ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

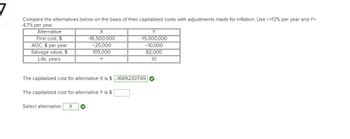

Transcribed Image Text:Compare the alternatives below on the basis of their capitalized costs with adjustments made for inflation. Use /=13% per year and f=

4.7% per year.

Alternative

First cost, $

AOC, $ per year

Salvage value, $

Life, years

X

-16,500,000

-25,000

105,000

00

The capitalized cost for alternative X is $ -1669230769

The capitalized cost for alternative Y is $

Select alternative X

Y

-15,000,000

-10,000

82,000

10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- ! Required information Eight years ago, Ohio Valley Trucking purchased a large- capacity dump truck for $102,000 to provide short-haul earth-moving services. The company sold it today for $45,000. Operating and maintenance costs averaged $10,200 per year. A complete overhaul at the end of year 4 costs an extra $3600. Calculate the annual cost of the truck at i = 8% per year. The annual cost of the truck is $- per year.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardThe cost of constructing a roundabout (R/A) in a low-traffic residential neighborhood 5 years ago was $625,000. A civil engineer designing another R/A that is almost the same design estimates the cost today will be $740,000. If the cost had increased only by the inflation rate over the 5 years, determine the inflation rate per year.arrow_forward

- An offshore services company is considering the purchase of equipment that has a cost today of $96,000. Inflation is a concern. The manufacturer plans to raise the price exactly in accordance with the inflation rate that may be somewhere between 1% and 8% per year. Develop a graph of how much the equipment will cost 3 years from now in terms of both (a) CV, and (b) future dollars.arrow_forwardPlease solve the problem and draw a diagram for the problem, Make sure you post pictures of your work instead of writing it. Please! Thank you for your help.arrow_forwardPlease answer as quickly as possible and zoom in for better viewarrow_forward

- Required information Eight years ago, Ohio Valley Trucking purchased a large-capacity dump truck for $116,000 to provide short-haul earth- moving services. The company sold it today for $45,000. Operating and maintenance costs averaged $10,900 per year. A complete overhaul at the end of year 3 costs an extra $3600. Calculate the annual cost of the truck at i= 8% per year. The annual cost of the truck is $- 503,717 per year. 13arrow_forwardRequired information To retire at a decent age and move to Hawaii, an engineer plans to trust her account to an investment firm that promises to make a real rate of return of 10% per year when the inflation rate is 4.000% per year. The account currently is valued at $520,000 and she wants to retire in 15 years. Determine how much (in then-current dollars) will be in the account for the realized rate of return to be a real 10% per year. (Round the final answer to three decimal places.) The account should have $arrow_forwardThe local bank pays 4% interest on savings deposits. In a nearby town, the bank pays 1% per quarter. A man who has $3000 to deposit wonders whether the higher interest paid in the nearby town justifies driving there What sum of money now is equivalent to $8250 two years hence, if interest is 4% per 6-month period? The answer is closest to: Hint : 4% per 6 month means semi annual periods so the n does not equal 2 anymore ! $8,923 $7,052 $8,580 $9,651arrow_forward

- Wylie has been offered the choice of receiving $4,700 today or an agreed-upon amount in 1 year. While negotiating the future amount, Wylie notes that he would be willing to take no less than $5,500 if he has to wait a year. What is his TVOM in %? % Carry all interim calculations to 5 decimal places and then round your final answer to 1 decimal place. The tolerance is ±0.2.arrow_forwardFind the value of APC when the APS is 0.49 ??????????????arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education