Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Sub : Finance

Pls answer ASAP.Dnt CHATGPT.I ll upvote. Thank You

Please answer all questions

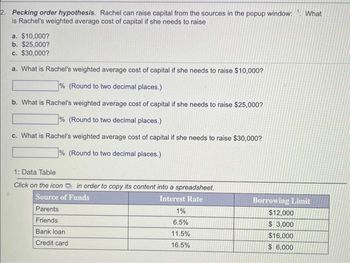

Transcribed Image Text:2. Pecking order hypothesis. Rachel can raise capital from the sources in the popup window:. What

is Rachel's weighted average cost of capital if she needs to raise

a. $10,000?

b. $25,000?

c. $30,000?

a. What is Rachel's weighted average cost of capital if she needs to raise $10,000?

% (Round to two decimal places.)

b. What is Rachel's weighted average cost of capital if she needs to raise $25,000?

% (Round to two decimal places.)

c. What is Rachel's weighted average cost of capital if she needs to raise $30,000?

% (Round to two decimal places.)

1: Data Table

Click on the icon in order to copy its content into a spreadsheet.

Source of Funds

Interest Rate

Parents

Friends

Bank loan

Credit card

1%

6.5%

11.5%

16.5%

Borrowing Limit

$12,000

$ 3,000

$16,000

$ 6,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Eva Oca mpo Bank Statement +. y onE68 GBzq2 ORffwnqVtgYY/edit # slide-id.g78c78cf0c6_0_0 %23 ades and Attend S Pearson Realize Student Assignmen.. * Login Page n NoRedink is on a m.. Dictionary.com |FL K K xton O Present ons Help Last edit was 6 days ago ckground Layout- Theme Transition 2 13 r 4 . 5. |.6 7 Example 1 Allison currently has a balance of $2,300 in her checking account. She deposits a $425.33 paycheck, a $20 rebate check, and a personal check for $550 into her checking account. She wants to receive $200 in cash. How much will she have in her account after the transaction? Show work here:arrow_forwardA v2.cengagenow.com da EXCHANGE PASSWORD REQUIRED 1 FA2021 - Fina... X CengageNOWv2 | Online teaching and learning reso. 11m O https://www.toolingu.com/Ims/contentplayer/?corpo. Enter your password for "hjmolin" in Internet Accounts. еВook Show Me How Note Payable and Accrued Interest Fairborne Company borrowed $600,000 on an 8%, interest-bearing note on October 1, 2023. Fairborne ends its fiscal year on December 31. The note was paid with interest on May 1, 2024. Required: 1. Prepare the entry for this note on October 1, 2023. If an amount box does not require an entry, leave it blank. 2023 Oct. 1 Cash Notes Payable (Record issuance of note) Feedback 2. Prepare the adjusting entry for this note on December 31, 2023. If an amount box does not require an entry, leave it blank. 2023 Dec. 31 Interest Expense Interest Payable (Record accrued interest) Feedback 3. Indicate how the note and the accrued interest would appear in the balance sheet at December 31, 2023. Among the current…arrow_forwardmheducation.com/ext/map/index.html?_con3Dcon&external_browser%-D0&launchUrl=https%253A%252F%252Fblackboard.waketech.edu%252Fwebapps%252Fpc Homework i Saved 9 You skipped this question in the previous attempt. CNBC reported that one in five consumers who purchase bitcoin do so using their credit card. Melissa Gamez purchased a used RV with 19,100 miles for $47,000. Originally the RV sold for $70,500 with a residual value of $20,100. After subtracting the residual value, depreciation allowance per mile was $0.87. How much was Melissa's purchase price over or below the book value? (Input the amount as positive value.) Purchase price was the book value by Does she have any equity that might assist her with purchasing bitcoin? O Yes O Noarrow_forward

