FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

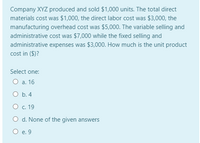

Transcribed Image Text:Company XYZ produced and sold $1,000 units. The total direct

materials cost was $1,000, the direct labor cost was $3,000, the

manufacturing overhead cost was $5,000. The variable selling and

administrative cost was $7,000 while the fixed selling and

administrative expenses was $3,000. How much is the unit product

cost in ($)?

Select one:

О а. 16

O b. 4

О с. 19

O d. None of the given answers

O e. 9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Direct material $0.10, Direct laber is $0.25, Variable Overhead is $0.10, Fixed overhead is $0.40 what is the fixed costs per unit, the total cost per unit, and gross margin if 1,600,000 units were produced?arrow_forwardBob Corp uses three products with the following production and cost information: P1 P2 MAS Total Units Produced & Sold 2,000 4,000 6,000 2,000 150 12,000 4,000 20,000 10,000 Direct labor hours Number of Machine Set-ups Number of Shipments Number Engineering change orders Direct labor cost per hour 100 250 500 200 225 275 700 15 10 5. 30 P0.50 PO.50 РО.50 Direct material cost per unit P2.00 P2.00 P2.00 Selling price per unit P50.00 P15.00 P10.00 The factory overhead costs include set-ups of P45,000; shipping costs of P70,000; and engineering costs of P90,000. Using Traditional Costing and ABC 1. Compute for the factory overhead per unit 2. Total Manufacturing Cost 3. Gross Profit per unit. per unitarrow_forwardThe East Company manufactures several different products. Unit costs associated with Product ORD210 are as follows: Direct materials $54Direct manufacturing labor 8Variable manufacturing overhead 11Fixed manufacturing overhead 25 Sales commissions (2% of sales) 5Administrative salaries 12Total$115What are the period costs per unit associated with Product ORD203 ? Oa. $120 b. $50 c. $17© d $18arrow_forward

- Dinesh bhaiarrow_forwardBenoit Company produces three products—A, B, and C. Data concerning the three products follow (per unit): Product A B C Selling price $ 92.00 $ 66.00 $ 82.00 Variable expenses: Direct materials 27.60 18.00 12.00 Other variable expenses 27.60 31.50 45.40 Total variable expenses 55.20 49.50 57.40 Contribution margin $ 36.80 $ 16.50 $ 24.60 Contribution margin ratio 40% 25% 30% The company estimates that it can sell 950 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 6,100 pounds available each month. Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third? 3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 6,100 pounds of materials?arrow_forwardCalculate the Direct expenses and factory cost from the following information: Direct Labor RO 5,000, Direct material RO:8.000, production overheads are RO 3.000 and prime cost is RO 19,000. a. Direct expenses RO 6,000, Factory cost RO 22:000 b. Direct expenses RO 6,000; Factory cost RO 11,000 c. Direct expenses RO 11,000; Factory cost RO 22,000 d. Direct expenses RO 22.000, Factory cost RO 6,000arrow_forward

- Puritan Apparels is a clothing retailer. Unit costs associated with one of its products, Product DCF 130, are as follows: Direct materials $110 Direct manufacturing labor Variable manufacturing overhead 20 75 Fixed manufacturing overhead Sales commissions (2% of sales) Administrative salaries 35 14 28 Total $282 ト What are the indirect nonmanufacturing variable costs per unit associated with Product DCF130? O A. $14 O B. $42 OC. $254 OD. $130arrow_forwardQuestion 5: The Information below is taken from production department of Salalah Company for August: The number of units produced is 20000. All amounts are in OMR. Total Costs Variable Cost Fixed Cost Direct material cost Total labor cost 800000 500000 110000 Manufacturing Overhead 100000 40000 Calculate: A. Find the missing information in the above table. Some values may not be applicable, explain. B. Calculate cost per unit C. Describe the production costs in the equation form Y = f+ yvX. D. Assume Salalah intends to produce 30000 units next month. Calculate total production costs for the month (Ctrl) -arrow_forwardProblem 3-15 High-Low Method; Predicting Cost [LO1, LO2] Crosshill Company's total overhead costs at various levels of activity are presented below: Total Overhead Month Machine-Hours Cost April May 120,000 110, 000 130, 000 140, 000 $206, 800 $319,000 $361,000 $391, 000 June July Assume that the overhead cost above consists of utilities, supervisory salaries, and maintenance. The breakdown of these costs at the 110,000-machine-hour level of activity in May is as follows: Utilities (variable) Supervisory salaries (fixed) Maintenance (mixed) $ 88,000 25, 000 125, еее Total overhead cost $238, 000 The company wants to break down the maintenance cost into its variable and fixed cost elements. Required: 1. Estimate how much of the $391,000 of overhead cost in July was maintenance cost. (Hint: To do this, first determine how much of the $391,000 consisted of utilities and supervisory salaries. Think about the behaviour of variable and fixed costs within the relevant range.) (Round the…arrow_forward

- Max Machining incurs the following utilities costs at different levels of production: 0 units: 500 units: 1,000 units: How would utility costs be properly classified? Select one: A. Stepped B. Fixed C. Mixed D. Curvilinear E. Variable $120 $2,620 $5,120arrow_forwardA Cothing Manufacturing Company provides the following unit costs associated with one of its products: Direct materials. Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Operating costs Total $160 50 55 32 30 $327 What are the period costs per unit associated with the Product? O A $30 O B. $33 OC. $100 O D. $17arrow_forwardAccording to following information, which of the following is the total cost function in the form of Y = F+V*X? Number of units produced is 18,000. Fixed Variable Total Cost Cost Costs Material used in Production 88,000 40,000 128,000 Labour used in Production 42,000 38,500 80,500 Production Facilities cost 37,000 167,000 108,000 275,000 29,500 66,500 TOTAL COST Select one: O a. Y = 275,000+V*108 O b. Y = 167,000+V*18 O CY = 167,000+V*6, O d.Y = 108,000+V*275 e to search F10 D Gy H i BY NT Marrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education