Concept explainers

In reconciling a bank statement, when a check from the previous month appears on the bank statement (but not the cash balance due to timing), how would you state it on the reconciliation?

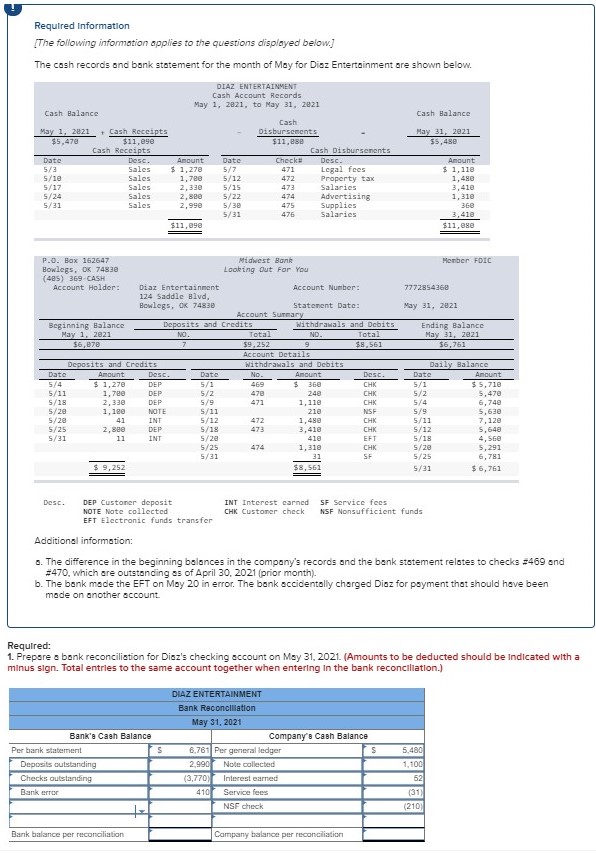

The note that was given: The difference in the beginning balances in the company’s records and the bank statement relates to checks #469 and #470, which are outstanding as of April 30, 2021 (prior month).

Attached is an image of my current progress.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Could you please provide an image of the balance reconciliation account? Show what needs to be added and subtracted from each side. Thank you.

Could you please provide an image of the balance reconciliation account? Show what needs to be added and subtracted from each side. Thank you.

- Winson Company reported the following information related to its 31 August 2019 bank statement: i) The bank statement's balance is $3267. ii) The cash account balance is $3193. iii) The outstanding checks total $612. iv) The deposits in transit amount to $1415. v)The bank service charge is $27. vi) Winson's accountant issued a check for $153 (inpayment on an account payable) that was erroneously recorded in the ledger as $135. vii)Bank debit memorandum for$138 NSF (not sufficient funds)check from one of its customers. viii) The bank collected an account receivable in the amount of $1060 on. behalf if Winson Company. Required; Prepare Winson Company's bank reconciliation on 31 August 2019.arrow_forwardBank Reconciliation and Adjusting Entries (Appendix 6.1) Odum Corporation’s cash account showed a balance of $17,198 on March 31, 2019. The bank statement balance for the same date indicated a balance of $17,924.55. The following additional information is available concerning Odum’s cash balance on March 31: • Undeposited cash on hand on March 31 amounted to $724.50. • A customer’s NSF check for $173.80 was returned with the bank statement. • A note for $2,000 plus interest of $25 was collected for Odum by the bank during March. The bank notified Odum of this collection on the bank statement. • The bank service charge for March was $15. • A deposit of $951.75 mailed to the bank on March 31 did not appear on the bank statement. The following checks mailed to creditors had not been processed by the bank on March 31: #429 $57.40 #432 $147.50 #433 $214.80 #434 $191.90 A customer check for $149.50 in payment of his account and listed correctly for that amount on the bank state-ment had…arrow_forwardThe accountant of ABC has collected the following information for the month of July 2019. ABC’s bank statement for July 2019 shows the following data: Balance on 1 July as per bank $29,500 Balance on 31 July as per bank $15,907.45 The cash balance as per company records as of July 31 is $11,589.45. Further review of the data reveals the following information: Errors: Check no115 for $1,226. The bank correctly paid the amount, but ABC recorded the check as $1,262. Outstanding checks on July 31, total $5,904 Deposits in transit on July 31 total $2,201.40 Bank statement shows: A. Debit-NSF check: $425.60 B. Debit-bank fee $30 C. Credit- collection of note receivable for $1,000 plus interest earned $50 and bank collection fee $15. Required:Prepare bank reconciliation on July 31, 2019.arrow_forward

- please answerarrow_forwardAssume you are a new hire in the accounting department of an organization. One of your responsibilities is the reconciliation of the operating account. After the end of the month you are given a copy of the bank statement and the cancelled checks, and are instructed to perform your reconciliation. You notice that there are some faint markings on a portion of the bank statement that could be alterations. What steps would you take in performing the reconciliation?arrow_forwardUse the following bank statement and T-account to prepare any journal entries needed as a result of the May 31 bank recor no entry Is requlred for a transactlon/event, select "No Journal Entry Requlred" In the first account fleld.) BANK STATEMENTarrow_forward

- Problem Solving. Required: 1. Prepare a properly classified bank reconciliation statement for each of the problems given below.2. Prepare the necessary adjusting journal entries on the company’s book for book reconciling items.arrow_forwardA table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation. (Select the answers in the appropriate cells. Leave no cells blank. Be certain to select "NA" in fields which are not applicable.)arrow_forwardBased on the following information, prepare a bank reconciliation to determine the adjusted (corrected) balance: (Input each amount as a positive value.) Bank balance $ 776 Account fees $ 27 Checkbook balance $ 732 ATM withdrawals $ 116 Outstanding checks $ 148 Deposit in transit $ 69 Direct deposits $ 98 Interest earned $ 10arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education