- Google änai X + x 3) php?attempt%3D1764984&cmid=875183&page=11 come to Self Se.. Mail - s126527@st.. SQU E-learning New Tab SQU PORTAL ATTENDANCE - dda. خدمات القطم الإلكترونی SQU E-LEARNI 1:05:03 l أخل اختياري 24 J A Company uses a job-order costing system with a single plantwide predetermined overhead rate based on direct labor cost. The company based its predetermined overhead rate for the current year on total estimated manufacturing overhead cost of 40% of direct labor cost. The job cost sheet of Job2121 shows that the number of units in this job order is 60 units which incurred total of 90 labor-hours. This job consumed $40/unit of direct materials cost and $90/hour of direct labor. What would be the total ?manufacturing cost for Job2121 approximately 0.80 $10,500 a O $11,340 b O $5.640 c O $13,740 d O None of the given answers 旗arrow_forwardQuestion 3arrow_forwardPlease give handwrittenarrow_forward

- Analyze each of the following transactions in terms of their effects on the accounting equation of Osgood Delivery Service. Enter the correct amounts in the columns of the spreadsheetarrow_forwardPlease watch the following video, then answer the prompt below: https://youtu.be/nfkqCv3Rd_g: copy and paste it to view After watching, answer the question below: Describe the Time Value of Money.arrow_forwardAssessment Builder UI App X iley.com/was/ui/v2/assessment-player/index.html?launchld%3D562228aa-1a3a-4c39-9085-b90c7defbe14#/question/1 NWP Assessment Player UI Appli X Chapter 3 Question 2 of 5 The ledger of Blossom, Inc. on March 31, 2022, includes the following selected accounts before adju Debit Credit Prepaid Insurance $2,000 Supplies 2,000 Equipment 29,000 Unearned Service Revenue $8,500 An analysis of the accounts shows the following. 1. Insurance expires at the rate of $400 per month. 2. Supplies on hand total $1,400. 3. The equipment depreciates $300 per month. 4. During March, services were performed for two-fifths of the unearned service revenue. Prepare the adjusting entries for the month of March. (List all debit entries before credit entries. Credit account titles are autn Credu indented when the amount is entered. Do not indent manually.) Debit Date Account Titles and Explanation No. rcharrow_forward

- Chap 11. Q.3arrow_forwardD Chrome View Edit File Bookmarks History Profiles Tab Window Help bjs-Google Search x C The following financial statem × 0 xiConnect - Home M Question 18 - Chapter 1 Hom ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%2 Chapter 1 Homework Saved 18 [Ine following information applies to the questions displayed below.j The following financial statement information is from five separate companies. Company A Part 5 of 5 Beginning of year Assets Liabilities $ 36,000 29,520 Company B $ 28,080 Company C Company D Company E $ 23,040 $ 64,080 $ 98,280 19,656 12,441 44,215 ? End of year Assets 41,000 4.03 points 29,520 ? 74,620 113,160 Liabilities ? 20,073 13,460 35,817 89,396 Changes during the year Owner investments 6,000 1,400 9,750 ? 6,500 Net income (loss) 9,470 ? 6,000 11,938 eBook Owner withdrawals 8,608 3,500 2,000 5,875 0 11,000 Ask Print References Mc Graw Hill Problem 1-2A (Algo) Part 5 5. Compute the amount of liabilities…arrow_forwardAnswered: The fo x b Details | bartleby x b My Questions |b x Post Altendee -2 x FA Midterm Exan X -> File | C:/Users/Wendy/Downloads/FA%20Midterm%20Exam.pdf ME6 Which of the following entries records the payment of an account payable? a) Debit Accounts Payable, credit Cash b) Debit Cash, credit Accounts Payable c) Debit Expense, credit Cash d) Debit Cash, credit Expense ME7 The process of initially recording a business transaction is called: a) Sliding b) Posting c) Journalizing d) Transposing ME8 Which of the following entries for goods sold by cash is correct? a) Cash Dr, AR Cr b) AR Dr, Revenue Cr c) Fees Earned, debit; Cash credit d) Cash, debit; Bank Cr ME9 The verification that the sum of the debits and the sum of the credits in the ledger are equal is called: a) A journal b) A ledger c) Posting Type here to searcharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education