12,000,000 d. $6,000,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education