FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

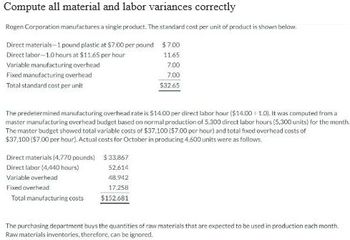

Transcribed Image Text:Compute all material and labor variances correctly

Rogen Corporation manufactures a single product. The standard cost per unit of product is shown below.

$7.00

Direct materials-1 pound plastic at $7.00 per pound

Direct labor-1.0 hours at $11.65 per hour

11.65

7.00

7.00

$32.65

Variable manufacturing overhead

Fixed manufacturing overhead

Total standard cost per unit

The predetermined manufacturing overhead rate is $14.00 per direct labor hour ($14.00 1.0). It was computed from a

master manufacturing overhead budget based on normal production of 5,300 direct labor hours (5,300 units) for the month.

The master budget showed total variable costs of $37,100 ($7.00 per hour) and total fixed overhead costs of

$37,100 ($7.00 per hour). Actual costs for October in producing 4.600 units were as follows.

Direct materials (4.770 pounds)

Direct labor (4,440 hours)

Variable overhead

Fixed overhead

Total manufacturing costs

$33.867

52.614

48.942

17,258

$152.681

The purchasing department buys the quantities of raw materials that are expected to be used in production each month.

Raw materials inventories, therefore, can be ignored.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardTharaldson Corporation makes a product with the following standard costs: Standard Quantity or Hours 5.6 ounces 0.3 hours 0.3 hours Direct materials Direct labor Variable overhead The company reported the following results concerning this product in June. Originally budgeted output Actual output Raw materials used in production Purchases of raw materials Actual direct labor-hours Actual cost of raw materials purchases Actual direct labor cost Actual variable overhead cost Multiple Choice O O The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor efficiency variance for June is: O O $6,600 F $6,600 U Standard Price or Rate $ 3.00 per ounce $ 10.00 per hour $7.00 per hour $8,800 F $8,800 U 4,000 units 4,000 units 22,000 ounces 22,700 ounces 540 hours $ 42,700 $ 14,000 $ 4,000 Standard Cos Per Unit $ 16.80 $ 3.00 $ 2.10arrow_forwardStandard Product Costs Deerfield Company manufactures product M in its factory. Production of M requires 2 pounds of material P, costing $4 per pound and 0.5 hour of direct labor costing, $10 per hour. The variable overhead rate is $8. per direct labor hour, and the fixed overhead rate is $12 per direct labor hour. What is the standard product cost for product M? Direct material Direct labor Variable overhead Fixed overhead Standard product cost per unit $ $arrow_forward

- Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month $270,000 $ 240,000 per Unit Sold Advertising Sales salaries and commissions Shipping expenses $ 10.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was…arrow_forwardUrarrow_forward6arrow_forward

- Preble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: $40.00 Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour Total standard variable cost per unit $84.00 The company also established the following cost formulas for its selling expenses: Variable Cost Fixed Cost per Month per Unit Sold Advertising Sales salaries and commissions Shipping expenses. 000 $ 10.00 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. c. Total variable manufacturing overhead for the month was…arrow_forwardneview Problem Xavier Company produces a single product. Variable manufacturing overhead is applied to prod- ucts on the basis of direct labor-hours. The standard costs for one unit of product are as follows: Direct material: 6 ounces at $0.50 per ounce Direct labor: 0.6 hours at $30.00 per hour.. Variable manufacturing overhead: 0.6 hours at $10.00 per hour.. $ 3.00 18.00 6.00 Total standard variable cost per unit.. $27.00 During June, 2,000 units were produced. The costs associated with June's operations were as follows: Material purchased: 18,000 ounces at $0.60 per ounce. Material used in production: 14,000 ounces. Direct labor: 1,100 hours at $30.50 per hour Variable manufacturing overhead costs incurred $10,800 $33,550 $12,980 Required: Compute the direct materials, direct labor, and variable manufacturing overhead variances.arrow_forwardDoogan Corporation makes a product with the following standard costs: Standard Quantity or Hours Standard Price or Rate Direct materials 2.0 grams $ 7.00 per gram Direct labor 0.5 hours $ 19.00 per hour Variable overhead 0.5 hours $ 5.00 per hour The company produced 4,700 units in January using 10,230 grams of direct material and 2,210 direct labor-hours. During the month, the company purchased 10,800 grams of the direct material at $7.20 per gram. The actual direct labor rate was $19.80 per hour and the actual variable overhead rate was $4.90 per hour. The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for January is:arrow_forward

- ABC company manufactures rivets in an automated factory. The company uses standard costing system to control costs & to assign costs to its inventory. Price Standard Quantity Standard Direct material $3/ unit 16 meters/rivet Direct labour $11 per hour 3 hours per rivet Variable overheads are estimated at $5.50 per rivet. Fixed overheads are $26,000 per month. The standard fixed overhead rate is based on an estimated production of 1,000 per month. Required: a. Prepare a production budget for the coming year based on a planned production of 12,000 rivets. b. Compare the budget prepared in a) with a flexible budget based on actual production of 15,000 rivets.arrow_forwardSubject: Accountingarrow_forwardPreble Company manufactures one product Its variable manufacturing overhead is applied to production based on direct labor-hours and its standard cost card per unit is as follows: $40.00 Direct material: 4 pounds at $10.00 per pound Direct labor: 2 hours at $16 per hour Variable overhead: 2 hours at $6 per hour Total standard variable cost per unit The company also established the following cost formulas for its selling expenses: Fixed Cost Variable Cost per Month per Unit Sold Advertising Sales salaries and commissions Shipping expenses $ 240,000 The planning budget for March was based on producing and selling 30,000 units. However, during March the company actually produced and sold 34,500 units and incurred the following costs: a. Purchased 150,000 pounds of raw materials at a cost of $9.20 per pound. All of this material was used in production. b. Direct-laborers worked 62,000 hours at a rate of $17.00 per hour. C. Total variable manufacturing overhead for the month was $390,600.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education